Question: Auditing : Complete the given bolded sections. Read the case 5-40 below and understand its questions (a, b, c) before proceed to the next section:

Auditing: Complete the given bolded sections.

Read the case 5-40 below and understand its questions (a, b, c) before proceed to the next section:

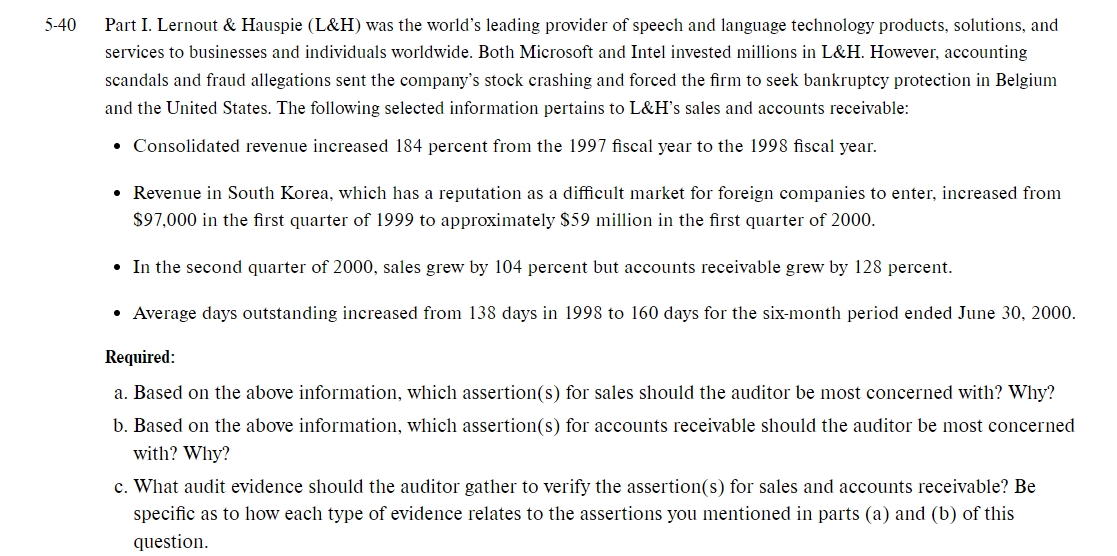

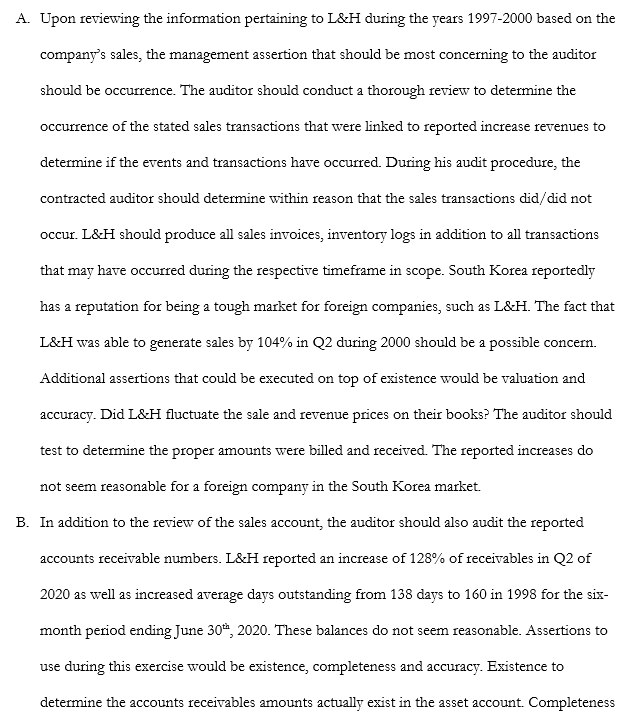

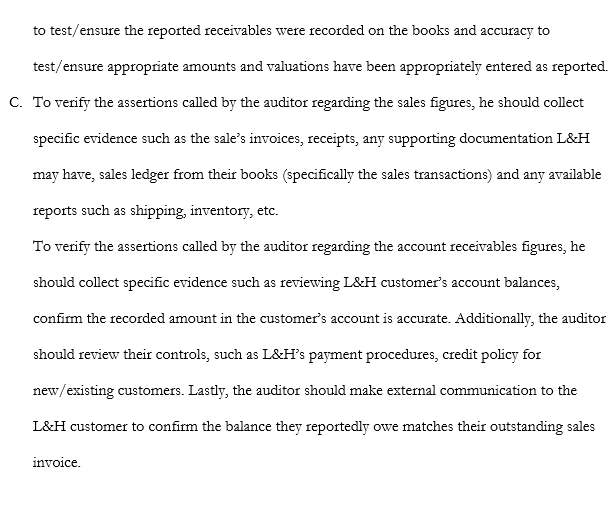

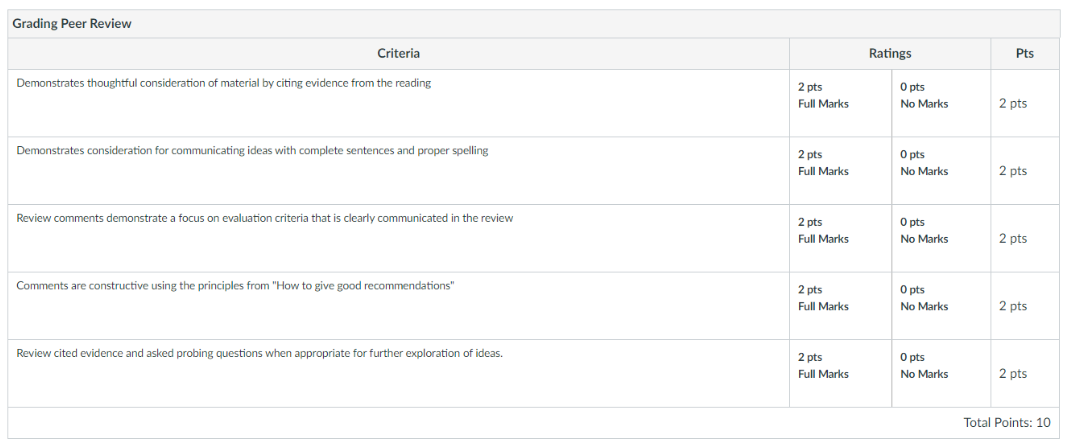

5-40 Part I. Lernout & Hauspie (L&H) was the world's leading provider of speech and language technology products, solutions, and services to businesses and individuals worldwide. Both Microsoft and Intel invested millions in L&H. However, accounting scandals and fraud allegations sent the company's stock crashing and forced the firm to seek bankruptcy protection in Belgium and the United States. The following selected information pertains to L&H's sales and accounts receivable: . Consolidated revenue increased 184 percent from the 1997 fiscal year to the 1998 fiscal year. . Revenue in South Korea, which has a reputation as a difficult market for foreign companies to enter, increased from $97,000 in the first quarter of 1999 to approximately $59 million in the first quarter of 2000. . In the second quarter of 2000, sales grew by 104 percent but accounts receivable grew by 128 percent. . Average days outstanding increased from 138 days in 1998 to 160 days for the six-month period ended June 30, 2000. Required: a. Based on the above information, which assertion(s) for sales should the auditor be most concerned with? Why? b. Based on the above information, which assertion(s) for accounts receivable should the auditor be most concerned with? Why? c. What audit evidence should the auditor gather to verify the assertion(s) for sales and accounts receivable? Be specific as to how each type of evidence relates to the assertions you mentioned in parts (a) and (b) of this question.A. Upon reviewing the information pertaining to L&H during the years 1997-2000 based on the company's sales, the management assertion that should be most concerning to the auditor should be occurrence. The auditor should conduct a thorough review to determine the occurrence of the stated sales transactions that were linked to reported increase revenues to determine if the events and transactions have occurred. During his audit procedure, the contracted auditor should determine within reason that the sales transactions did/ did not occur. L&H should produce all sales invoices, inventory logs in addition to all transactions that may have occurred during the respective timeframe in scope. South Korea reportedly has a reputation for being a tough market for foreign companies, such as L& H. The fact that L&H was able to generate sales by 104% in Q2 during 2000 should be a possible concern. Additional assertions that could be executed on top of existence would be valuation and accuracy. Did L&H fluctuate the sale and revenue prices on their books? The auditor should test to determine the proper amounts were billed and received. The reported increases do not seem reasonable for a foreign company in the South Korea market. B. In addition to the review of the sales account, the auditor should also audit the reported accounts receivable numbers. L&:H reported an increase of 128% of receivables in Q2 of 2020 as well as increased average days outstanding from 138 days to 160 in 1998 for the six- month period ending June 30, 2020. These balances do not seem reasonable. Assertions to use during this exercise would be existence, completeness and accuracy. Existence to determine the accounts receivables amounts actually exist in the asset account. Completenessto test/ensure the reported receivables were recorded on the books and accuracy to test/ ensure appropriate amounts and valuations have been appropriately entered as reported. C. To verify the assertions called by the auditor regarding the sales figures, he should collect specific evidence such as the sale's invoices, receipts, any supporting documentation L&H may have, sales ledger from their books (specifically the sales transactions) and any available reports such as shipping, inventory, etc. To verify the assertions called by the auditor regarding the account receivables figures, he should collect specific evidence such as reviewing L&H customer's account balances, confirm the recorded amount in the customer's account is accurate. Additionally, the auditor should review their controls, such as L& H's payment procedures, credit policy for new/existing customers. Lastly, the auditor should make external communication to the L&H customer to confirm the balance they reportedly owe matches their outstanding sales invoice.Grading Peer Review Criteria Ratings Pts Demonstrates thoughtful consideration of material by citing evidence from the reading 2 pts 0 pts Full Marks No Marks 2 pts Demonstrates consideration for communicating ideas with complete sentences and proper spelling 2 pts 0 pts Full Marks No Marks 2 pts Review comments demonstrate a focus on evaluation criteria that is clearly communicated in the review 2 pts 0 pts Full Marks No Marks 2 pts Comments are constructive using the principles from "How to give good recommendations" 2 pts 0 pts Full Marks No Marks 2 pts Review cited evidence and asked probing questions when appropriate for further exploration of ideas. 2 pts 0 pts Full Marks No Marks 2 pts Total Points: 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts