Question: AutoSave O OFF ~ 4 2 6 . 68 - Case 2- Inter 1 Terry Case Template Home Insert Draw Page Layout Formulas Data Review

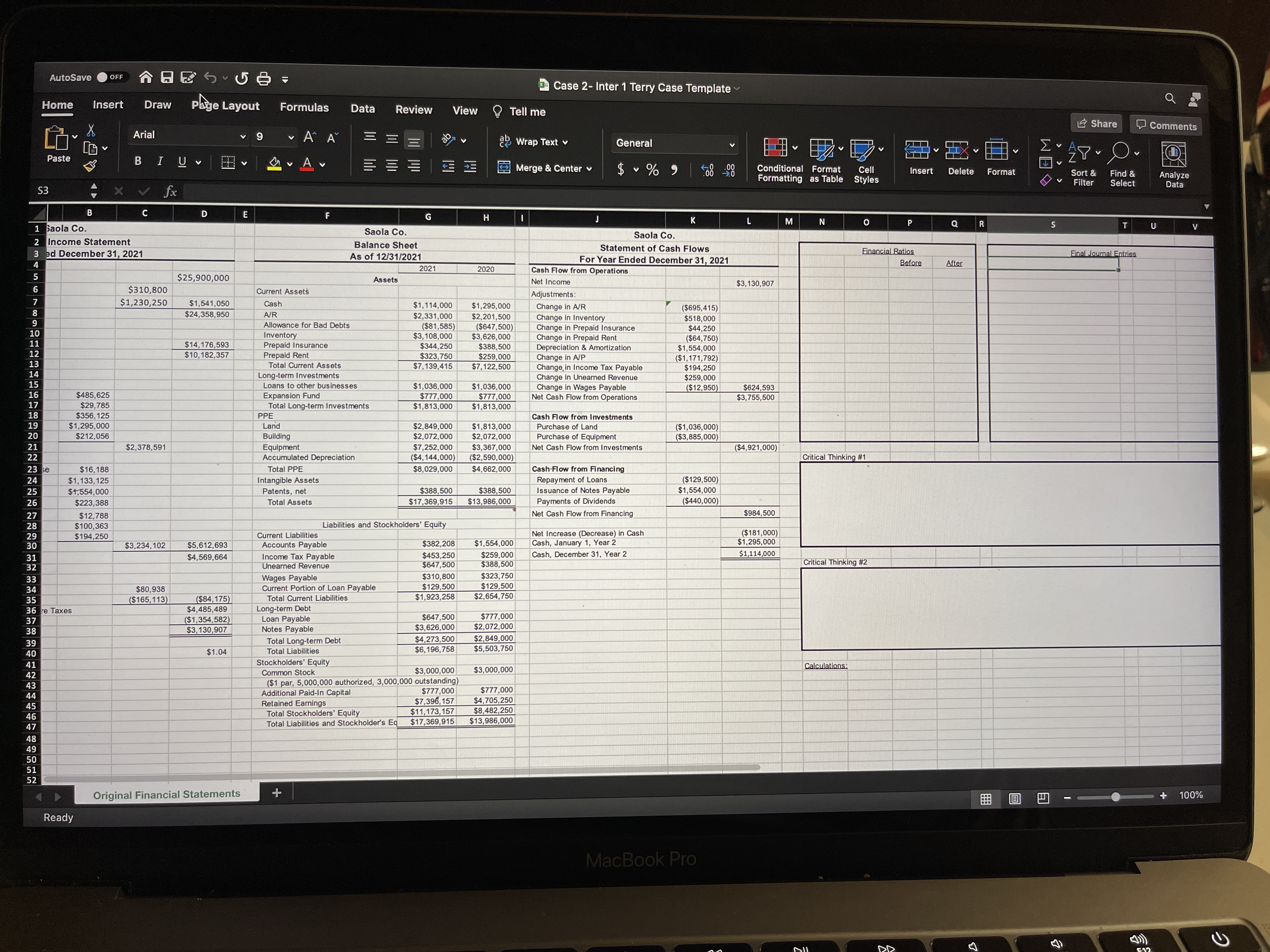

AutoSave O OFF ~ 4 2 6 . 68 - Case 2- Inter 1 Terry Case Template Home Insert Draw Page Layout Formulas Data Review View ? Tell me Share Comments Arial A 7 V D Wrap Text v General Paste BIUV Merge & Center v $ ~ % " 08 28 Conditional ormat Cell Insert Delete Format DVE Sort & Find & nalyze Formatting as Table Styles Filter Select Data $3 fx C D E H M N 0 Q S T U Saola Co. Saola Co. Saola Co. Income Statement Balance Sheet Statement of Cash Flows Financial Ratios ed December 31, 2021 As of 12/31/2021 Final Journal Entries For Year Ended December 31, 2021 Before After 2021 2020 Cash Flow from Operations $25,900,000 Assets Net Income $3, 130,907 $310,800 Current Assets Adjustments $1,230,250 $1,541,050 Cash $1, 114,000 $1,295,000 Change in A/R ($695,415) $24,358,950 A/R $2,331,000 $2,201,500 Change in Inventory $518,000 Allowance for Bad Debts ($81,585) ($647,500) Change in Prepaid Insurance $44,250 Inventory $3, 108,000 $3,626,000 Change in Prepaid Rent ($64,750) $14, 176,595 Prepaid Insurance $344,250 $388,500 Depreciation & Amortization $1,554,000 $10, 182,357 Prepaid Rent $323,750 $259,000 Change in A/P $1,171,792) Total Current Assets $7, 139,415 $7, 122,500 Change in Income Tax Payable $194,250 ong-term Investments Change in Unearned Revenue $259 000 Loans to other businesses 1,036,000 $1,036,000 Change in Wages Payable ($12,950) $624,593 $485,625 Expansion Fund $777,000 $777,000 Net Cash Flow from Operations $3,755,500 $29,785 Total Long-term Investments $1,813,000 $1,813,000 $356, 125 PE Cash Flow from Investments $1,295,000 Land $2,849,000 $1,813,000 Purchase of Land $1,036,000) $212,056 Building $2,072,000 $2,072,000 Purchase of Equipment ($3,885,000) $2, 378,591 Equipment $7,252,000 $3,367,000 Net Cash Flow from Investments ($4,921,000) Accumulated Depreciation $4, 144,000) ($2,590,000) Critical Thinking # 1 Cash Flow from Financing NNUNE $16, 188 Total PPE $8,029,000 $4,662,000 $1, 133, 125 ntangible Assets Repayment of Loans ($129,500) $4,554,000 Patents, net $388,500 $388,500 Issuance of Notes Payable 1,554,000 $223 , 388 Total Assets $17,369,915 $13,986,000 Payments of Dividends $440,000) $984,500 $12 ,788 Net Cash Flow from Financing $100,363 Liabilities and Stockholders' Equity $194,250 Current Liabilities Net Increase (Decrease) in Cash ($181,000) $3,234, 102 $5,612,693 Accounts Payable $382,208 $1,554,000 Cash, January 1, Year 2 $4,569,664 Income Tax Payable $453,25 $259,000 Cash, December 31, Year 2 $1,114,000 $647,500 $388,500 Critical Thinking #2 Unearned Revenue Wages Payable $310,800 $323,750 $80,938 Current Portion of Loan Payable $129,500 $129.500 ($165, 113) ($84,175) Total Current Liabilities 1,923,258 2,654,750 re Taxes $4,485,489 ong-term Debt $1,354,582) Loan Payable $647,500 $777,000 $3, 130,907 Notes Payable $3,626,000 $2,072,000 Total Long-term Debt $4,273,500 $2,849,000 $1.04 Total Liabilities $6, 196,758 $5,503 , 750 Stockholders' Equity Common Stock $3,000,000 $3,000,000 Calculations: ($1 par, 5,000,000 authorized, 3,000,000 outstanding) Additional Paid-In Capital $777,000 $777,000 Retained Earnings $4,705,250 Total Stockholders' Equity $11,173, 157 $8,482,250 Total Liabilities and Stockholder's Eq $17,369,915 $13,986,000 Original Financial Statements + + 100% Ready MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts