Question: AutoSave OFF A A ? CG ... w ACCT 1008 Lau Wen Tao Assignment 1 Home Insert Draw Design Layout References Mailings Review View Table

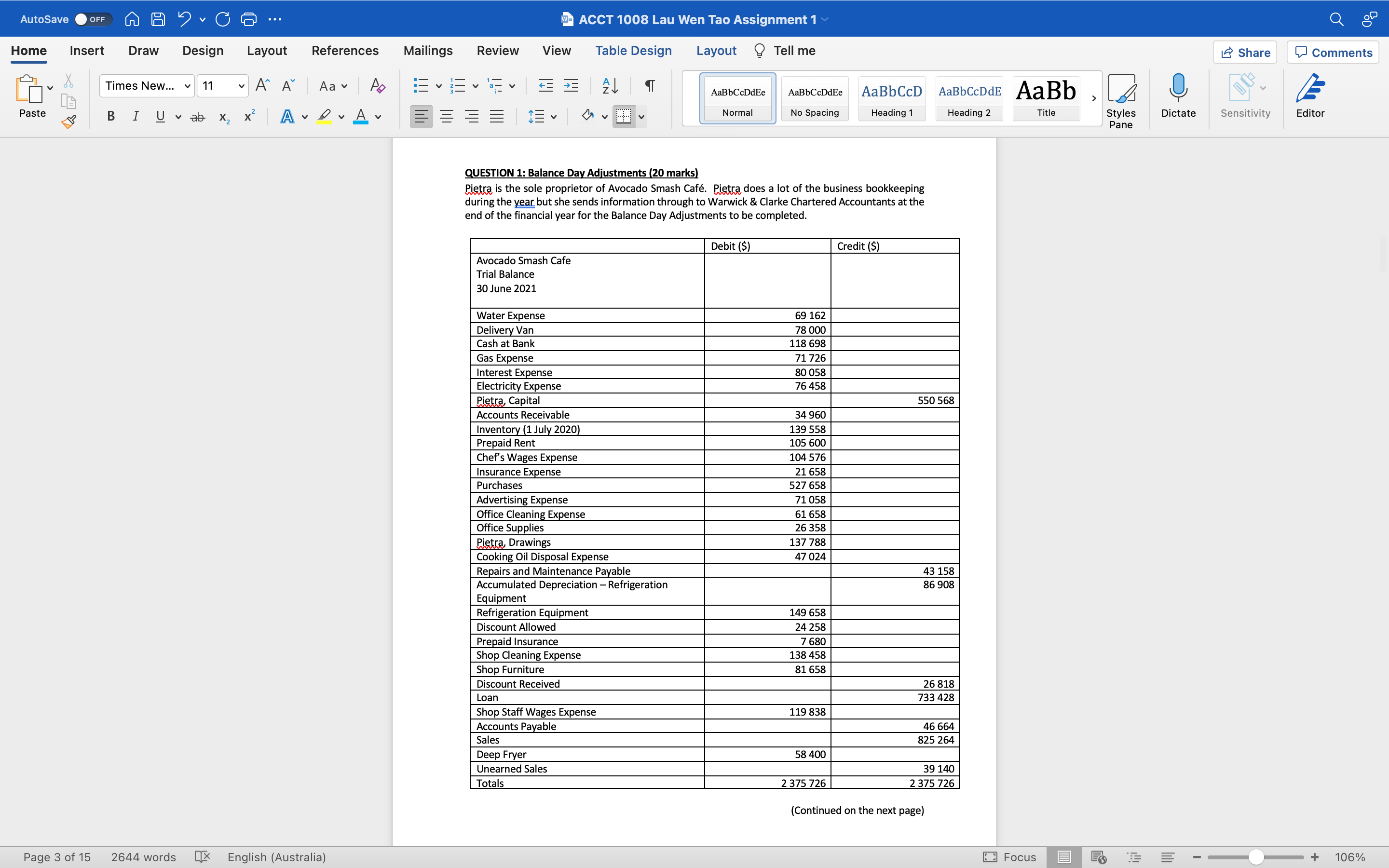

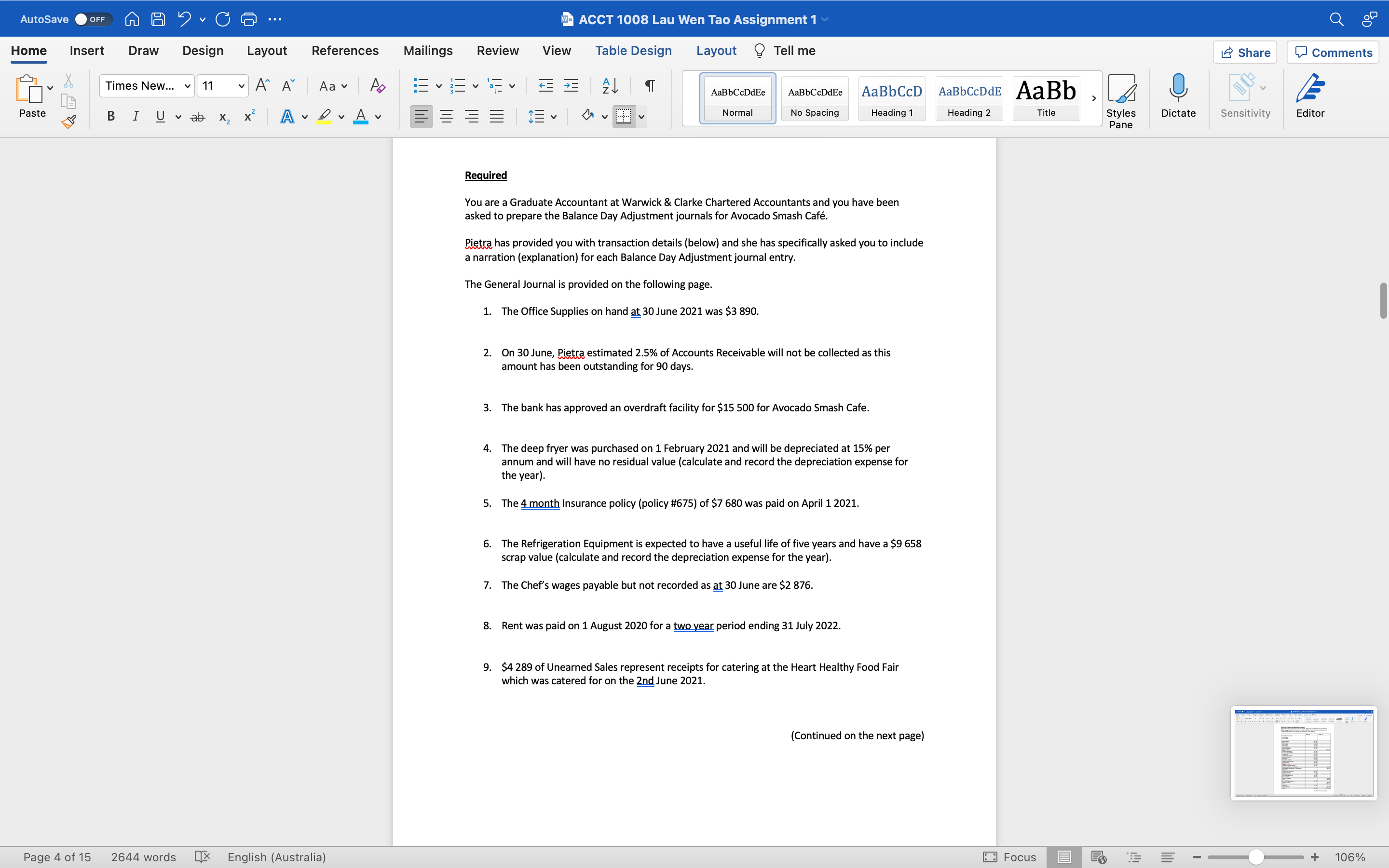

AutoSave OFF A A ? CG ... w ACCT 1008 Lau Wen Tao Assignment 1 Home Insert Draw Design Layout References Mailings Review View Table Design Layout ? Tell me Share Comments Times New... v 11 A A Aa Ap AaBbCcDdEe AaBbCcDdEe AaBbCcD AaBbCcDdE AaBb Paste BIUvab X X A LAV Norma No Spacing Heading 1 Heading 2 Title Styles Dictate Sensitivity Editor Pane QUESTION 1: Balance Day Adjustments (20 marks) Pietra is the sole proprietor of Avocado Smash Cafe. Pietra does a lot of the business bookkeeping during the year but she sends information through to Warwick & Clarke Chartered Accountants at the end of the financial year for the Balance Day Adjustments to be completed Debit ($) Credit ($) Avocado Smash Cafe Trial Balance 30 June 2021 Water Expense 69 162 Delivery Van 78 000 Cash at Bank 118 698 Gas Expense 71 726 Interest Expense 80 058 Electricity Expense 76 458 Pietra, Capital 550 568 Accounts Receivable 34 960 Inventory (1 July 2020) 139 558 Prepaid Rent 105 600 Chef's Wages Expense 104 576 Insurance Expense 21 658 Purchases $27 658 Advertising Expense 71 058 Office Cleaning Expense 61 658 Office Supplies 26 358 Pietra, Drawings 37 788 Cooking Oil Disposal Expense 47 024 Repairs and Maintenance Payable 43 158 Accumulated Depreciation - Refrigeration 86 908 Equipment Refrigeration Equipment 49 658 Discount Allowed 24 258 Prepaid Insurance 7 680 Shop Cleaning Expense 138 458 Shop Furniture 81 658 Discount Received 26 818 Loan 733 428 Shop Staff Wages Expense 19 838 Accounts Payable 46 664 Sales 25 264 Deep Fryer 58 400 Unearned Sales 39 140 Totals 2 375 726 2 375 726 (Continued on the next page) Page 3 of 15 2644 words X English (Australia) Focus E + 106%AutoSave OFF A A ? CG ... w ACCT 1008 Lau Wen Tao Assignment 1 Home Insert Draw Design Layout References Mailings Review View Table Design Layout ? Tell me Share Comments Times New... v 11 A" A Aa Ap EV EVEVEE 24 T AaBbCcDdEe AaBbCcDdEe AaBbCcD AaBbCcDdE AaBb Paste BIUvab X X A L Av Norma No Spacing Heading 1 Heading 2 Title Styles Dictate Sensitivity Editor Pane Required You are a Graduate Accountant at Warwick & Clarke Chartered Accountants and you have been asked to prepare the Balance Day Adjustment journals for Avocado Smash Cafe. Pietra has provided you with transaction details (below) and she has specifically asked you to include a narration (explanation) for each Balance Day Adjustment journal entry The General Journal is provided on the following page 1. The Office Supplies on hand at 30 June 2021 was $3 890. 2. On 30 June, Pietra estimated 2.5% of Accounts Receivable will not be collected as this amount has been outstanding for 90 days. 3. The bank has approved an overdraft facility for $15 500 for Avocado Smash Cafe. 4. The deep fryer was purchased on 1 February 2021 and will be depreciated at 15% per annum and will have no residual value (calculate and record the depreciation expense for the year). 5. The 4 month Insurance policy (policy #675) of $7 680 was paid on April 1 2021. 6. The Refrigeration Equipment is expected to have a useful life of five years and have a $9 658 scrap value (calculate and record the depreciation expense for the year). 7. The Chef's wages payable but not recorded as at 30 June are $2 876. 8. Rent was paid on 1 August 2020 for a two year period ending 31 July 2022. . $4 289 of Unearned Sales represent receipts for catering at the Heart Healthy Food Fair which was catered for on the 2nd June 2021. (Continued on the next page) Page 4 of 15 2644 words X English (Australia) Focus E + 106%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts