Question: Autolave ON Template - ACC 213 Lab 7 for Chapter 8() - Excel Search Formulas Data View Help Home Insert X cur Copy romat Painter

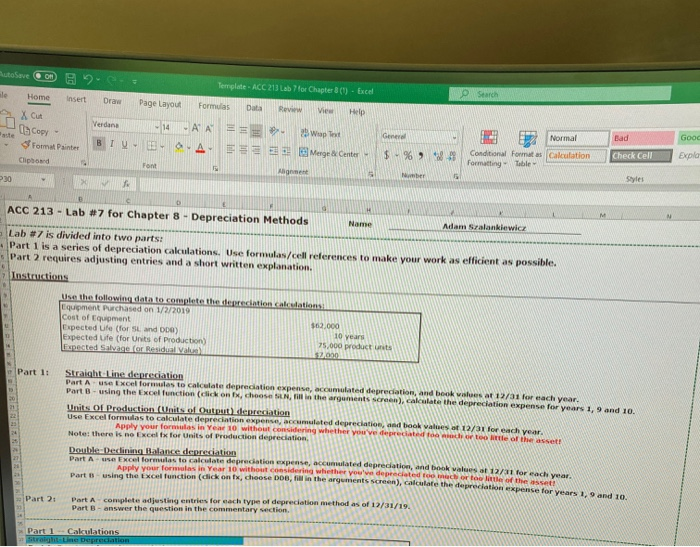

Autolave ON Template - ACC 213 Lab 7 for Chapter 8() - Excel Search Formulas Data View Help Home Insert X cur Copy romat Painter Draw Page Layout Verdana 1914 - AA = BIVS A Wap tot Genere Bad Good Merge Center $ % 2 2 Normal Conditional Formatas Calculation Formatting Table Check Cell Explo Font Algement 30 ber Styles D ACC 213 - Lab #7 for Chapter 8 - Depreciation Methods Name Adam Nalankiewic Lab #7 is divided into two parts: Part 1 is a series of depreciation cakulations. Use formulas/cell references to make your work as efficient as possible. Part 2 requires adjusting entries and a short written explanation. Instructions Use the following data to complete the depreciation calculations Equipment Purchased on 1/2/2019 Cost of Equipment $62.000 Expected Life (for SL and ODA) 10 years Expected Life (for Units of Production) 75.000 product units Expected Salvage Cor Residual Value Part 1: Straight line depreciation Part A use Excel formulas to calculate depreciation expense, accumulated depreciation, and book was at 12/31 for each year, Part 8 - using the Excel function (click on x, choose SN, in the arguments sco), calculate the depreciation expense for years 1, 9 and 10. Units Of Production (Units of Output) depreciation Use Excel formulas to calculate depreciation expense, accumulated depreciation, and book values of 12/31 for each year. Apply your formulas in Year 10 without considering whether you ve deprecated storite of the asset Note: there is no Excel fx for Units of Product depreciation Double Declining Balance depreciation Part A u Excel formulas to calculate depreciation expense, accumulated depreciation, and book values 12/31 for each year. Part 8 - using the excel function (dick on fx, choose toe, in the arguments screen), calculate the depreciation expense for years, and 10. - Part 2 Part A complete adjusting entries for each type of depreciation method as of 12/31/19. Part 3 - answer the question in the commentary section. Part 1 Cakulations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts