Question: auestion 2. a) what is the difference between beta coefficlent and standard deviation as risk? b) How may the beta be used in the capital

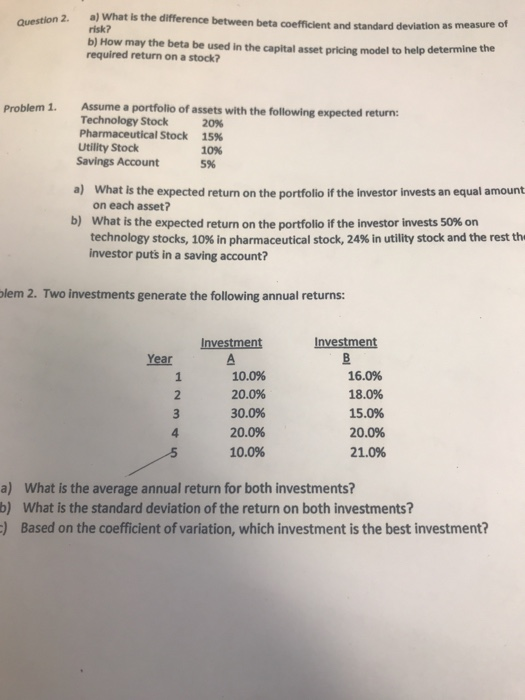

auestion 2. a) what is the difference between beta coefficlent and standard deviation as risk? b) How may the beta be used in the capital asset pricing required return on a stock? model to help determine the Problem 1.Assume a portfolio of assets with the following expected return Technology Stock Pharmaceutical Stock Utility Stock Savings Account 20% 15% 10% 5% a) What is the expected return on the portfolio if the investor invests an equal amount on each asset? what is the expected return on the portfolio if the investor invests 50% on technology stocks, 10% in pharmaceutical stock, 24% in utility stock and the rest the investor put's in a saving account? b) lem 2. Two investments generate the following annual returns: Investment Investment Year 10.0% 20.0% 30.0% 20.0% 10.0% 16.0% 18.0% 15.0% 20.0% 21.0% a) What is the average annual return for both investments? b) What is the standard deviation of the return on both investments? ) Based on the coefficient of variation, which investment is the best investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts