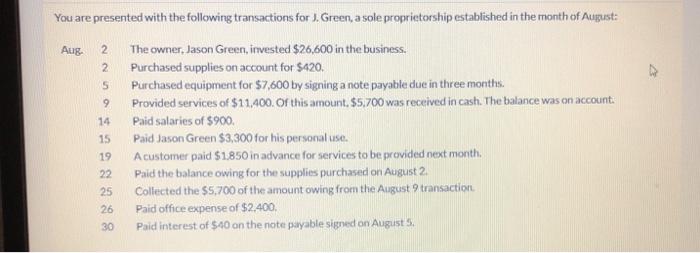

Question: Aug 2 2 5 9 You are presented with the following transactions for J. Green, a sole proprietorship established in the month of August: The

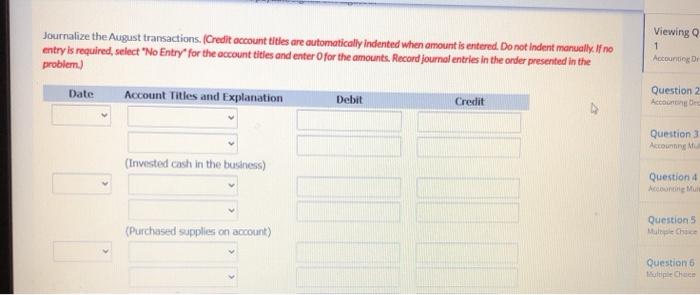

Aug 2 2 5 9 You are presented with the following transactions for J. Green, a sole proprietorship established in the month of August: The owner, Jason Green, invested $26,600 in the business. Purchased supplies on account for $420. Purchased equipment for $7,500 by signing a note payable due in three months. Provided services of $11,400. Or this amount, $5.700 was received in cash. The balance was on account: Paid salaries of $900. Paid Jason Green $3,300 for his personal use. A customer paid $1.850 in advance for services to be provided next month. Paid the balance owing for the supplies purchased on August 2. Collected the $5,700 of the amount owing from the August 9 transaction Paid office expense of $2,400, Paid interest of $40 on the note payable signed on August 14 15 19 22 25 26 30 Journalize the August transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Viewing a 1 Accounting Date Account Titles and Explanation Debit Credit Question 2 Accounting Question 3 Account (Invested cash in the business) Question 4 Accounting Mur (Purchased supplies on account) Questions Mulle chic Question 6 Cheer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts