Question: Australia tax QUESTION 4 11 points Save Answer (a) Meme is a small business taxpayer. At 1 July 2019 the balance of the taxpayer's Small

Australia tax

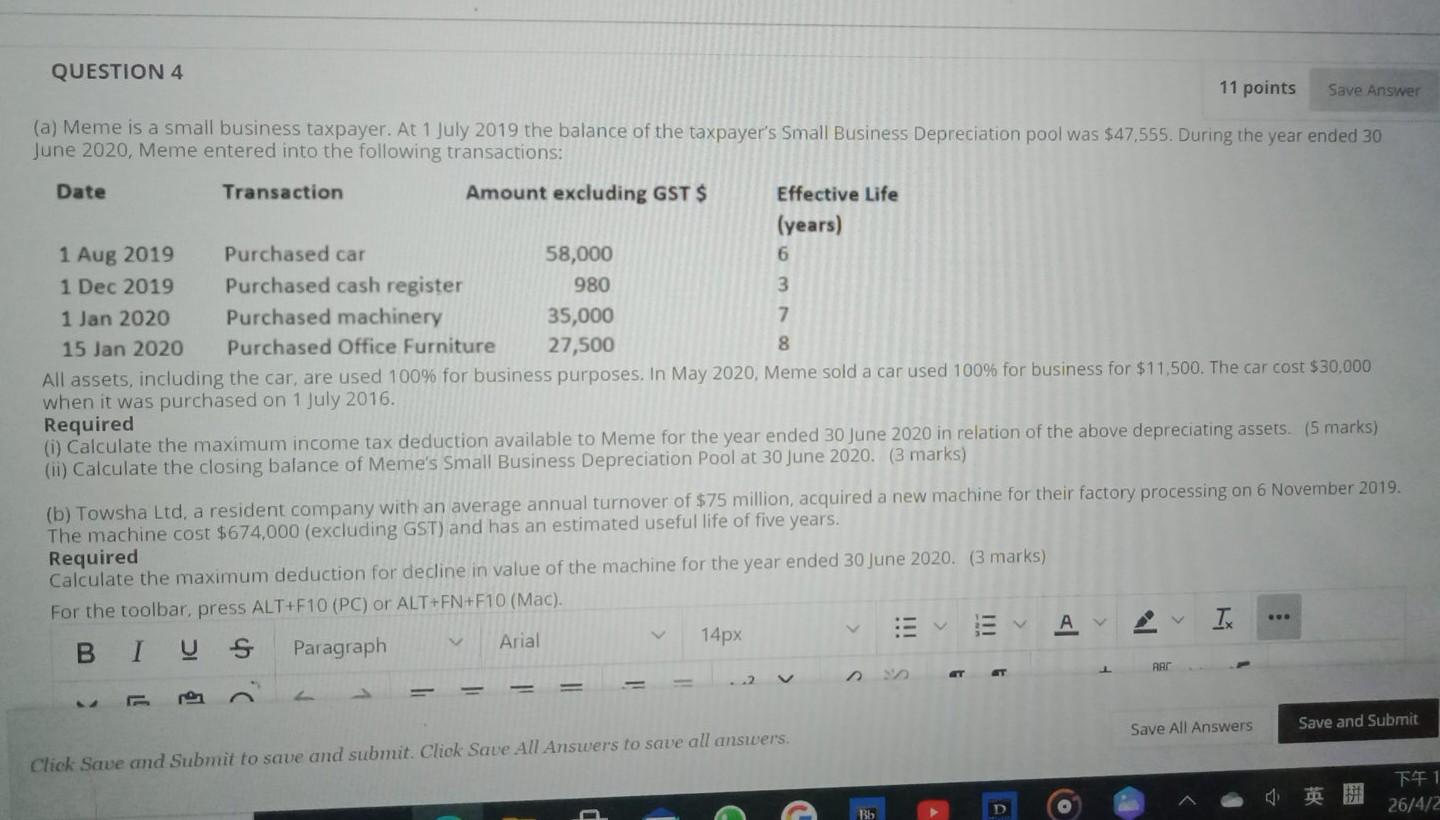

QUESTION 4 11 points Save Answer (a) Meme is a small business taxpayer. At 1 July 2019 the balance of the taxpayer's Small Business Depreciation pool was $47,555. During the year ended 30 June 2020, Meme entered into the following transactions: Date Transaction Amount excluding GST $ Effective Life (years) 1 Aug 2019 Purchased car 58,000 6 1 Dec 2019 Purchased cash register 980 3 1 Jan 2020 Purchased machinery 35,000 7 15 Jan 2020 Purchased Office Furniture 27,500 8 All assets, including the car, are used 100% for business purposes. In May 2020, Meme sold a car used 100% for business for $11,500. The car cost $30,000 when it was purchased on 1 July 2016. Required (i) Calculate the maximum income tax deduction available to Meme for the year ended 30 June 2020 in relation of the above depreciating assets. (5 marks) (ii) Calculate the closing balance of Meme's Small Business Depreciation Pool at 30 June 2020. (3 marks) (b) Towsha Ltd, a resident company with an average annual turnover of $75 million, acquired a new machine for their factory processing on 6 November 2019. The machine cost $674,000 (excluding GST) and has an estimated useful life of five years. Required Calculate the maximum deduction for decline in value of the machine for the year ended 30 June 2020. (3 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B. I S Paragraph Arial 14px T ART T Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. d T71 26/4/2 Bb QUESTION 4 11 points Save Answer (a) Meme is a small business taxpayer. At 1 July 2019 the balance of the taxpayer's Small Business Depreciation pool was $47,555. During the year ended 30 June 2020, Meme entered into the following transactions: Date Transaction Amount excluding GST $ Effective Life (years) 1 Aug 2019 Purchased car 58,000 6 1 Dec 2019 Purchased cash register 980 3 1 Jan 2020 Purchased machinery 35,000 7 15 Jan 2020 Purchased Office Furniture 27,500 8 All assets, including the car, are used 100% for business purposes. In May 2020, Meme sold a car used 100% for business for $11,500. The car cost $30,000 when it was purchased on 1 July 2016. Required (i) Calculate the maximum income tax deduction available to Meme for the year ended 30 June 2020 in relation of the above depreciating assets. (5 marks) (ii) Calculate the closing balance of Meme's Small Business Depreciation Pool at 30 June 2020. (3 marks) (b) Towsha Ltd, a resident company with an average annual turnover of $75 million, acquired a new machine for their factory processing on 6 November 2019. The machine cost $674,000 (excluding GST) and has an estimated useful life of five years. Required Calculate the maximum deduction for decline in value of the machine for the year ended 30 June 2020. (3 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B. I S Paragraph Arial 14px T ART T Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. d T71 26/4/2 Bb

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts