Question: AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page

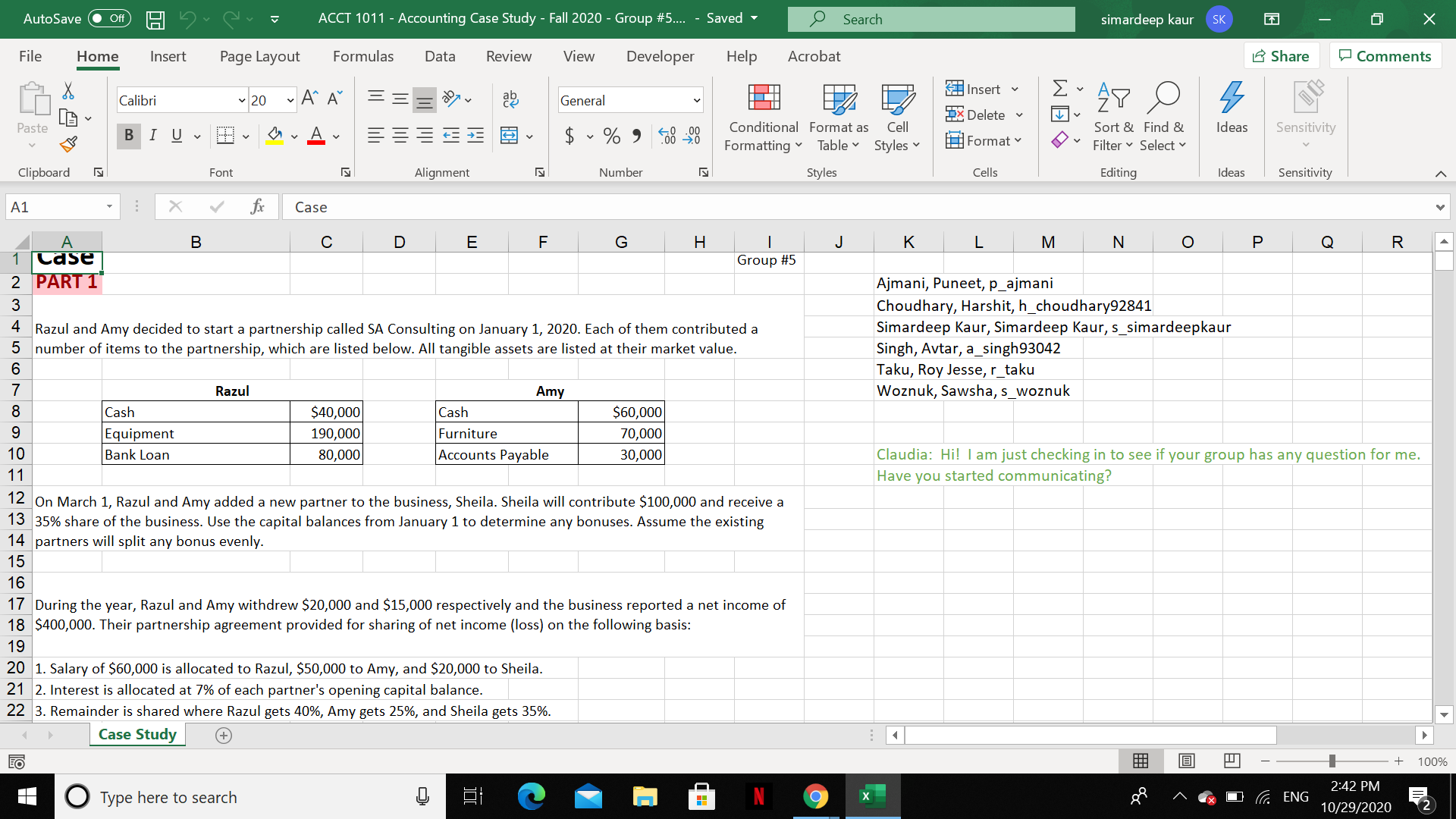

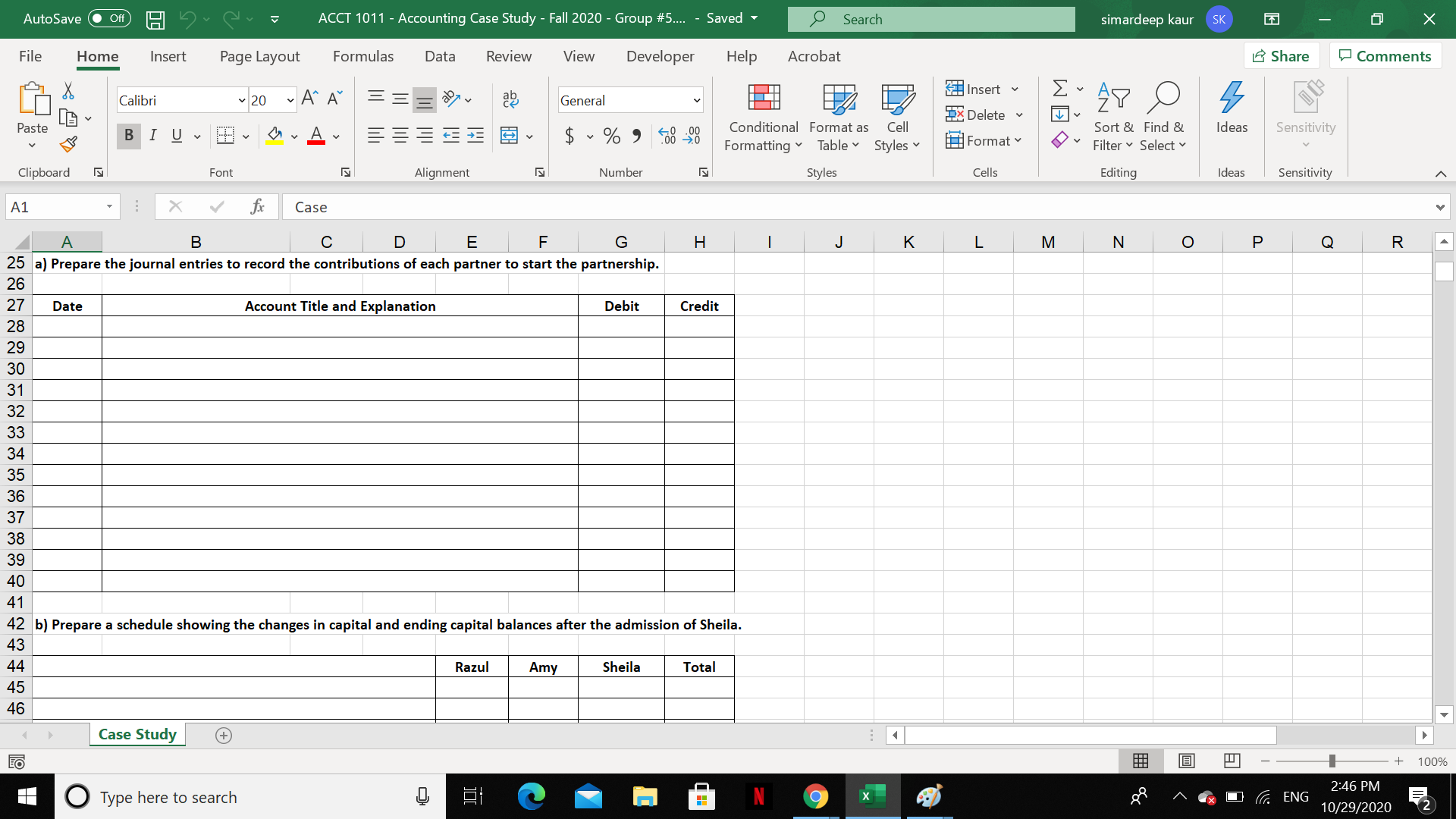

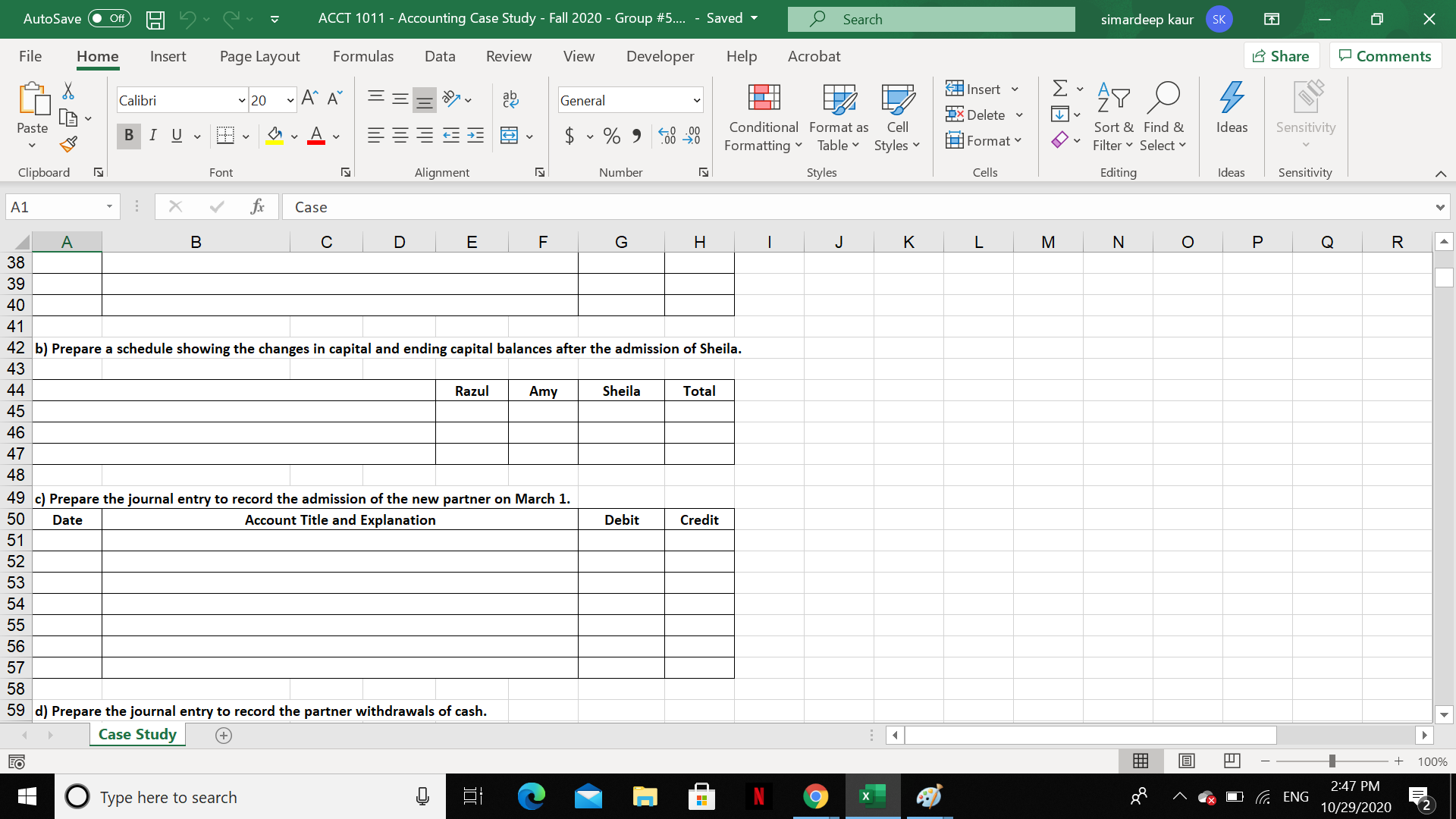

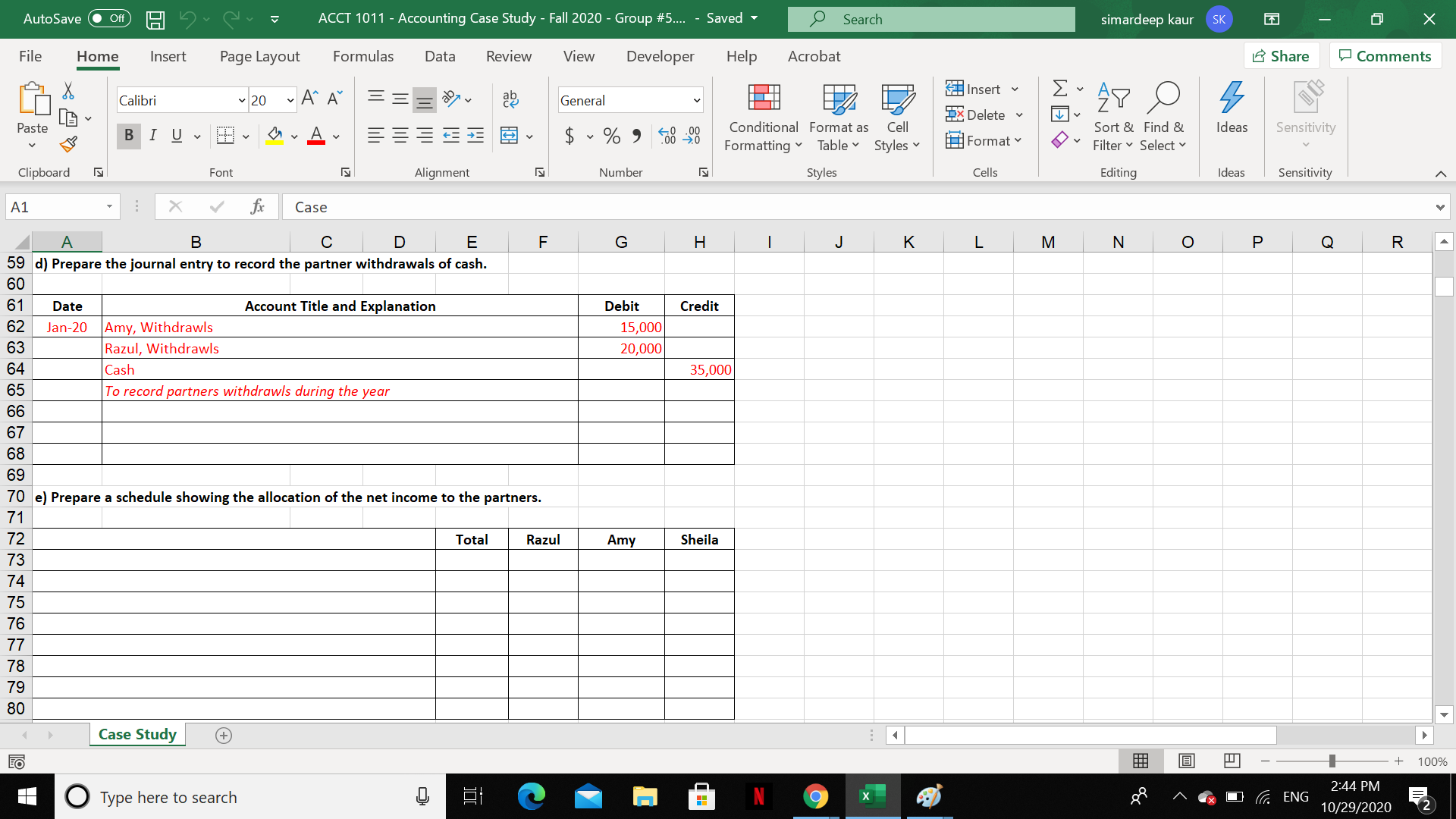

AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments X Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U 60 Ideas A $ ~ %> COM Sensitivity Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select D Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case J K L M N O Q R Ajmani, Puneet, p_ajmani Choudhary, Harshit, h_choudhary92841 Simardeep Kaur, Simardeep Kaur, s_simardeepkaur Singh, Avtar, a_singh93042 Taku, Roy Jesse, r_taku Woznuk, Sawsha, s_woznuk Claudia: Hi! I am just checking in to see if your group has any question for me. Have you started communicating? B D E F G H 1 Case Group #5 2 PART 1 3 4 Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020. Each of them contributed a 5 number of items to the partnership, which are listed below. All tangible assets are listed at their market value. 6 7 Razul Amy 8 Cash $40,000 Cash $60,000 9 Equipment 190,000 Furniture 70,000 10 Bank Loan 80,000 Accounts Payable 30,000 11 12 on March 1, Razul and Amy added a new partner to the business, Sheila. Sheila will contribute $100,000 and receive a 13 35% share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing 14 partners will split any bonus evenly. 15 16 17 During the year, Razul and Amy withdrew $20,000 and $15,000 respectively and the business reported a net income of 18 $400,000. Their partnership agreement provided for sharing of net income (loss) on the following basis: 19 20 1. Salary of $60,000 is allocated to Razul, $50,000 to Amy, and $20,000 to Sheila. 21 2. Interest is allocated at 7% of each partner's opening capital balance. 22 3. Remainder is shared where Razul gets 40%, Amy gets 25%, and Sheila gets 35%. Case Study + 100% Type here to search a X ENG 2:42 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U Ideas A $ - % 9 o O Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case 1 J K L M N o P Q R D E F. G H 25 a) Prepare the journal entries to record the contributions of each partner to start the partnership. 26 27 Date Account Title and Explanation Debit Credit 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 43 44 Razul Amy Sheila Total 45 46 Case Study + 100% Type here to search ENG 2:46 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U 60 Ideas A $ - %, O Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case J K L M N o P Q R A B D E F G H 38 39 40 41 42 b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 43 44 Razul Amy Sheila Total 45 46 47 48 49 c) Prepare the journal entry to record the admission of the new partner on March 1. 50 Date Account Title and Explanation Debit Credit 51 52 53 54 55 56 57 58 59 d) Prepare the journal entry to record the partner withdrawals of cash. Case Study + 100% 1 Type here to search ENG 2:47 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . Ideas B I U A $ - %. Og Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case G 1 J K L M N o P Q R Credit Debit 15,000 20,000 35,000 A D E F 59 d) Prepare the journal entry to record the partner withdrawals of cash. 60 61 Date Account Title and Explanation 62 Jan-20 Amy, Withdrawls 63 Razul, Withdrawls 64 Cash 65 To record partners withdrawls during the year 66 67 68 69 70 e) Prepare a schedule showing the allocation of the net income to the partners. 71 72 Total Razul 73 74 75 76 77 78 79 80 Amy Sheila Case Study + 100% Type here to search ENG 2:44 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments X Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U 60 Ideas A $ ~ %> COM Sensitivity Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select D Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case J K L M N O Q R Ajmani, Puneet, p_ajmani Choudhary, Harshit, h_choudhary92841 Simardeep Kaur, Simardeep Kaur, s_simardeepkaur Singh, Avtar, a_singh93042 Taku, Roy Jesse, r_taku Woznuk, Sawsha, s_woznuk Claudia: Hi! I am just checking in to see if your group has any question for me. Have you started communicating? B D E F G H 1 Case Group #5 2 PART 1 3 4 Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020. Each of them contributed a 5 number of items to the partnership, which are listed below. All tangible assets are listed at their market value. 6 7 Razul Amy 8 Cash $40,000 Cash $60,000 9 Equipment 190,000 Furniture 70,000 10 Bank Loan 80,000 Accounts Payable 30,000 11 12 on March 1, Razul and Amy added a new partner to the business, Sheila. Sheila will contribute $100,000 and receive a 13 35% share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing 14 partners will split any bonus evenly. 15 16 17 During the year, Razul and Amy withdrew $20,000 and $15,000 respectively and the business reported a net income of 18 $400,000. Their partnership agreement provided for sharing of net income (loss) on the following basis: 19 20 1. Salary of $60,000 is allocated to Razul, $50,000 to Amy, and $20,000 to Sheila. 21 2. Interest is allocated at 7% of each partner's opening capital balance. 22 3. Remainder is shared where Razul gets 40%, Amy gets 25%, and Sheila gets 35%. Case Study + 100% Type here to search a X ENG 2:42 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U Ideas A $ - % 9 o O Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case 1 J K L M N o P Q R D E F. G H 25 a) Prepare the journal entries to record the contributions of each partner to start the partnership. 26 27 Date Account Title and Explanation Debit Credit 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 43 44 Razul Amy Sheila Total 45 46 Case Study + 100% Type here to search ENG 2:46 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . B I U 60 Ideas A $ - %, O Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case J K L M N o P Q R A B D E F G H 38 39 40 41 42 b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 43 44 Razul Amy Sheila Total 45 46 47 48 49 c) Prepare the journal entry to record the admission of the new partner on March 1. 50 Date Account Title and Explanation Debit Credit 51 52 53 54 55 56 57 58 59 d) Prepare the journal entry to record the partner withdrawals of cash. Case Study + 100% 1 Type here to search ENG 2:47 PM 10/29/2020 2 AutoSave Off B. ACCT 1011 - Accounting Case Study - Fall 2020 - Group #5.... Saved Search simardeep kaur SK - File Home Insert Page Layout Formulas Data Review View Developer Help Acrobat Share Comments Insert Calibri 20 ' ' abe General 5 DX Delete Paste . Ideas B I U A $ - %. Og Conditional Format as Cell Formatting Table Styles Sensitivity Sort & Find & Filter Select Format Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity A1 fi Case G 1 J K L M N o P Q R Credit Debit 15,000 20,000 35,000 A D E F 59 d) Prepare the journal entry to record the partner withdrawals of cash. 60 61 Date Account Title and Explanation 62 Jan-20 Amy, Withdrawls 63 Razul, Withdrawls 64 Cash 65 To record partners withdrawls during the year 66 67 68 69 70 e) Prepare a schedule showing the allocation of the net income to the partners. 71 72 Total Razul 73 74 75 76 77 78 79 80 Amy Sheila Case Study + 100% Type here to search ENG 2:44 PM 10/29/2020 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts