Question: AutoSave C of H - - B. = Chapter_6_Applying_Excel_Student_Form - Search (Alt+Q) Harness, Terah HT X File Home Insert Draw Page Layout Formulas Data Review

![A ab Wrap Text General Comma [0] 2 Currency [0] 2 Currency](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/6739790865162_7846739790855412.jpg)

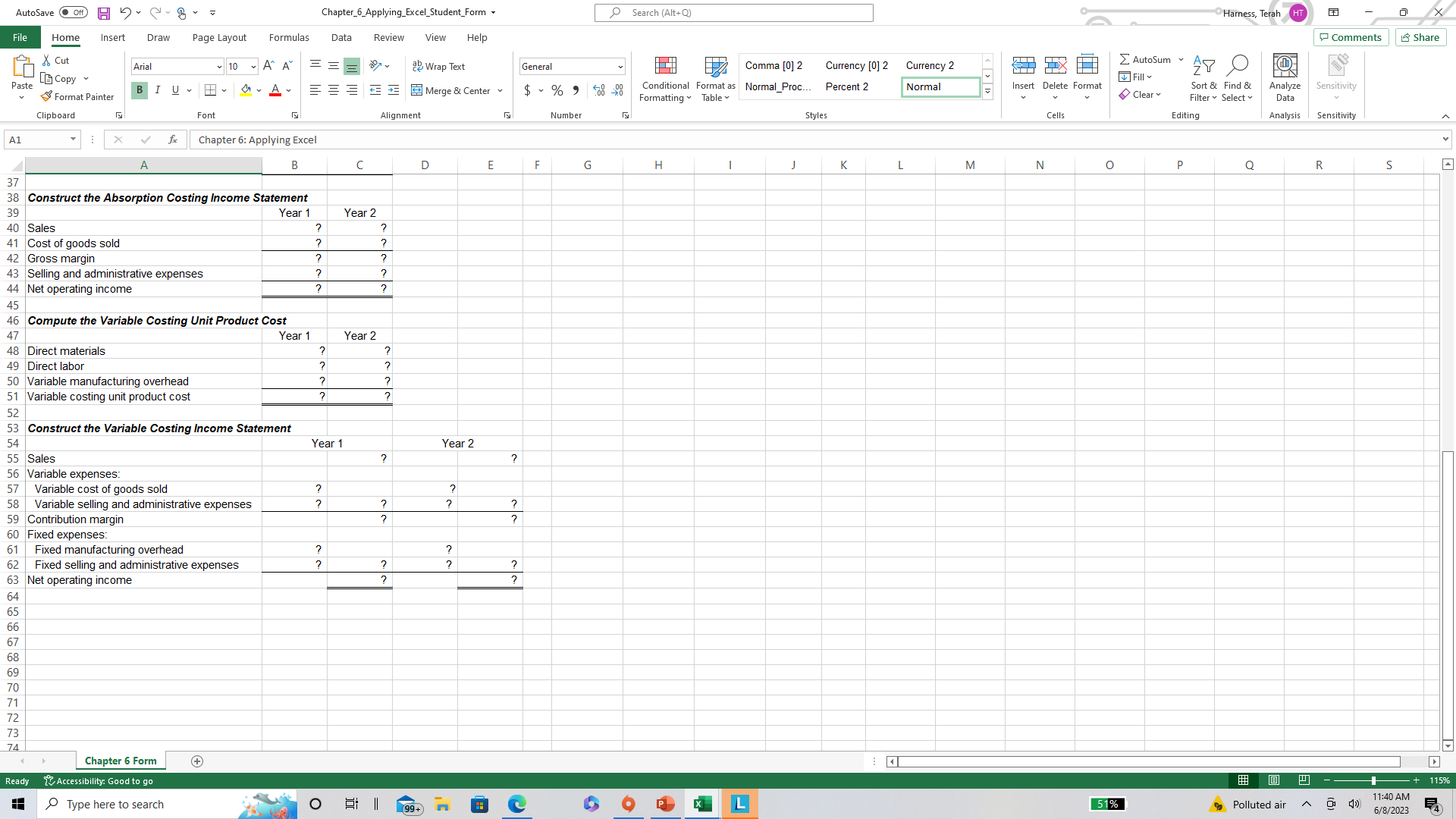

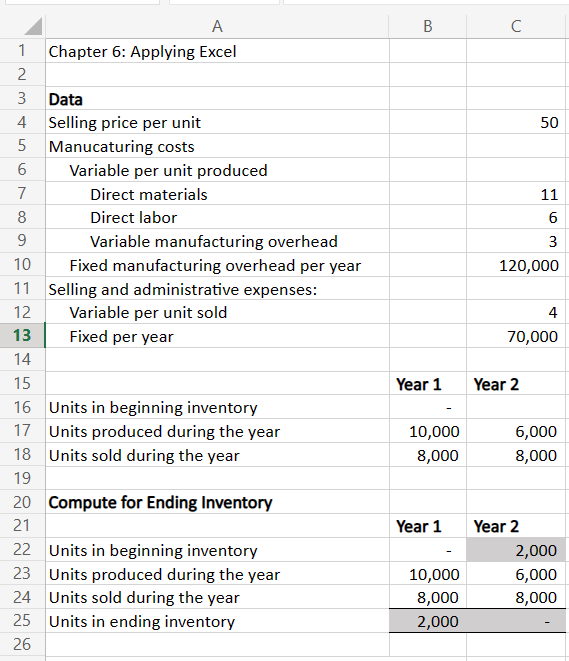

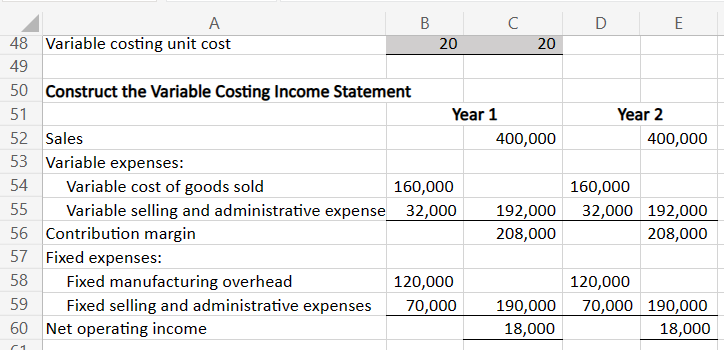

AutoSave C of H - - B. = Chapter_6_Applying_Excel_Student_Form - Search (Alt+Q) Harness, Terah HT X File Home Insert Draw Page Layout Formulas Data Review View Help Comments Share & Cut Aria 10 ~ A" A ab Wrap Text General Comma [0] 2 Currency [0] 2 Currency 2 AutoSum AY O Fill Paste [B Copy E $ ~ % 2 00 20 Conditional Format as Normal_Proc..- Percent 2 nsert Delete Format Sort & Find & Format Painter E Merge & Center Norma Analyze Sensitivity Formatting Table Clear ~ Filter ~ Select v Dat Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity A1 I X V fx Chapter 6: Applying Excel B C D E F G H K L M N O P Q R S Chapter 6: Applying Excel 2 Data 4 Selling price per unit $50 Manufacturing costs Variable per unit produced Direct materials $11 Direct labor $6 Variable manufacturing overhead $3 10 Fixed manufacturing overhead per year $120,000 11 Selling and administrative expenses Variable per unit sold $4 13 Fixed per year $70,000 14 15 Year 1 Year 2 16 Units in beginning inventory 17 Units produced during the year 10,000 6,000 18 Units sold during the year 8,000 8,000 19 20 Enter a formula into each of the cells marked with a ? below Review Problem 1: Contrasting Variable and Absorption Costing 22 23 Compute the Ending Inventory 24 Year 1 Year 2 25 Units in beginning inventory 26 Units produced during the year 27 Units sold during the year 28 Units in ending inventory 29 30 Compute the Absorption Costing Unit Product Cost 31 Year 1 Year 2 32 Direct materials 33 Direct labor 34 Variable manufacturing overhead 35 Fixed manufacturing overhead J . 36 Absorption costing unit product cost 37 38 Construct the Absorption Costing Income Statement Chapter 6 Form + D Ready 1 Accessibility: Good to go 115% Polluted air ~ [: () 11:40 AM Type here to search L 51% 6/8/2023AutoSave C of H - - B. = Chapter_6_Applying_Excel_Student_Form . Search (Alt+Q) Harness, Terah HT X File Home Insert Draw Page Layout Formulas Data Review View Help Comments Share & Cut Aria 10 ~ A" A" ab Wrap Text General Comma [0] 2 Currency [0] 2 Currency 2 AutoSum AY O Paste [B Copy ~ Fill Analyze Format Painter BIUMAv Sort & Find & Sensitivity E E Merge & Center $ ~ % 2 00 20 Conditional Format as Normal_Proc..- Percent 2 Norma nsert Delete Format Formatting ~ Table Clear ~ Filter ~ Select v Dat Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity A1 1 X v fox Chapter 6: Applying Excel B C D E F G H K L M N O P Q R S 37 38 Construct the Absorption Costing Income Statement 39 Year 1 Year 2 40 Sales ? ? 41 Cost of goods sold ? 42 Gross margin 43 Selling and administrative expenses ? 44 Net operating income 45 46 Compute the Variable Costing Unit Product Cost 47 Year 1 Year 2 48 Direct materials 49 Direct labor 50 Variable manufacturing overhead 51 Variable costing unit product cost 52 53 Construct the Variable Costing Income Statement 54 Year 1 Year 2 55 Sales ? 56 Variable expenses: 57 Variable cost of goods sold 58 Variable selling and administrative expenses ? ? 59 Contribution margin 60 Fixed expenses Fixed manufacturing overhead 62 Fixed selling and administrative expenses ? 63 Net operating income 64 65 66 67 68 69 70 71 72 73 74 Chapter 6 Form + D Ready Accessibility: Good to go 115% 11:40 AM Type here to search 6 O P H L 51% Polluted air ~ [: () 6/8/2023A B C 1 Chapter 5: Applying Excel 2 3 Data 4 Selling price per unit 50 5 Manucaturing costs 6 Variable per unit produced 7 Direct materials 11 8 Direct labor 6 9 Variable manufacturing overhead 3 '0 Fixed manufacturing overhead per year 120,000 \"I Selling and administrative expenses: ' 2 Variable per unit sold 4 13 Fixed per year 730,000 '4 ' 5 Year 1 Year 2 ' 6 Units in beginning inventory ' 7" Units produced during the year 10,000 6,000 ' 8 Units sold during the year 8,000 8,000 '9 20 Compute for Ending Inventory 21 Year 1 Year 2 22 Units in beginning inventory - 2,000 23 Units produced during the year 10,000 6,000 24 Units sold during the year 8,000 8,000 25 Units in ending inventory 2,000 [\\J 0'1 A B C 25 Units in ending inventory 2,000 26 27 Compute the Absorption Costing Unit Product Cost 28 Year 1 Year 2 29 Direct materials 11 11 30 Direct labor 6 6 31 Variable manufacturing overhead 3 3 32 Fixed manufacturing overhead per year 12 20 33 Absorption costing unit cost 32 40 34 35 Construct the Absorption Costing Income Statement 36 Year 1 Year 2 37 Sales 400,000 400,000 38 Cost of goods sold 256,000 320,000 39 Gross margin 144,000 80,000 40 Selling and administrative expenses 102,000 102,000 41 Net operating income 42,000 22,000 42 43 Compute the Variable Costing Unit Product Cost 44 Year 1 Year 2 45 Direct materials 11 11 46 Direct labor 6 6 47 Variable manufacturing overhead 3 3 48 Variable costing unit cost 20 20 4948 49 50 5'1 52 53 54 55 56 57 58 59 60 A B C D E Variable costing unit cost 20 20 Construct the 1ll'arialnle Costing Income Statement Year 1 Year 2 Sales 400,000 400,000 Variable expenses: Variable cost of goods sold 160,000 160,000 Variable selling and administrative expense 32,000 192,000 32,000 192,000 Contribution margin 208,000 208,000 Fixed expenses: Fixed manufacturing overhead 120,000 120,000 Fixed selling and administrative expenses 70,000 190,000 70,000 190,000 Net operating income 18,000 18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts