Question: AutoSave OFF HE SU Lab 5 Assignment(5) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Tms Rmn V .

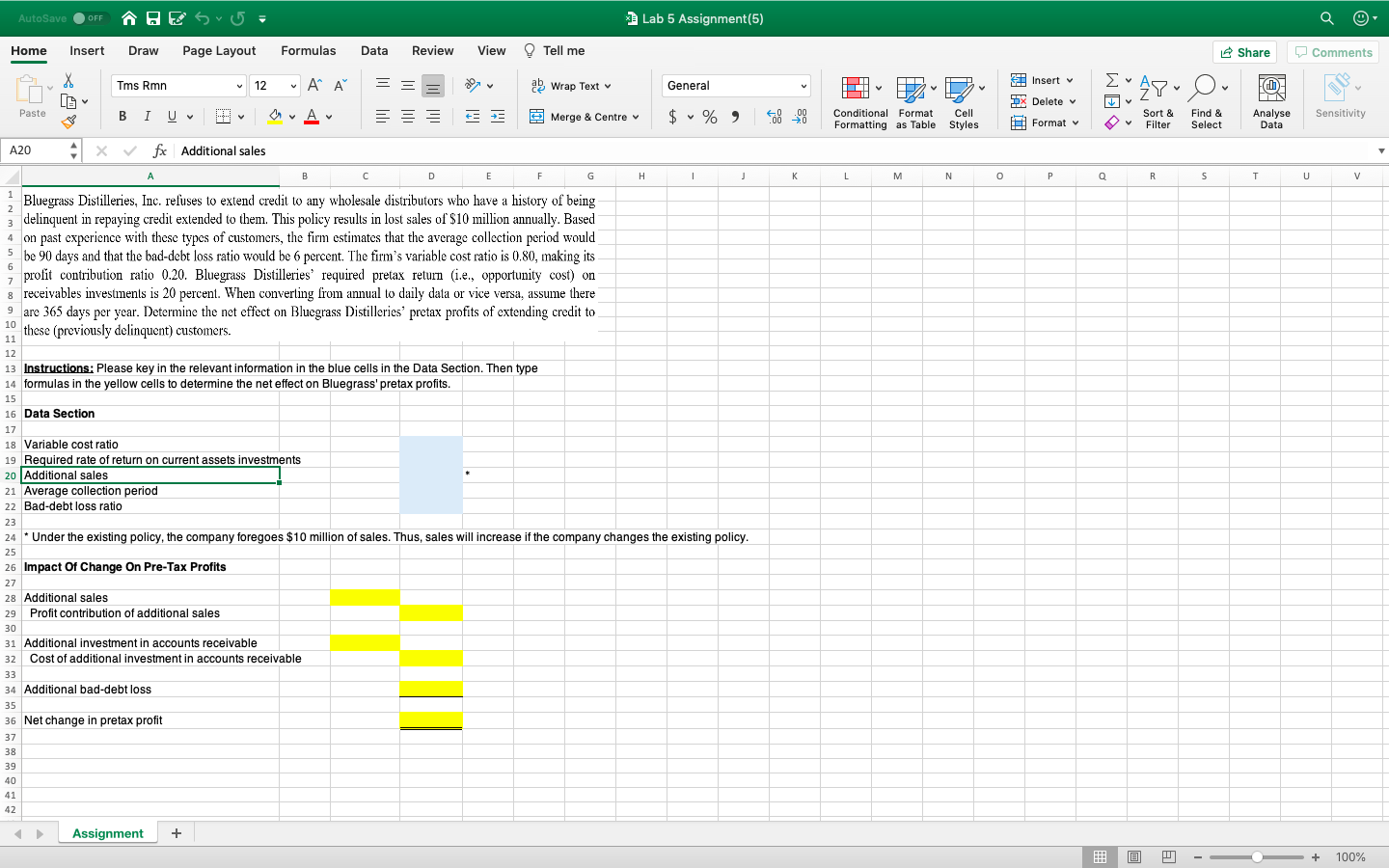

AutoSave OFF HE SU Lab 5 Assignment(5) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Tms Rmn V . A Insert 12 = = ab Wrap Text General Do AY WE THIS ch Ow DX Delete v Paste B IU A V Merge & Centre V $ % ) .00 00 0 Sensitivity Conditional Format Cell Formatting as Table Styles Find & Select Sort & Filter Analyse Data Format A20 4 x v fx Additional sales A B D E F G H H 1 L M N o P Q S U U V 1 2 5 6 7 Bluegrass Distilleries, Inc. refuses to extend credit to any wholesale distributors who have a history of being delinquent in repaying credit extended to them. This policy results in lost sales of $10 million annually. Based on past experience with these types of customers, the firm estimates that the average collection period would be 90 days and that the bad-debt loss ratio would be 6 percent. The firm's variable cost ratio is 0.80, making its profit contribution ratio 0.20. Bluegrass Distilleries' required pretax return (1.e., opportunity cost) on 8 receivables investiments is 20 percent. When converting from annual to daily data or vice versa, assume there 9 are 365 days per year. Determine the net effect on Bluegrass Distilleries' pretax profits of extending credit to 11 these (previously delinquent) customers. 12 13 Instructions: Please key in the relevant information in the blue cells in the Data Section. Then type 14 formulas in the yellow cells to determine the net effect on Bluegrass'pretax profits. 15 16 Data Section 17 18 Variable cost ratio 19 Required rate of return on current assets investments 20 Additional sales 21 Average collection period -- 22 Bad-debt loss ratio 23 24 * Under the existing policy, the company foregoes $10 million of sales. Thus, sales will increase if the company changes the existing policy. 25 25 26 Impact of Change On Pre-Tax Profits 27 28 Additional sales Profit contribution of additional sales 30 31 Additional investment in accounts receivable Cost of additional investment in accounts receivable 33 34 Additional bad-debt loss 35 36 Net change in pretax profit * 29 32 37 38 39 40 41 42 Assignment + A - + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts