Question: AutoSave O OFF A A e ? . C ... Construction Timeline & Budget (version 1).xisb - AutoRecovered Q Home Insert Draw Page Layout Formulas

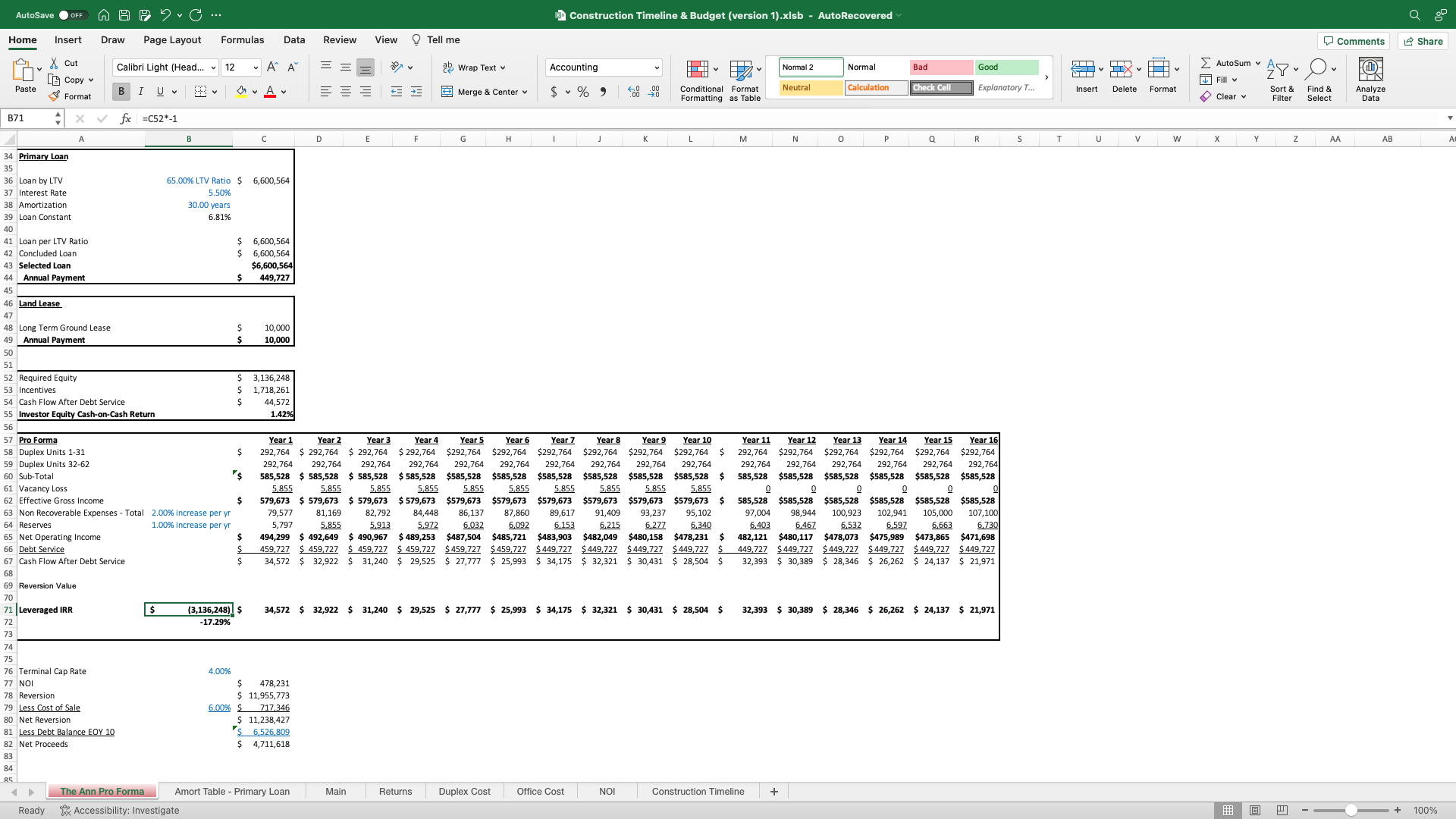

AutoSave O OFF A A e ? . C ... Construction Timeline & Budget (version 1).xisb - AutoRecovered Q Home Insert Draw Page Layout Formulas Data Review View ? Tell me Comments Share & Cut Calibri Light (Head... ~ 12 . A A = 27 v ap Wrap Text Accounting Normal 2 Normal Bad Good 2 AutoSum Av [ Copy Fill Paste BIUVV VAV Merge & Center $ ~ % " Conditional Fo Neutral Calculation Check Cell Explanatory T... Insert Delete Format Clear v Sort & Find & nalyze Format Formatting as Table Filter Select Data B71 X V fx =(52*-1 B C D E F G H I K L M N 0 P Q R S T U v w X Y Z AA AB 34 Primary Loan 35 36 Loan by LTV 65.00% LTV Ratio $ 6,600,564 37 Interest Rate 5.50% 38 Amortization 30.00 years 39 Loan Constant 6.81% 40 41 Loan per LTV Ratio $ 6,600,564 42 Concluded Loan 6,600,564 43 Selected Loan $6,600,564 44 Annual Payment 449,727 45 46 Land Lease 47 48 Long Term Ground Lease 10,000 49 Annual Payment 10,000 50 51 2 Required Equity 3,136,248 53 Incentives in in to 1,718,261 54 Cash Flow After Debt Service 14.572 55 Investor Equity Cash-on-Cash Return 1.42% 56 57 Pro Forma Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 58 Duplex Units 1-31 $ 292,764 $ 292,764 $ 292,764 $ 292,764 $292,764 $292,764 $292,764 $292,764 $292,764 $292,764 $ 292,764 $292,764 $292,764 $292,764 $292,764 $292,764 59 Duplex Units 32-62 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 292,764 60 Sub-Total 585,528 $ 585,528 $ 585,528 $ 585,528 $585,528 $585,528 $585,528 $585,528 $585,528 $585,528 $ 585,528 $585,528 $585,528 $585,528 $585,528 $585,528 61 Vacancy Loss 5,855 5.855 5.855 5.855 5,855 5.855 5,855 5,855 5.855 5.855 62 Effective Gross Income S 579,673 $ 579,673 $ 579,673 $ 579,673 $579,673 $579,673 $579,673 $579,673 $579,673 $579,673 $ 585,528 $585,528 $585,528 $585,528 $585,528 $585,528 63 Non Recoverable Expenses - Total 2.00% increase per yr 79,577 81,169 32.792 84.448 86,137 87,860 89.617 91,409 93,237 95.102 97,004 98.944 100,923 102,941 105,000 107,100 64 Reserves 1.00% increase per 5,797 5.855 5,913 5.972 6.032 6,092 6.153 6.215 6,277 6,340 6.403 6.467 6.532 6.597 6.663 6.730 65 Net Operating Income 494,299 $ 492,649 $ 490,967 $ 489,253 $487,504 $485,721 $483,903 $482,049 $480,158 $478,231 $ 482,121 $480,117 $478,073 $475,989 $473,865 $471,698 66 Debt Service 459,727 $ 459.727 $ 459,727 $ 459,727 $459,7279 $ 459,727 $ 449,727 $ 449,727 $ 449,727 $ 449,727 449,727 $ 449.727 $ 449,727 $ 449,727 $ 449,727 $ 449,727 67 Cash Flow After Debt Service 34,572 $ 32,922 $ 31,240 $ 29,525 $ 27,777 $ 25,993 $ 34,175 $ 32,321 $ 30,431 $ 28,504 32,393 $ 30,389 $ 28,346 $ 26,262 $ 24,137 $ 21,971 68 69 Reversion Value 70 71 | Leveraged IRR (3,136,248)| $ 34,572 $ 32,922 $ 31,240 $ 29,525 $ 27,777 $ 25,993 $ 34,175 $ 32,321 $ 30,431 $ 28,504 $ 32,393 $ 30,389 $ 28,346 $ 26,262 $ 24,137 $ 21,971 72 -17.29% 73 74 75 76 Terminal Cap Rate 4.00% 77 NOI 478,231 78 Reversion $ 11,955,773 79 Less Cost of Sale 6.00% $ 717,346 80 Net Reversion $ 11,238,427 81 Less Debt Balance EOY 10 $ 6,526,809 82 Net Proceeds S 4,711,618 83 84 85 The Ann Pro Forma Amort Table - Primary Loan Main Returns Duplex Cost Office Cost NOI Construction Timeline + Ready Tix Accessibility: Investigate - 100%