Question: AutoSave (O off ) Raez Smart Zutter_Problem 2.4_Start - Excel Search File Home Insert Draw Page Layout Formulas Data Review View Help Times New Roman

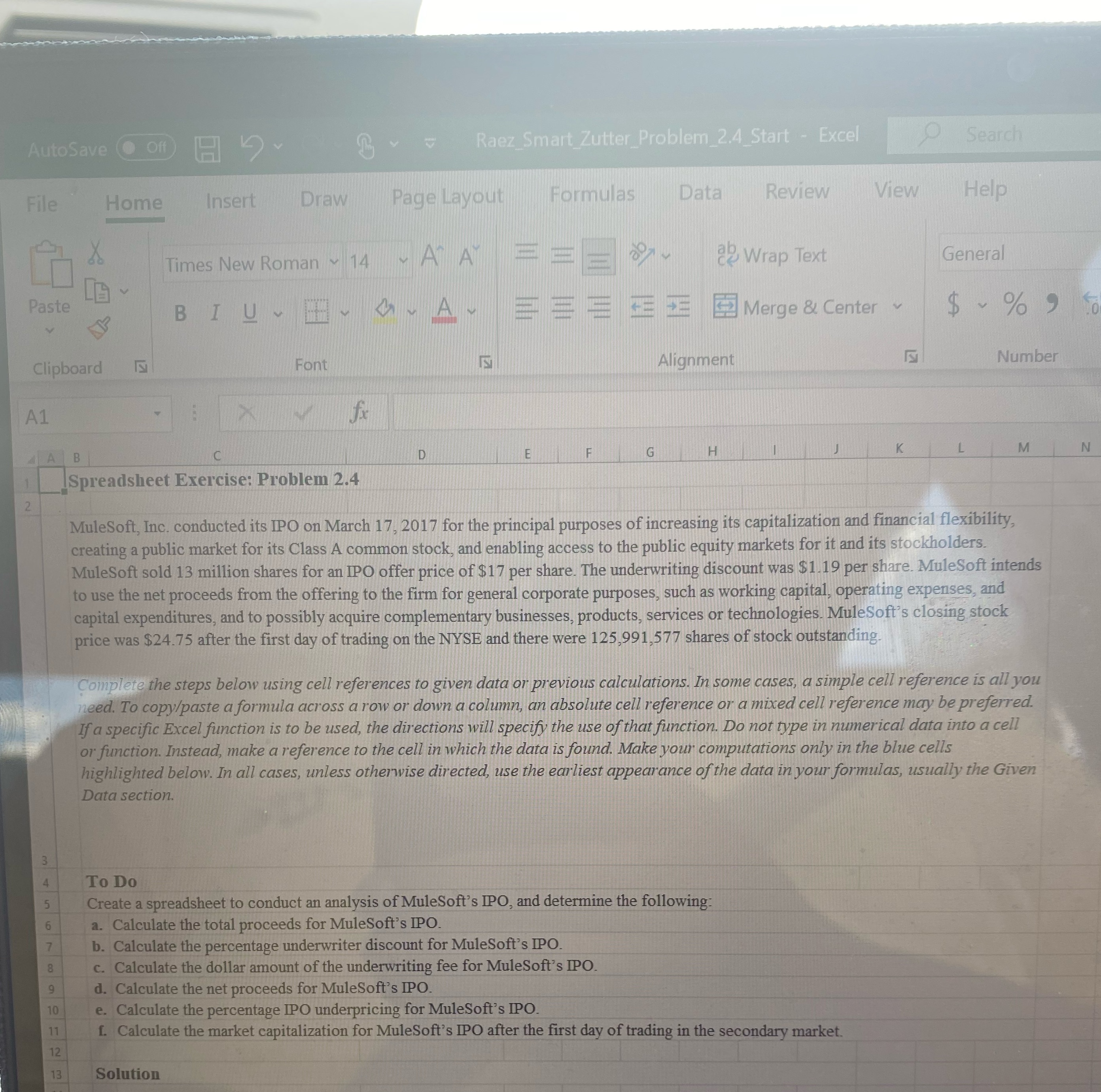

AutoSave (O off ) Raez Smart Zutter_Problem 2.4_Start - Excel Search File Home Insert Draw Page Layout Formulas Data Review View Help Times New Roman ~ 14 AA a2 Wrap Text General Paste BI U ~ ~ GAY Merge & Center ~ $ ~ % " Clipboard IN Font Alignment Number A1 A B E F G H M N Spreadsheet Exercise: Problem 2.4 MuleSoft, Inc. conducted its IPO on March 17, 2017 for the principal purposes of increasing its capitalization and financial flexibility, creating a public market for its Class A common stock, and enabling access to the public equity markets for it and its stockholders. MuleSoft sold 13 million shares for an IPO offer price of $17 per share. The underwriting discount was $1 19 per share. MuleSoft intends to use the net proceeds from the offering to the firm for general corporate purposes, such as working capital, operating expenses, and capital expenditures, and to possibly acquire complementary businesses, products, services or technologies. MuleSoft's closing stock price was $24.75 after the first day of trading on the NYSE and there were 125,991,577 shares of stock outstanding. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. To Do Create a spreadsheet to conduct an analysis of MuleSoft's IPO, and determine the following a. Calculate the total proceeds for MuleSoft's IPO. b. Calculate the percentage underwriter discount for MuleSoft's IPO. 8 c. Calculate the dollar amount of the underwriting fee for MuleSoft's IPO. d. Calculate the net proceeds for MuleSoft's IPO. e. Calculate the percentage IPO underpricing for MuleSoft's IPO. 11 1. Calculate the market capitalization for MuleSoft's IPO after the first day of trading in the secondary market. 12 Solution