Question: AutoSave Off File C30 PivotTable Recommended Table Pivot Tables 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

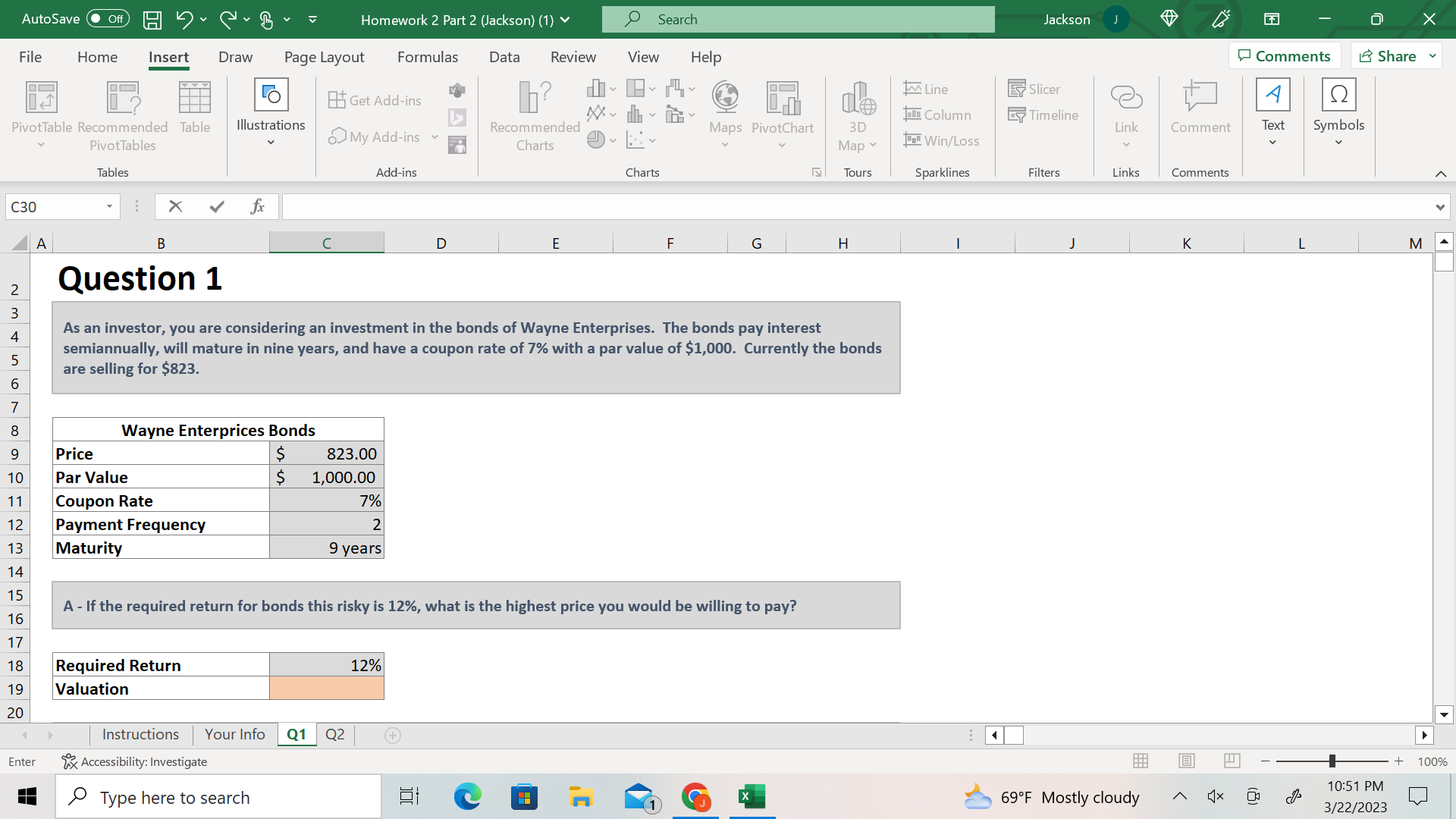

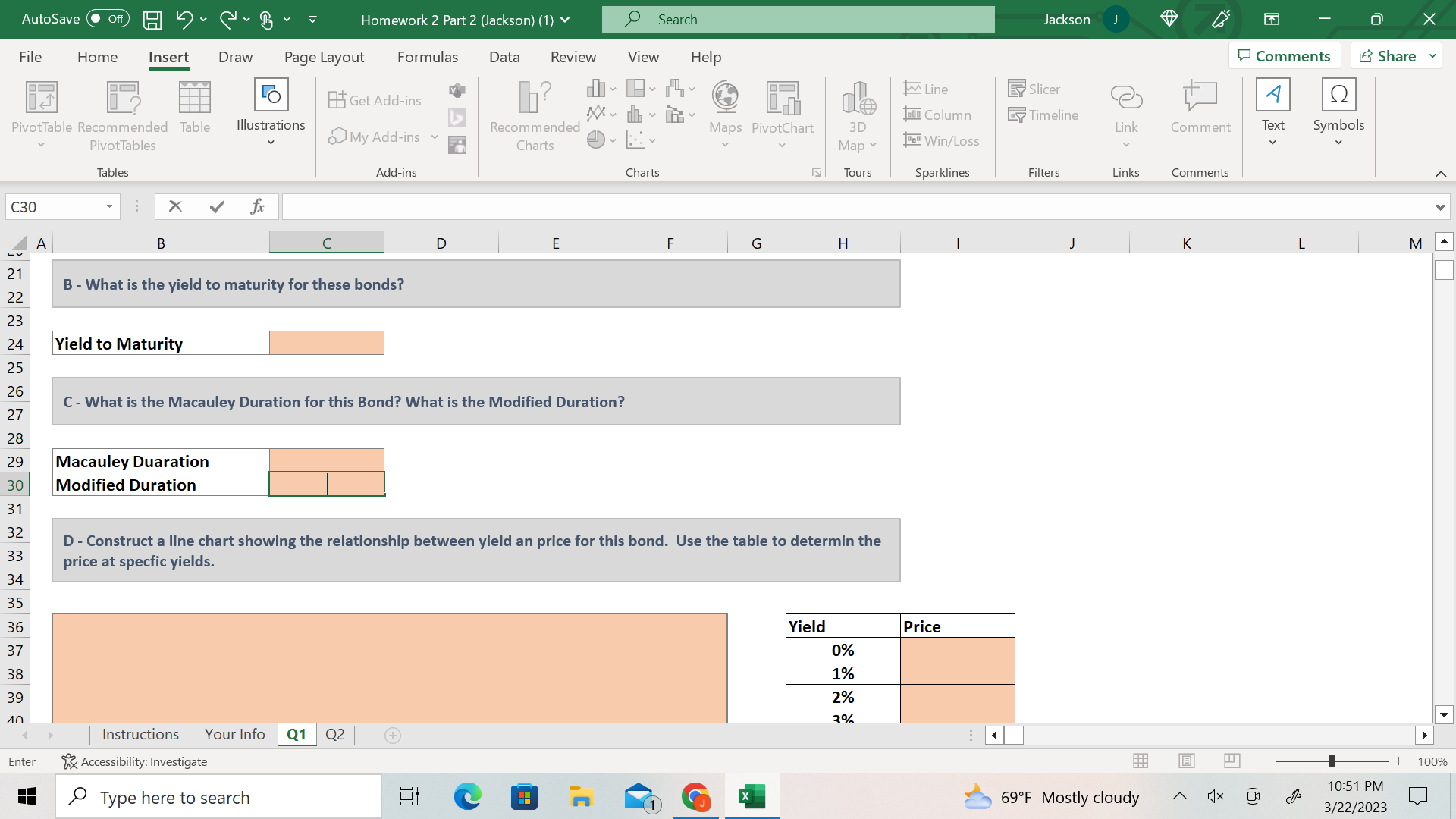

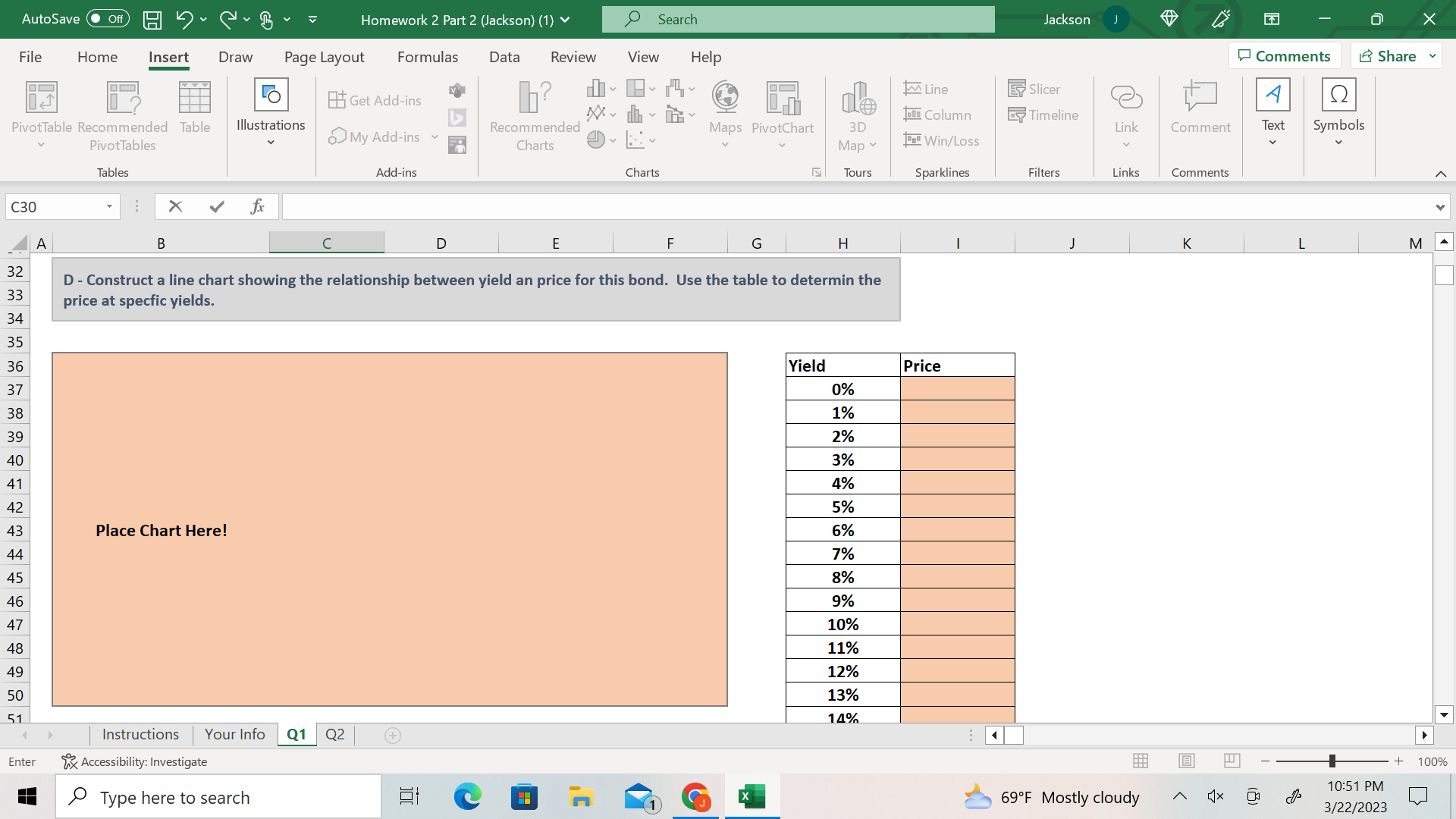

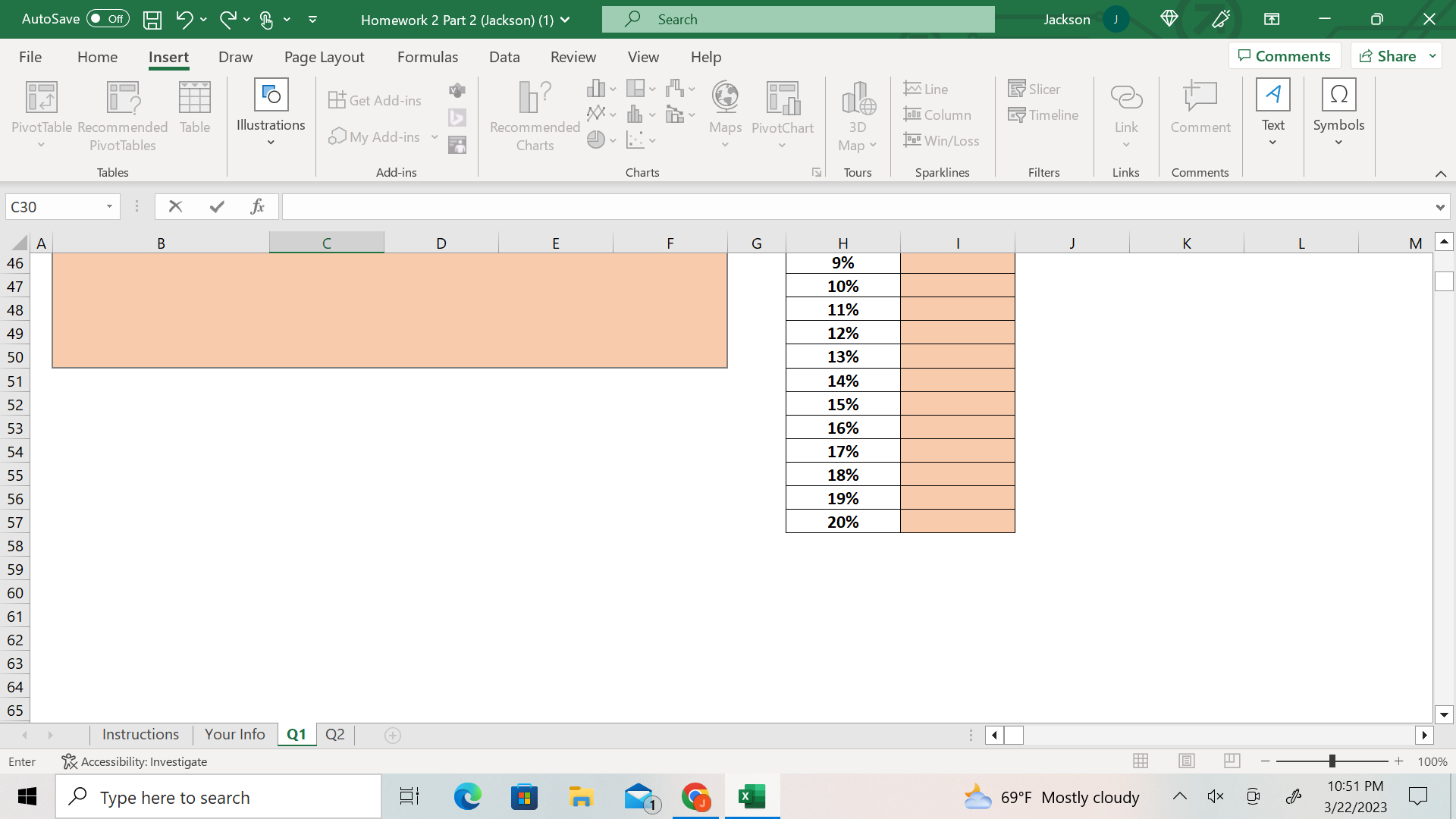

AutoSave Off File C30 PivotTable Recommended Table Pivot Tables 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 A Enter Home Insert Tables H Price Par Value B X Coupon Rate Payment Frequency Maturity 8 Illustrations Wayne Enterprices Bonds $ $ Required Return Valuation Draw Page Layout Formulas fx Accessibility: Investigate Type here to search Homework 2 Part 2 (Jackson) (1) Get Add-ins My Add-ins Instructions Your Info Q1 Q2 Add-ins 823.00 1,000.00 7% 2 9 years Data 12% Review d 10 b? Recommended Charts E Search View ^^* Question 1 As an investor, you are considering an investment in the bonds of Wayne Enterprises. The bonds pay interest semiannually, will mature in nine years, and have a coupon rate of 7% with a par value of $1,000. Currently the bonds are selling for $823. Charts A - If the required return for bonds this risky is 12%, what is the highest price you would be willing to pay? F Help Maps PivotChart G S 3D Map Tours H Line alla Column 1 Win/Loss Sparklines LG Jackson J Slicer Timeline Filters J Link Links 69F Mostly cloudy Comments K A Comment Text Symbols x 183 Comments CO C L Share 10:51 PM 3/22/2023 + X M 100% AutoSave Off File C30 PivotTable Recommended Table Pivot Tables 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 10 A Enter Home Insert H Tables B X Yield to Maturity Macauley Duaration Modified Duration 8 Illustrations Draw Page Layout Formulas fx Accessibility: Investigate B- What is the yield to maturity for these bonds? Homework 2 Part 2 (Jackson) (1) Instructions Your Info Q1 Q2 Type here to search Get Add-ins My Add-ins Add-ins Data C - What is the Macauley Duration for this Bond? What is the Modified Duration? 10 Review d b? Recommended Charts E H+ ^^* Search View Charts F Help Maps PivotChart G N D - Construct a line chart showing the relationship between yield an price for this bond. Use the table to determin the price at specfic yields. 3D Yield Map Tours H 0% 1% 2% 3% Line alla Column 1 Win/Loss Sparklines Price LG Jackson J Slicer Timeline Filters J Link Links 69F Mostly cloudy Comments K A Comment Text Symbols x 183 Comments CO C L Share 10:51 PM 3/22/2023 + X M 100% AutoSave Off File C30 PivotTable Recommended Table Pivot Tables 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 A Enter Home Insert H Tables B X Place Chart Here! Draw Page Layout Formulas 8 Illustrations Accessibility: Investigate fx Instructions Your Info Q1 Q2 Type here to search Homework 2 Part 2 (Jackson) (1) Get Add-ins My Add-ins Add-ins Data Et Review d b? Recommended Charts HH E Search View ^^* Charts F Help D - Construct a line chart showing the relationship between yield an price for this bond. Use the table to determin the price at specfic yields. Maps PivotChart G S 3D Map Tours Yield H 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% Line alla Column 1 Win/Loss Sparklines Price LG Jackson J Slicer Timeline Filters J Link Links 69F Mostly cloudy Comments K A Comment Text Symbols x 183 Comments CO C L Share 10:51 PM 3/22/2023 + X M 100% AutoSave Off File C30 PivotTable Recommended Table Pivot Tables Tables 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 64 65 A Enter H Home Insert B X Homework 2 Part 2 (Jackson) (1) Draw Page Layout Formulas Data Review d XX dh Accessibility: Investigate 8 Illustrations Instructions Your Info fx Type here to search Q1 Q2 Get Add-ins My Add-ins Add-ins at b? Recommended Charts E Search View Charts F Help Maps PivotChart G S 3D Map Tours H 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Line allo Column 1 Win/Loss Sparklines LG Jackson J Slicer Timeline Filters Link Links 69F Mostly cloudy Comments K A Comment Text Symbols x 183 Comments CO C L Share 10:51 PM 3/22/2023 + X M 100%

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

A To calculate the highest price you would be willing to pay for the bonds given a required return of 12 you can use the present value formula for a b... View full answer

Get step-by-step solutions from verified subject matter experts