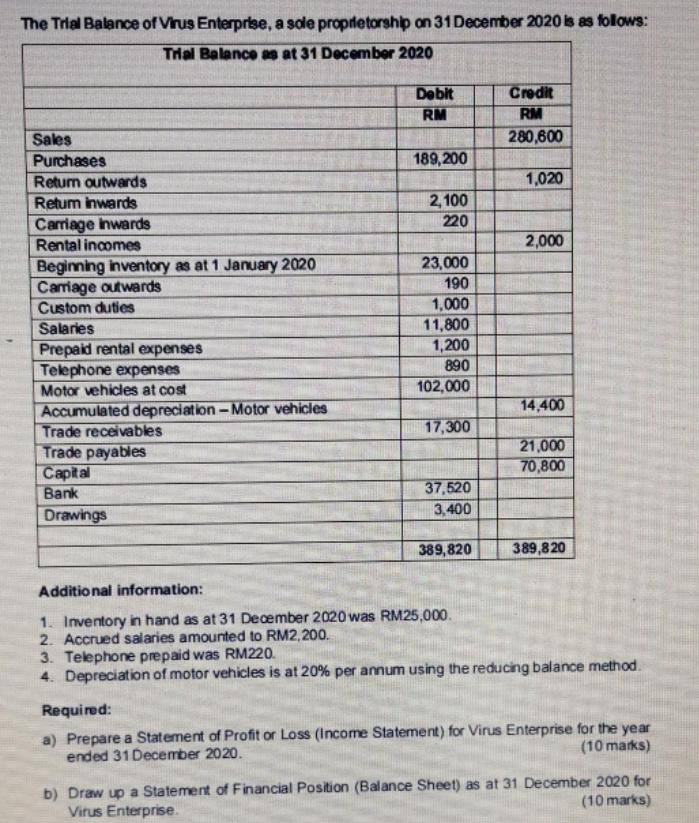

Question: The Trial Balance of Virus Enterprlse, a sole proprletorship on 31 December 2020 is as follows: Trial Balance as at 31 December 2020 Credit

The Trial Balance of Virus Enterprlse, a sole proprletorship on 31 December 2020 is as follows: Trial Balance as at 31 December 2020 Credit RM 280,600 Debit RM Sales Purchases 189,200 Retum outwards 1,020 2,100 220 Retum inwards Carriage inwards Rental incomes Beginning inventory as at 1 January 2020 Cariage outwards 2,000 23,000 190 1,000 11,800 1,200 890 102,000 Custom duties Salaries Prepaid rental expenses Telephone expenses Motor vehicles at cost 14,400 Accumulated depreciation -Motor vehicies Trade receivables Trade payables Capital Bank 17,300 21,000 70,800 37,520 3,400 Drawings 389,820 389,820 Additional information: 1. Inventory in hand as at 31 December 2020was RM25,000. 2. Accrued salaries amounted to RM2,200. 3. Telephone prepaid was RM220. 4. Depreciation of motor vehicles is at 20% per annum using the reducing balance method. Required: a) Prepare a Statement of Profit or Loss (Income Statement) for Virus Enterprise for the year ended 31 December 2020. (10 marks) b) Draw up a Statement of Financial Position (Balance Sheet) as at 31 December 2020 for Virus Enterprise. (10 marks)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Answer Explanation 1 Income Statement Amount RM Sales 280600 Less Return Inward 210... View full answer

Get step-by-step solutions from verified subject matter experts