Question: - + Automatic Zoom Question 4 (a) Consider the following two strategies: Strategy 1: short one call option with strike price X + 2a, short

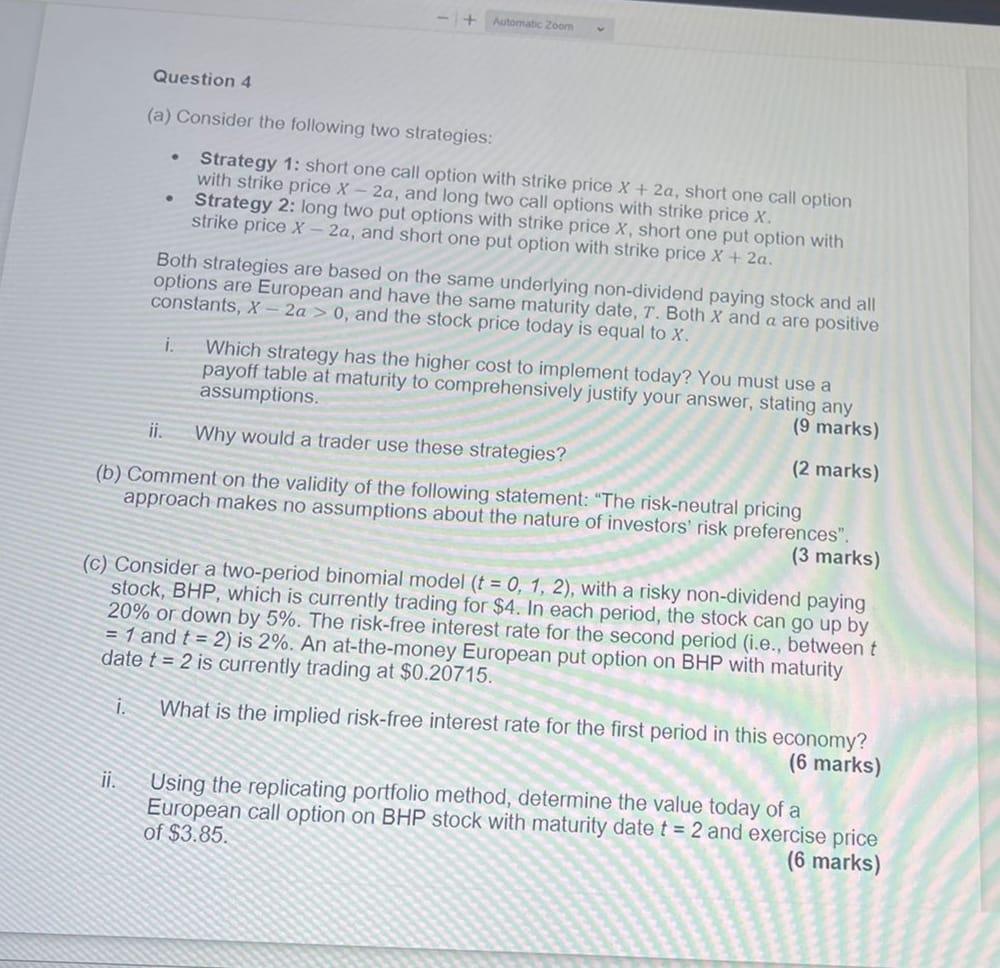

- + Automatic Zoom Question 4 (a) Consider the following two strategies: Strategy 1: short one call option with strike price X + 2a, short one call option with strike price X - 2a, and long two call options with strike price X. Strategy 2: long two put options with strike price x, short one put option with strike price x - 2a, and short one put option with strike price X + 2a. . Both strategies are based on the same underlying non-dividend paying stock and all options are European and have the same maturity date, T. Both X and a are positive constants, X - 2a > 0, and the stock price today is equal to X. i. Which strategy has the higher cost to implement today? You must use a payoff table at maturity to comprehensively justify your answer, stating any assumptions. (9 marks) ii. Why would a trader use these strategies? (2 marks) (b) Comment on the validity of the following statement: "The risk-neutral pricing approach makes no assumptions about the nature of investors' risk preferences". (3 marks) (c) Consider a two-period binomial model (t = 0, 1, 2), with a risky non-dividend paying stock, BHP, which is currently trading for $4. In each period, the stock can go up by 20% or down by 5%. The risk-free interest rate for the second period (i.e., between t = 1 and t = 2) is 2%. An at-the-money European put option on BHP with maturity date t = 2 is currently trading at $0.20715. i. What is the implied risk-free interest rate for the first period in this economy? (6 marks) ii. Using the replicating portfolio method, determine the value today of a European call option on BHP stock with maturity date t = 2 and exercise price of $3.85. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts