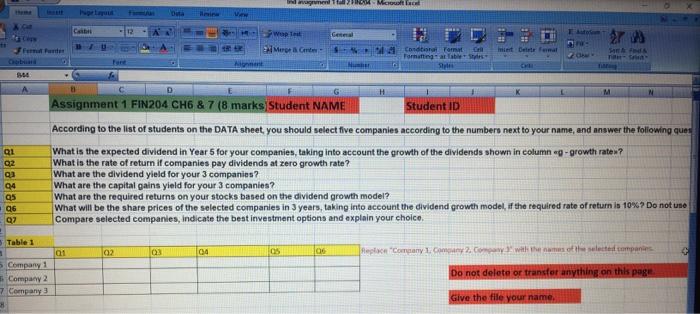

Question: augmenta Micro ten Duta View Cat ar 71 Meron Codi Tomat Formatting miest Delete fama 66 M Assignment 1 FIN204 CH6 & 7 (8 marks

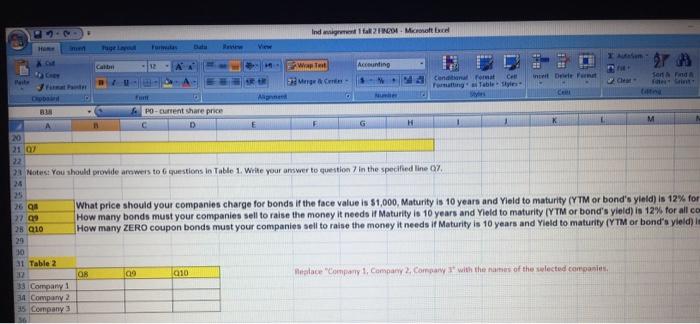

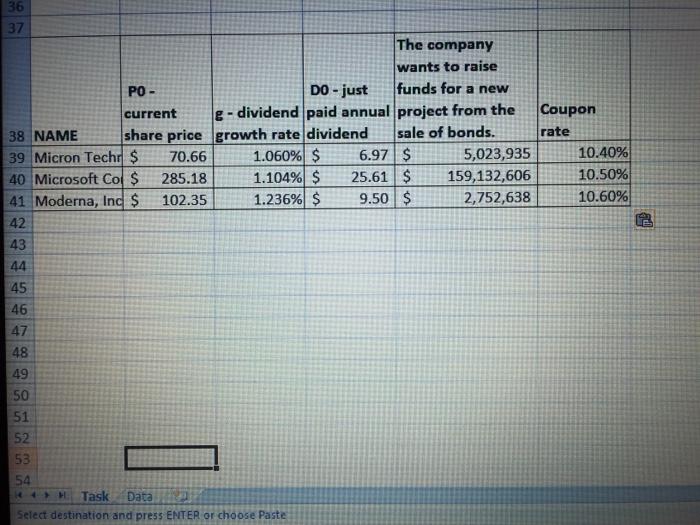

augmenta Micro ten Duta View Cat ar 71 Meron Codi Tomat Formatting miest Delete fama 66 M Assignment 1 FIN204 CH6 & 7 (8 marks Student NAME Student ID Q1 02 Qu3 04 95 Q6 According to the list of students on the DATA sheet you should select five companies according to the numbers next to your name and answer the following ques What is the expected dividend in Year 5 for your companies, taking into account the growth of the dividends shown in column o-growth rate ? What is the rate of return if companies pay dividends at zero growth rate? What are the dividend yield for your 3 companies? What are the capital gains yield for your 3 companies? What are the required returns on your stocks based on the dividend growth model? What will be the share prices of the selected companies in 3 years, taking into account the dividend growth model, if the required rate of return is 10%? Do not use Compare selected companies, indicate the best investment options and explain your choice. Table 1 ai 02 03 04 05 106 Replace Company C. Com with the most companies 5 Company 1 Company 2 7 Company 3 Do not delete or transfer anything on this page Give the file your name. Indo Marmotte gela cal Accounting TA Wrap Mere in De Son FAQ Condoa Cell Formatting Table Styles Chat DO B A 20 21 01 PO-current share price D M G H K 2 Notes: You should provide arowers to questions in Table 1. Write your answer to question in the specified line 67 26 26 What price should your companies charge for bonds if the face value is $1,000, Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for 27 00 How many bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all co 25 910 How many ZERO coupon bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yleld) 20 30 31 Table 2 32 OR qo 010 Replace Company 1. Company Company with the names of the selected companies 33 Company 34 Company 2 35 Company 36 37 The company wants to raise PO - DO - just funds for a new current g - dividend paid annual project from the Coupon 38 NAME share price growth rate dividend sale of bonds. rate 39 Micron Techr $ 70.66 1.060% $ 6.97 $ 5,023,935 10.40% 40 Microsoft Cor $ 285.18 1.104% $ 25.61$ 159,132,606 10.50% 41 Moderna, Inc $ 102.35 1.236% $ 9.50 $ 2,752,638 10.60% 42 43 44 45 46 47 48 49 50 51 52 53 54 HH Task Data Select destination and press ENTER or choose Paste augmenta Micro ten Duta View Cat ar 71 Meron Codi Tomat Formatting miest Delete fama 66 M Assignment 1 FIN204 CH6 & 7 (8 marks Student NAME Student ID Q1 02 Qu3 04 95 Q6 According to the list of students on the DATA sheet you should select five companies according to the numbers next to your name and answer the following ques What is the expected dividend in Year 5 for your companies, taking into account the growth of the dividends shown in column o-growth rate ? What is the rate of return if companies pay dividends at zero growth rate? What are the dividend yield for your 3 companies? What are the capital gains yield for your 3 companies? What are the required returns on your stocks based on the dividend growth model? What will be the share prices of the selected companies in 3 years, taking into account the dividend growth model, if the required rate of return is 10%? Do not use Compare selected companies, indicate the best investment options and explain your choice. Table 1 ai 02 03 04 05 106 Replace Company C. Com with the most companies 5 Company 1 Company 2 7 Company 3 Do not delete or transfer anything on this page Give the file your name. Indo Marmotte gela cal Accounting TA Wrap Mere in De Son FAQ Condoa Cell Formatting Table Styles Chat DO B A 20 21 01 PO-current share price D M G H K 2 Notes: You should provide arowers to questions in Table 1. Write your answer to question in the specified line 67 26 26 What price should your companies charge for bonds if the face value is $1,000, Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for 27 00 How many bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all co 25 910 How many ZERO coupon bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yleld) 20 30 31 Table 2 32 OR qo 010 Replace Company 1. Company Company with the names of the selected companies 33 Company 34 Company 2 35 Company 36 37 The company wants to raise PO - DO - just funds for a new current g - dividend paid annual project from the Coupon 38 NAME share price growth rate dividend sale of bonds. rate 39 Micron Techr $ 70.66 1.060% $ 6.97 $ 5,023,935 10.40% 40 Microsoft Cor $ 285.18 1.104% $ 25.61$ 159,132,606 10.50% 41 Moderna, Inc $ 102.35 1.236% $ 9.50 $ 2,752,638 10.60% 42 43 44 45 46 47 48 49 50 51 52 53 54 HH Task Data Select destination and press ENTER or choose Paste

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts