Question: Audit Sampling - Part 1 ( February 2 0 2 3 ) fxamplent Scott Duftney, CPA, has randomily selected and audited a sargle of 1

Audit Sampling Part February

fxamplent

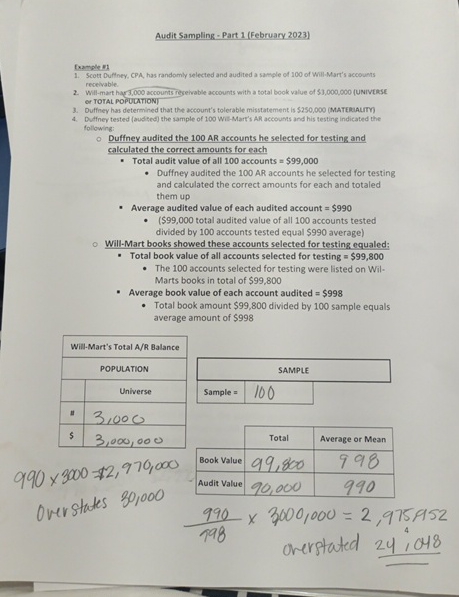

Scott Duftney, CPA, has randomily selected and audited a sargle of of Will Mart's acco unts recelvable:

Willmart har accounts regekable acoounts with a total book value of UNivtese or TOTAL POPtUCATION

Duffney has determined that the account's tolerable misstatement, is $MatEalutm

Duffney tested audited the sample of WitMart's AR accounts and his testing indicated the followirg:

Duffney audited the AR accounts he selected for testing and calculated the correct amounts for each

Total audit value of all accounts $

Duffney audited the AR accounts he selected for testing and calculated the correct amounts for each and totaled them up

Average audited value of each audited account $

$ total audited value of all accounts tested divided by accounts tested equal $ average

WillMart books showed these accounts selected for testing equaled:

Total book value of all accounts selected for testing $

The accounts selected for testing were listed on Wil. Marts books in total of $

Average book value of each account audited $

Total book amount $ divided by sample equals average amount of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock