Question: A.Using the following information (Document Attached)conduct ratio analysis and determine; Liquidity ratios ( Current Ratio, Quick Ratio, Debt to Equity Ratio, Interest Coverage Ratio) Profitability

A.Using the following information (Document Attached)conduct ratio analysis and determine;

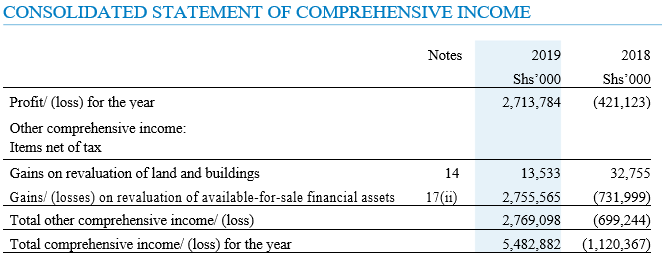

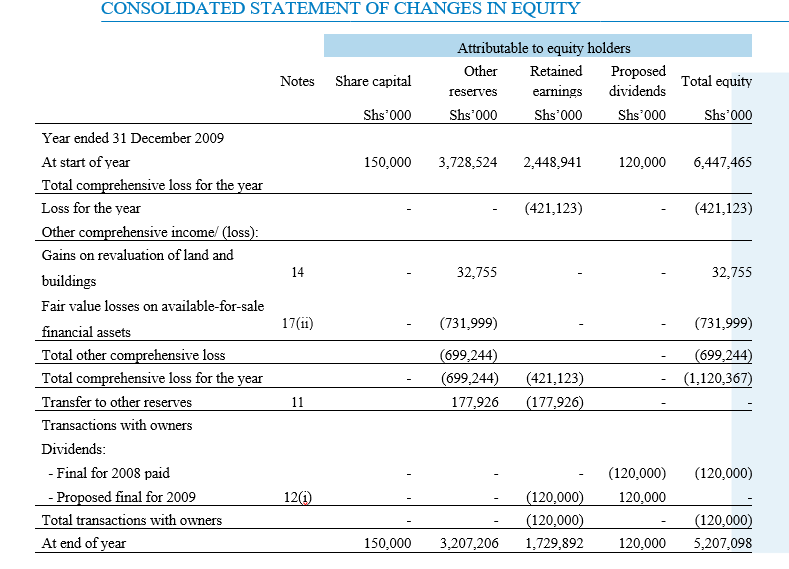

Liquidity ratios (Current Ratio, Quick Ratio, Debt to Equity Ratio, Interest Coverage Ratio)

Profitability ratios (Return on Assets (ROA), Return on Equity (ROE), Profit Margin)

Investment ratios (Price-to-Earnings Ratio (P/E) , Dividend Yield, Dividend Payout Ratio)

Explain how every ratio (Above) influences your investment decision.

B.Conduct a trend analysis for the last five years in relation to revenues and net earnings of the firm.

C.Conclusion. Based on your analysis, would you be interested in investing

\f\f\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts