Question: AutoSave OFF Chapter 6 HW Q Search Sheet Page Layout Formulas Data Review View Share Home Insert X Cut Copy Paste Format Times New... -

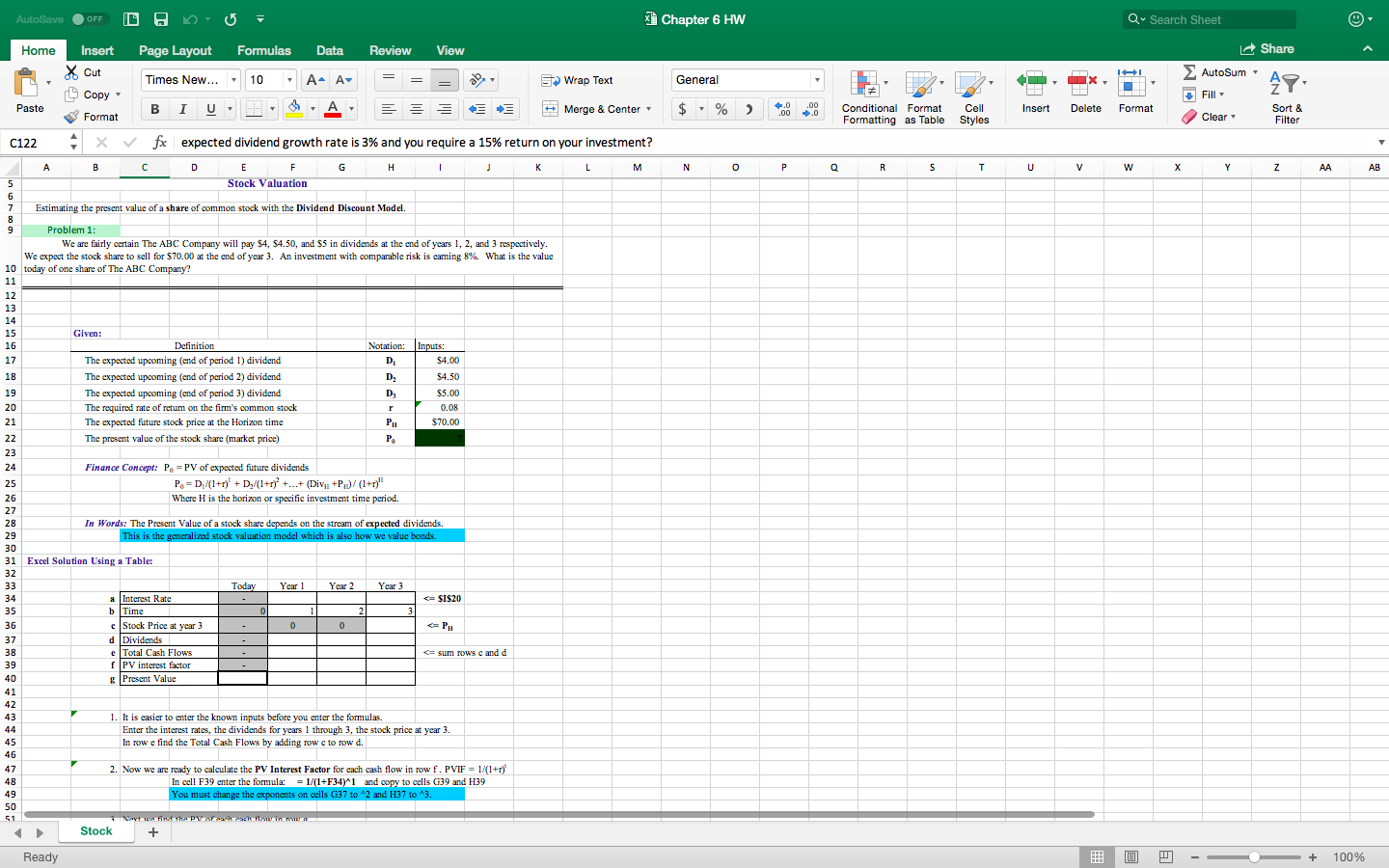

AutoSave OFF Chapter 6 HW Q Search Sheet Page Layout Formulas Data Review View Share Home Insert X Cut Copy Paste Format Times New... - A- A+ 10 AutoSum General 49 H 5 Wrap Text Merge & Center H Fill - B I A = $ % .0 .00 .00 0 Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter C122 fx expected dividend growth rate is 3% and you require a 15% return on your investment? L M N O P Q R S T U V w X Y Z Z AB r A B D E F G H 1 K 5 Stock Valuation 6 7 Estimating the present value of a share of common stock with the Dividend Discount Model, 8 9 Problem 1: We are fairly certain The ABC Company will pay $4, $4.50, and $5 in dividends at the end of years 1, 2, and 3 respectively. We expect the stock share to sell for $70.00 at the end of year 3. An investment with comparable risk is caring 8%. What is the value 10 today of one share of The ABC Company? 11 12 13 14 15 Given: 16 Definition Notation: Inputs: 17 The expected upcoming (end of period 1) dividend D $4.00 18 The expected upcoming (end of period 2) dividend D $4.50 19 The expected upcoming (end of period 3) dividend D $5.00 20 The required rate of return on the firm's common stock 0.08 21 The expected future stock price at the Horizon time PH $70.00 22 The present value of the stock share (market price) . P 23 24 Finance Concept: P, EPV of expected future dividends 25 Po = D./(1+r)' + D,/(1+ry +...+(Div, +P/(1+r)" 26 Where is the horizon or specific investment time period. 27 28 In Words: The Present Value of a stock share depends on the stream of expected dividends. 29 This is the generalized stock valuation model which is also how we value bonds. 30 31 Excel Solution Using a Table: 32 33 Today Year 1 Year 2 Year 3 34 a Interest Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts