Question: auditing i need d, e, f, g, h i need d, e, f, g, h i upload this questions since 3 days and you don't

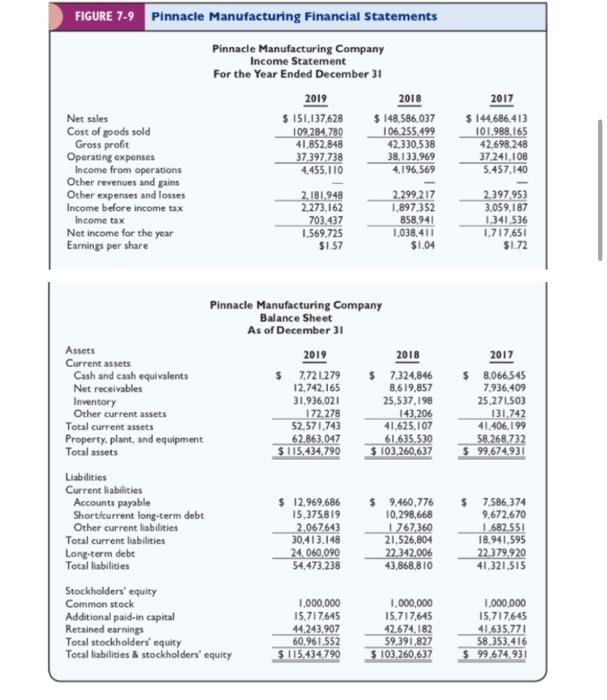

Part-2 - (7 Marks) Conclude from evaluation, the impact of the internal control environment of an organization on the auditor's assignment. C. Based on the analytical procedures calculated in parts a. and b., summarize your observations about Pinnacle's business, including your assessment of the client's business risk. d. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the following: Account Balance Estimate of $ Amount of Potential Misstatement e. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the one in requirement d. f. Explain whether you believe the information in requirement d. or e, provides the most useful data for evaluating the potential for misstatements. Explain why. 8. Analyze the account balances for accounts receivable, inventory, and short/current long-term debt. Describe any observations about those accounts and discuss additional information you want to consider during the current-year audit. h. Based on yourcalculations, assess the likelihood (high, medium, or low) that Pinnacle is likely to fail financially in the next 12 months. FIGURE 7-9 Pinnacle Manufacturing Financial Statements Pinnacle Manufacturing Company Income Statement For the Year Ended December 31 2019 2018 $ 151.137,628 $ 148,586,037 109,284,780 106.255,499 41.852,848 42.330.538 37.397.738 38,133.969 4.455.110 4.196.569 2017 $ 144.686.413 101.988,165 42.698.248 37.241.108 5.457.140 Net sales Cost of goods sold Gross profit Operating expenses Income from operations Other revenues and gains Other expenses and losses Income before income tax Income tax Net income for the year Earnings per share 2,181 948 2,273.162 703.437 1.569.725 $1.57 2.299.217 1.897.352 858.941 1.038,411 $1.04 2.397.953 3.059.187 1,341 536 1,717,651 $1.72 2017 $ 8,066.545 7.936,409 25.271.503 131, 742 41,406,199 58 268732 $ 99,674,931 Pinnacle Manufacturing Company Balance Sheet As of December 31 Assets 2019 2018 Current assets Cash and cash equivalents $ 7.724279 $ 7.324,846 Net receivables 12.742,165 8,619,857 Inventory 31.936,021 25,537,198 Other current assets 172.278 143,206 Total current assets 52,571.743 41.625,107 Property, plant, and equipment 62.863,047 61 635,530 Total assets $115,434,790 $ 103.260,637 Liabilities Current liabilities Accounts payable $ 12.969,686 $ 9,460,776 Shortcurrent long-term debt 15.375819 10,298,668 Other current liabilities 2.067643 1 767360 Total current liabilities 30,413.148 21.526,804 Long-term debe 24,060,090 22,342,006 Total liabilities 54.473.238 43,868,810 Stockholders' equity Common stock 1,000,000 1,000,000 Additional paid-in capital 15,717,645 15.717,645 Retained earnings 44.243.907 42.674,182 Total stockholders' equity 60,961,552 59,391,827 Total liabilities & stockholders' equity $ 115,434799 $ 103,260,637 7.586.374 9,672,670 1,682,551 18,941,595 22.379.920 41,321,515 1,000,000 15,717,645 41.635.771 58,353,416 $99.674931 Part-1 - (5 Marks) Develop audit planning and analytical techniques to deliver an effective audit opinion. a. Go to the Pinnacle manufacturing company website open the Pinnacle_Financials Excel file. The financial statement data is also shown above. Using the Excel file, compute percent changes in all Pinnacle Income Statement and Pinnacle Balance Sheet account balances from 2017-2018 and 2018-2019. b. The Excel file also includes a tab with the common ratios. Calculate at least five common ratios including at least one ratio from each category. Document the ratios in a format similar to the following: Ratio 2019 2018 2017 Current Ratio: Part-2 - (7 Marks) Conclude from evaluation, the impact of the internal control environment of an organization on the auditor's assignment. C. Based on the analytical procedures calculated in parts a. and b., summarize your observations about Pinnacle's business, including your assessment of the client's business risk. d. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the following: Account Balance Estimate of $ Amount of potential Misstatement e. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the one in requirement d. f. Explain whether you believe the information in requirement d.or e provides the most useful data for evaluating the potential for misstatements. Explain why. g. Analyze the account balances for accounts receivable, inventory, and short/current long-term debt. Describe any observations about those accounts and discuss additional information you want to consider during the current-year audit h. Based on yourcalculations, assess the likelihood (high, medium, or low) that Pinnacle is likely to fail financially in the next 12 months. Background Information- Pinnacle Manufacturing Company Your audit firm has recently been engaged as the new auditor for Pinnacle Manufacturing, effective for the audit of the financial statements for the year ended December 31, 2019. Pinnacle is a medium-sized corporation, with its headquarters located in Detroit, Michigan. The company is made up of three divisions. The first division, Welburn, has been in existencefor35 years and creates powerful dieselenginesforboats,trucks, and commercial farming equipment. The second division, Solar-Electro, was recently acquired from a hightechmanufacturing firm based out of Dallas, Texas. Solar-Electro producesstate-of-the-art, solar-powered engines. The solar-powered engine market continues to mature, and Pinnacle's top management believes that the Solar-Electro division will beextremely profitable. In the future as the focus on global climate change continues and anticipated regulations make solar- powered engines mandatory for certain public transportation vehicles. Finally, the third division, Machine- Tech, engages in a wide variety of machine service and repair operations. This division, also new to Pinnacle, is currently in its second year of operations, Pinnacle's board of directors has recently considered Selling the Machine-Tech division in order to focus more on core operations-engine manufacturing. However, before any sale will bemade, the boardhas agreed to evaluate this year's operatingresults. Excellent operating results may have the effect of keeping the division as part of Pinnacle for the next few years. The vice president for Machine-Tech is committed to making it profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts