Question: AutoSave Home 0 C . . . Chapter 1 6 Homework ( Empty ) Paste Insert Draw Page Layout Formulas Data Review View Calibri 1

AutoSave

Home

C

Chapter Homework Empty

Paste

Insert

Draw

Page Layout

Formulas Data Review View

Calibri

B

I

U

A

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off?

A

An a

Automate

Developer

abs

General

E

$

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off?

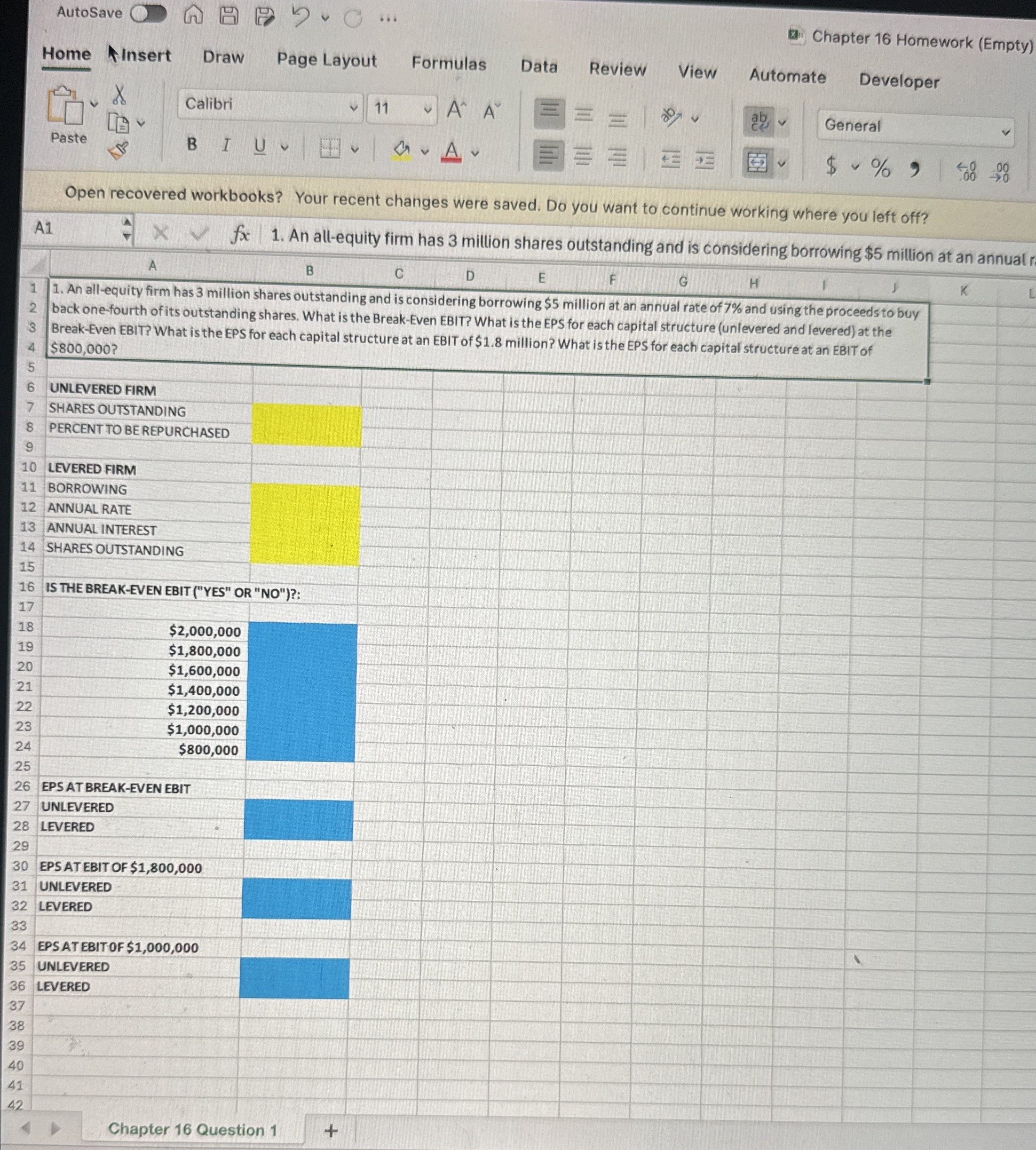

An allequity firm has million shares outstanding and is considering borrowing $ million at an annual rate of and using the proceeds to buy back onefourth of its outstanding shares. What is the BreakEven EBIT? What is the EPS for each capital structure unlevered and levered at the BreakEven EBIT? What is the EPS for each capital structure at an EBIT of $ million? What is the EPS for each capital structure at an EBIT of $

EPS AT BREAKEVEN EBIT

UNLEVERED

LEVERED

EPS AT EBIT OF $

UNLEVERED

LEVERED

EPS AT EBIT OF $

UNLEVERED

LEVERED

Chapter Question

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock