Question: AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review

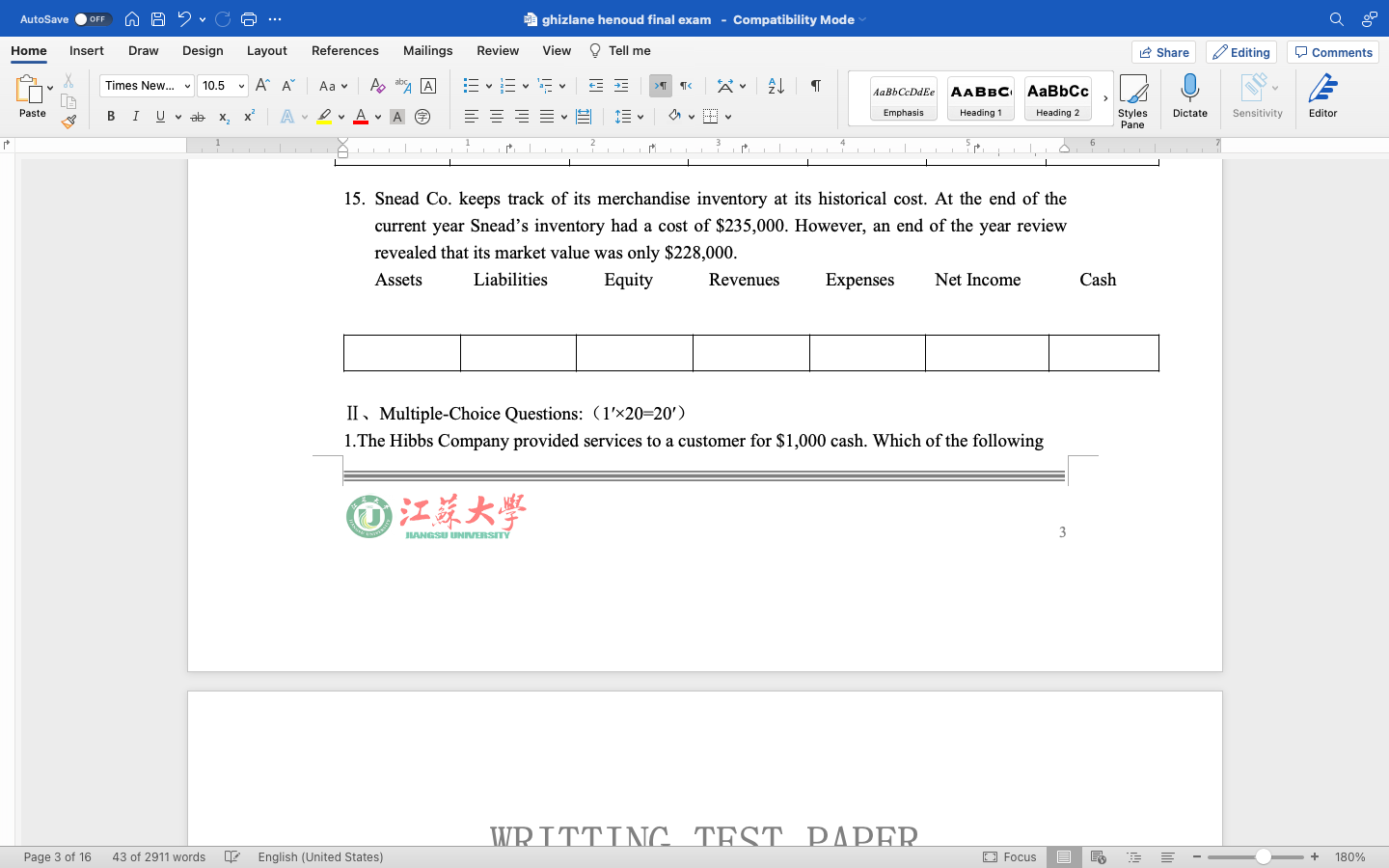

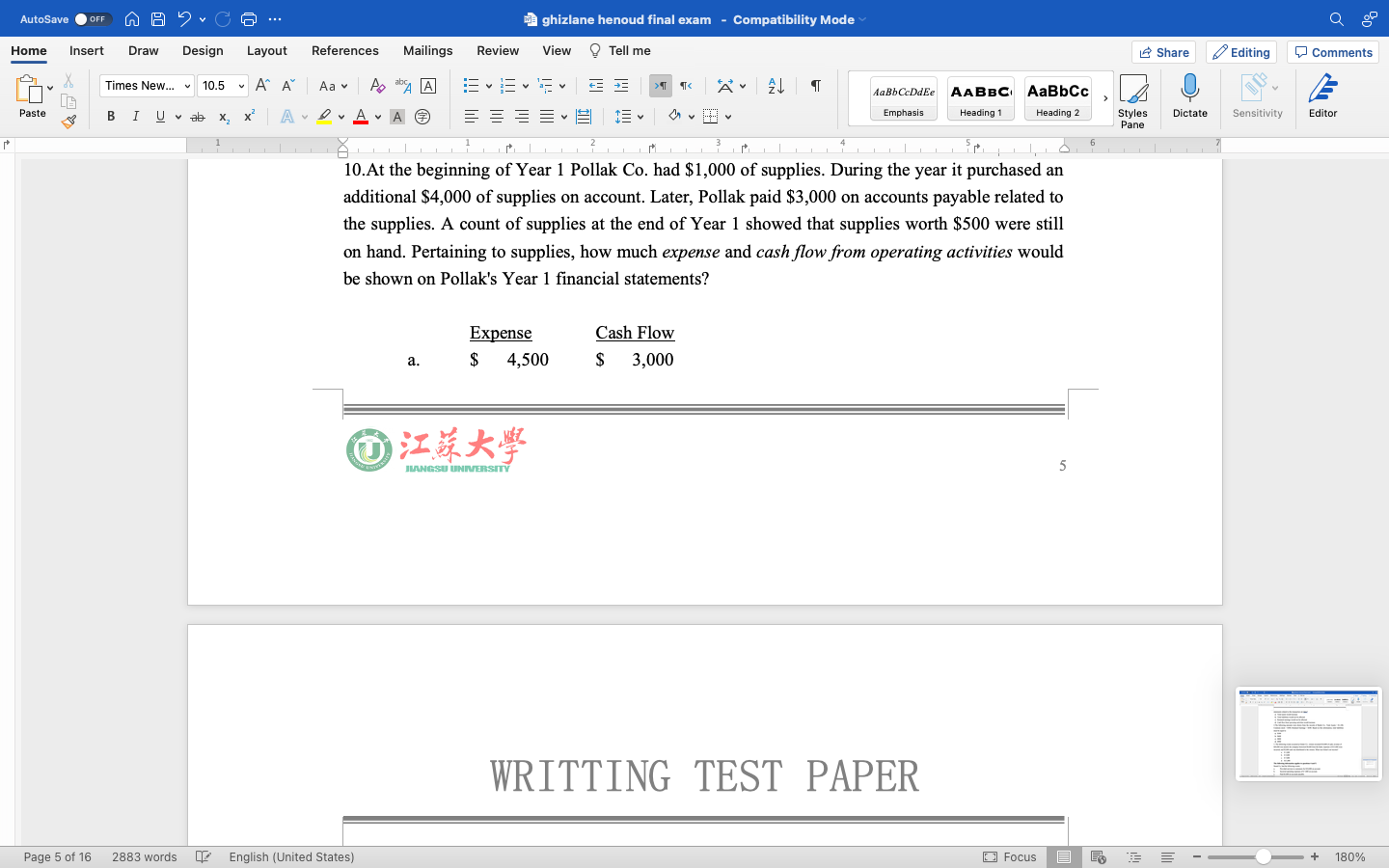

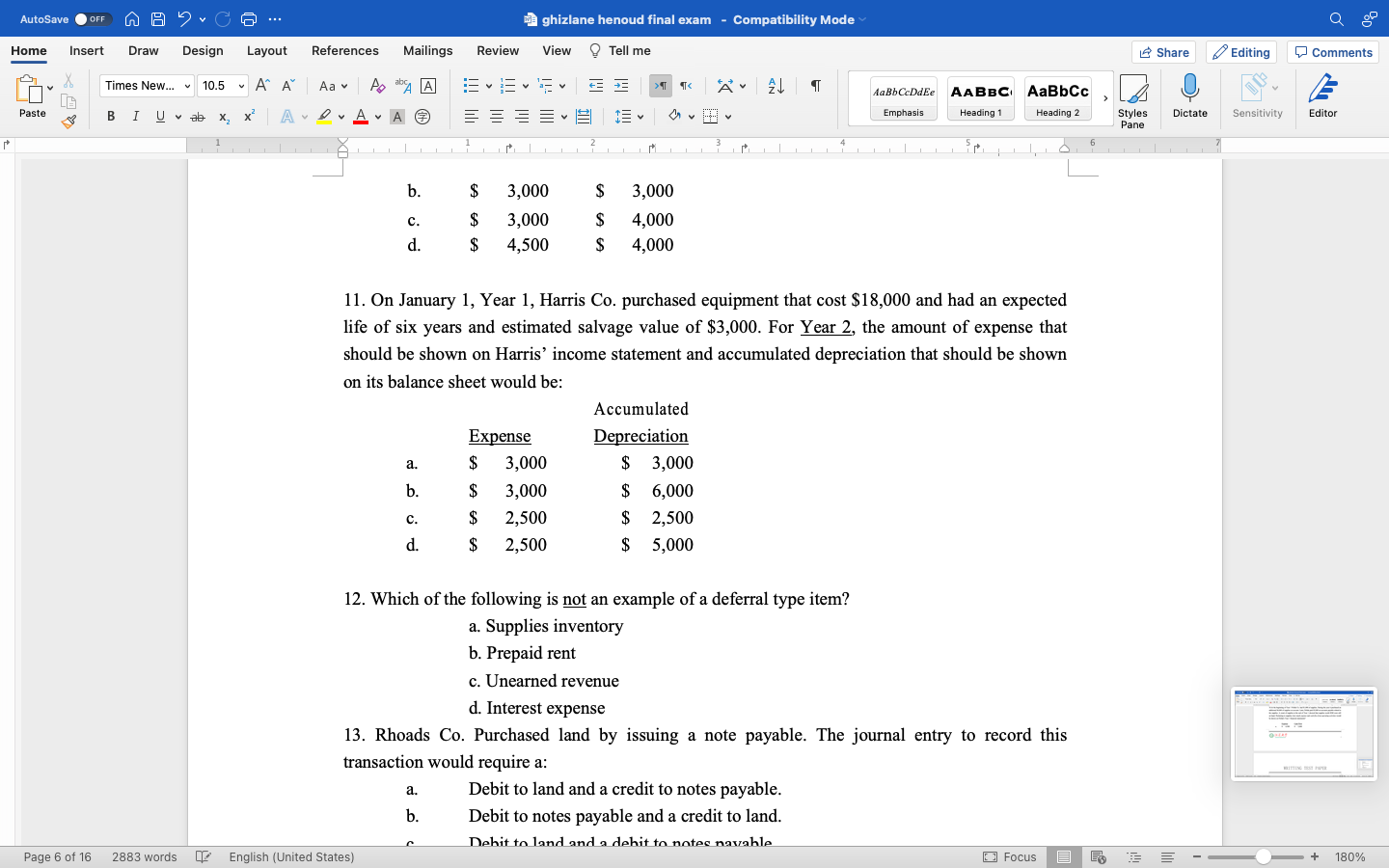

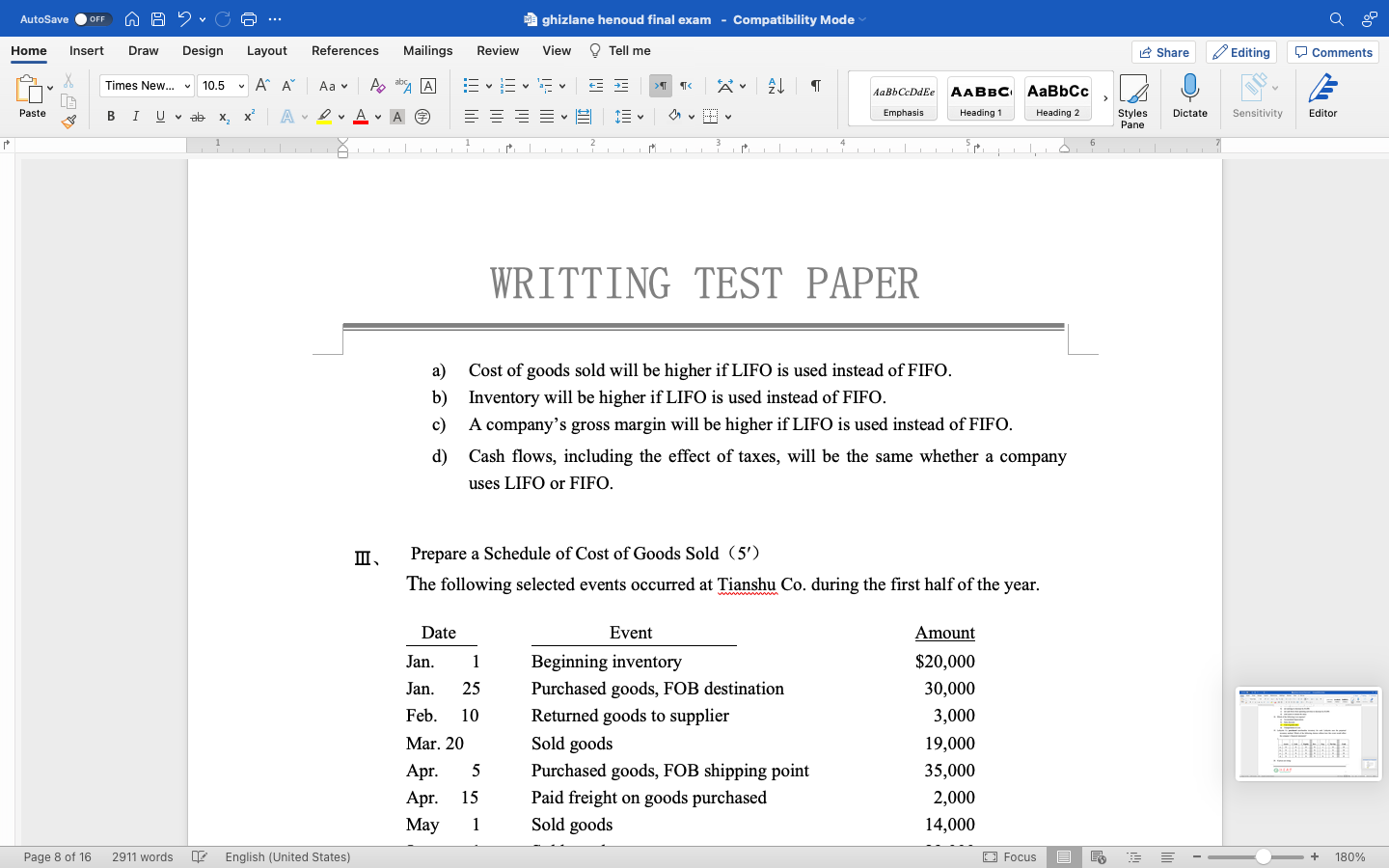

AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... " 10.5 ~ A" A Aa A ab A A AaBb CcDdEe AABBC AaBbCc Paste BIUab X x ALAA Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane 15. Snead Co. keeps track of its merchandise inventory at its historical cost. At the end of the current year Snead's inventory had a cost of $235,000. However, an end of the year review revealed that its market value was only $228,000. Assets Liabilities Equity Revenues Expenses Net Income Cash II , Multiple-Choice Questions: (1'x20=20') 1. The Hibbs Company provided services to a customer for $1,000 cash. Which of the following HANGSU UNIVERSITY 3 WRITTING TEST PAPER Page 3 of 16 43 of 2911 words OF English (United States) Focus E + 180%AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... ~ 10.5 ~ A" A Aa A b A A AaBbCcDdEe AABBC AaBbCc Paste BIUab X x ALAA Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane 6 statements related to this transaction are false? a) Total assets would increase. b) Total liabilities would not be affected. c) Retained earnings would not be affected. d) Cash flow from operating activities would increase. 2. The following amounts were drawn from the records of Shafer Co.: Total Assets = $1,100; Common stock = $300; Retained Earnings = $200. Based on this information, total liabilities must be equal to: a) $300 b) $600 c) $800 d) $900 3. The following events occurred at Ginter Co.: owners invested $10,000 of cash; revenue of $20,000 was earned; the company borrowed $4,000 from the bank; expenses of $13,000 were incurred; and $2,000 cash was distributed to the owners. What was Ginter's net income? a. $ 1,000 b. $ 5,000 c. $ 7,000 d. $11,000 The following information applies to questions 4 and 5. Snead Co. had the following events: a. Provided services to customers for $10,000 on account. b. Incurred operating expenses of $ 7,000 on account. C. Paid $5,000 on accounts payable. Page 4 of 16 2883 words English (United States) Focus E + 180%AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... ~ 10.5 ~ A" A Aa A b A A AaBb CcDdEe AABBC AaBbCc Paste BIUab X x|ALAA Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane 6 10.At the beginning of Year 1 Pollak Co. had $1,000 of supplies. During the year it purchased an additional $4,000 of supplies on account. Later, Pollak paid $3,000 on accounts payable related to the supplies. A count of supplies at the end of Year 1 showed that supplies worth $500 were still on hand. Pertaining to supplies, how much expense and cash flow from operating activities would be shown on Pollak's Year 1 financial statements? Expense Cash Flow a. $ 4,500 $ 3,000 JIANGSU UNIVERSITY WRITTING TEST PAPER Page 5 of 16 2883 words English (United States) Focus E E + 180%AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... ~ 10.5 ~ A" A Aa A A A AaBbCcDdEe AABBC AaBbCc Paste BIUabX x|ALA AE Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane b. $ 3,000 $ 3,000 C. 3,000 4,000 4,500 4,000 11. On January 1, Year 1, Harris Co. purchased equipment that cost $18,000 and had an expected life of six years and estimated salvage value of $3,000. For Year 2, the amount of expense that should be shown on Harris' income statement and accumulated depreciation that should be shown on its balance sheet would be: Accumulated Expense Depreciation a. $ 3,000 $ 3,000 b . $ 3,000 $ 6,000 C. $ 2,500 $ 2,500 $ 2,500 $ 5,000 12. Which of the following is not an example of a deferral type item? a. Supplies inventory b. Prepaid rent c. Unearned revenue d. Interest expense 13. Rhoads Co. Purchased land by issuing a note payable. The journal entry to record this transaction would require a: a. Debit to land and a credit to notes payable. b. Debit to notes payable and a credit to land. Dehit to land and a dehit to notes navable Page 6 of 16 2883 words English (United States) Focus + 180%AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... ~ 10.5 ~ A" A Aa A b A A AaBb CcDdEe AABBC AaBbCc Paste BIUab X x |ALA AE Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane IM 6 13. Rhoads Co. Purchased land by issuing a note payable. The journal entry to record this transaction would require a: a. Debit to land and a credit to notes payable. b . Debit to notes payable and a credit to land. C. Debit to land and a debit to notes payable. P Credit to land and a credit to notes payable. 14. How would the following journal entry affect the accounting equation? Prepaid Rent 500 Cash 500 a. Assets would increase and equity would decrease. b.Liabilities would increase and assets would decrease. c.Liabilities would decrease and assets would decrease. d. There would be no effect on total assets, liabilities, or equity. 15. Debit entries act to: a. Decrease assets. HANGSU UNIVERSITY 6 Page 6 of 16 2883 words [ English (United States) Focus E + 180%AutoSave O OFF A A ) . G G ... ghizlane henoud final exam - Compatibility Mode Home Insert Draw Design Layout References Mailings Review w ? Tell me Share Editing Comments Times New... ~ 10.5 ~ A" A Aa A b A A AaBbCcDdEe AABBC AaBbCc Paste BIUvab X x|ALAAE Emphasis Heading 1 Heading 2 Styles Dictate Sensitivity Editor Pane 6 WRITTING TEST PAPER a) Cost of goods sold will be higher if LIFO is used instead of FIFO. b ) Inventory will be higher if LIFO is used instead of FIFO. c) A company's gross margin will be higher if LIFO is used instead of FIFO. d) Cash flows, including the effect of taxes, will be the same whether a company uses LIFO or FIFO. II . Prepare a Schedule of Cost of Goods Sold (5') The following selected events occurred at Tianshu Co. during the first half of the year. Date Event Amount Jan. Beginning inventory $20,000 Jan. 25 Purchased goods, FOB destination 30,000 Feb. 10 Returned goods to supplier 3,000 Mar. 20 Sold goods 19,000 Apr 5 Purchased goods, FOB shipping point 35,000 Apr. 15 Paid freight on goods purchased 2,000 May 1 Sold goods 14,000 Page 8 of 16 2911 words English (United States) Focus E + 180%

Step by Step Solution

There are 3 Steps involved in it

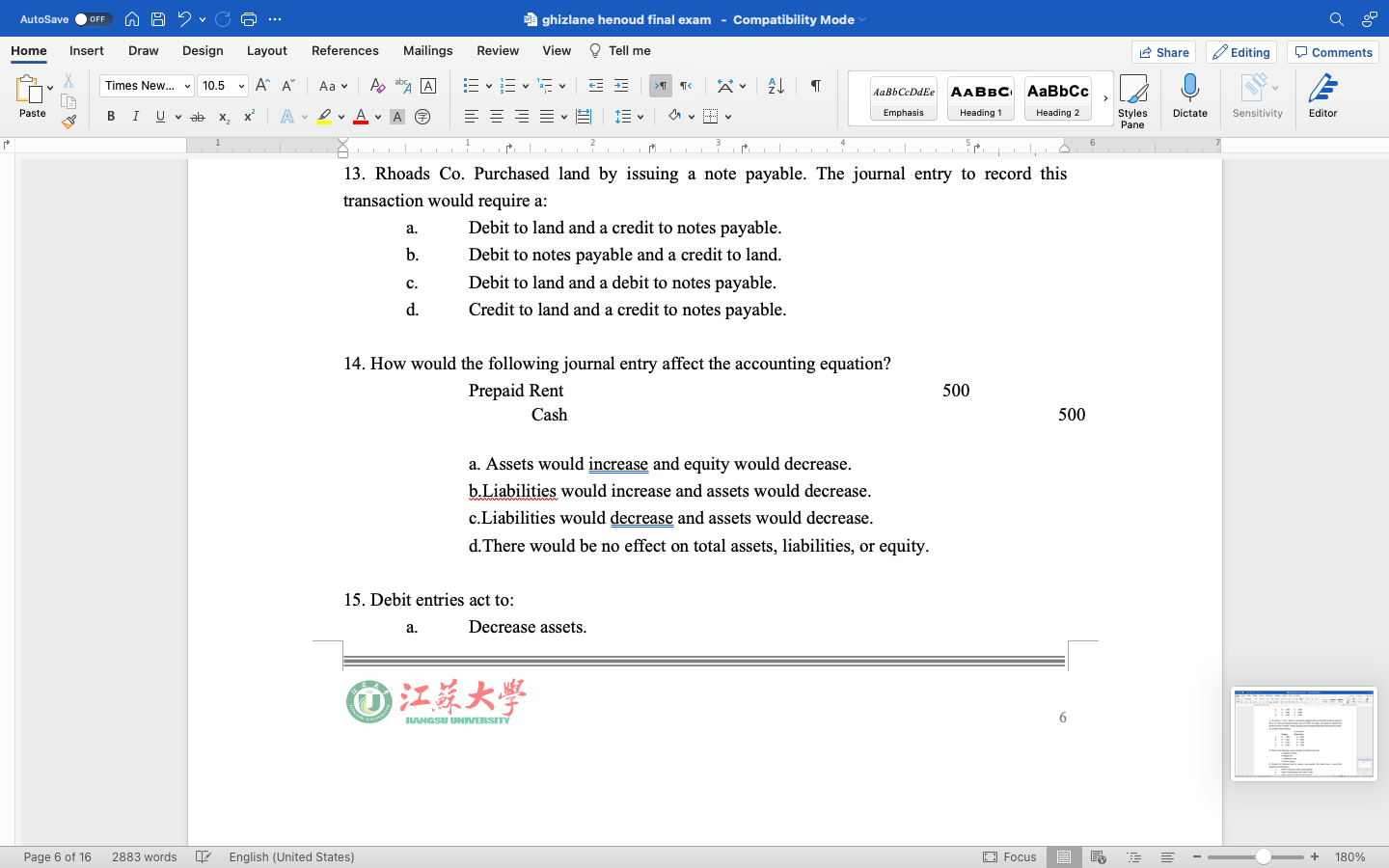

Get step-by-step solutions from verified subject matter experts