Question: AutoSave Chapter 11 HW OFF ABES Draw Page Layout Formulas Insert Data Review View Tell me X IG Calibri (Body) 11 2. Wrap Text BIU

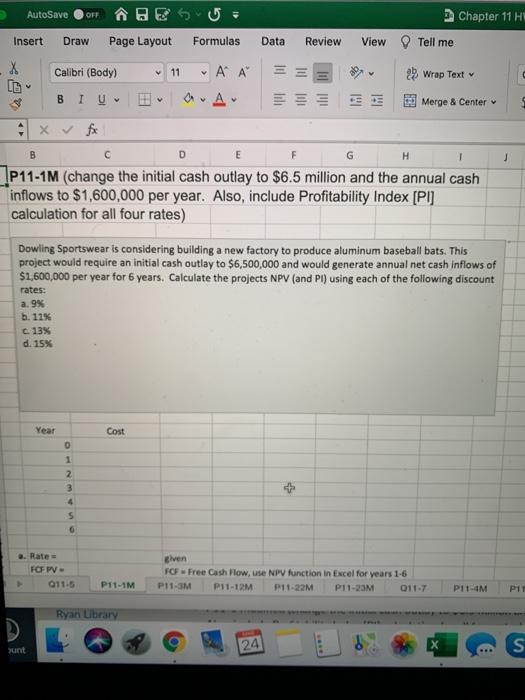

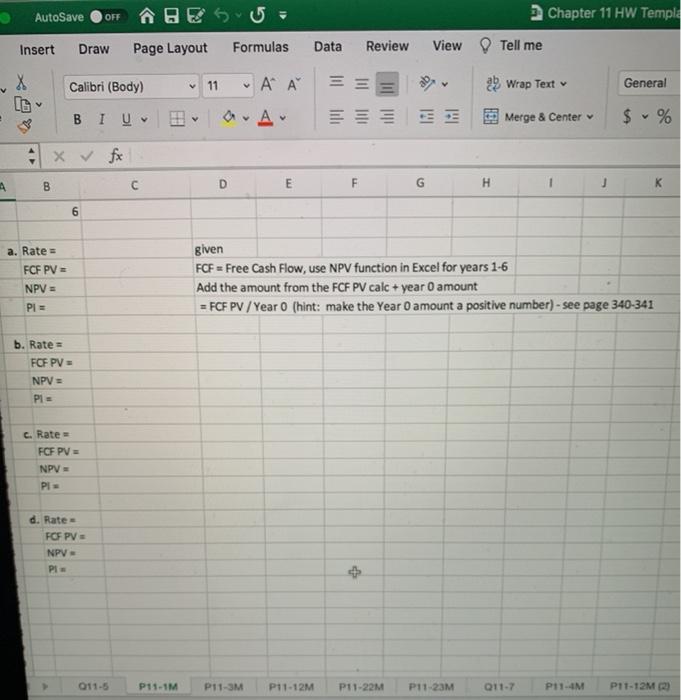

AutoSave Chapter 11 HW OFF ABES Draw Page Layout Formulas Insert Data Review View Tell me X IG Calibri (Body) 11 2. Wrap Text BIU a. Av Merge & Center B D F H P11-1M (change the initial cash outlay to $6.5 million and the annual cash inflows to $1,600,000 per year. Also, include Profitability Index [PI] calculation for all four rates) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay to $6,500,000 and would generate annual net cash inflows of $1,600,000 per year for 6 years, Calculate the projects NPV (and Pi) using each of the following discount rates: a. 9% h. 11% C. 13% d. 15% Year Cost 0 + 1 2 3 4 5 6 2. Rate FOFPV- 011-5 FCF Free Cash Flow, use NPV function in Excel for years 1-6 P11-3M P11-12M P11-22M P11-23M 011-7 P11-1M P1-4M PIT Ryan Library 24 s unt AutoSave OFF Chapter 11 HW Temple Insert Draw Page Layout Formulas Data Review View Tell me X Calibri (Body) 11 v ' ' == Wrap Text General BIU v a. Av Merge & Center $ % X B A D G E F H 6 a. Rate = FCF PV = NPV = PL = given FCF = Free Cash Flow, use NPV function in Excel for years 1-6 Add the amount from the FCFPV calc + year O amount = FCF PV / Year 0 (hint: make the Year O amount a positive number) - see page 340-341 b. Rate = FOFPV NPV = PL c. Rate FCFPV = NPV PI d. Rate FOFPV = NPV- PLE 011-5 P11-1M P11-3M P11-12M P11-22M P11-23M Q11-7 P11-4M P11-12M2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts