Question: AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT

AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut E ALT LG Copy * Format Painter Times New Rom - 11 A A Aa to BI abx x ADA 1 Normal 1 No Spac... Heading 1 Heading 2 Title Find Replace Select Paste Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Paragraph Styles !!!!!!!1!!!!!!!!!!!!!!!!!!!! 4.''T''.5''T''. 6.''A.7.'' Sensitivity Editor L 1..... Question 2: On July 1, 2019. Allied Material Company adopted a stock option plan that granted options to key executives to purchase 100,000 shares of the company's $1 par value common stock. The options were granted on January 1, 2020, and were exercisable 3 years after the date of grant if the grantee was still an employee of the company. The options expired 4 years from date of grant. The option price was set at $66, and the fair value option pricing model determines the total compensation expense to be $660,000. The company's fiscal year end is December 31. All of the options were exercised February 1, 2023, when the market price was $78 a share. Instructions a) Prepare the journal entry for December 31, 2020. Show all calculations. b) Indicate the account and the amount that would be on the income statement related to the options for the year ended December 31, 2021. Indicate the account and the amount that would be on the balance sheet related to the options as of December 31, 2021, and the section it would be in on the balance sheet. Show all calculations. Page 3 of 6 938 words LX C Focus 20 100% ' Type here to search O a 99+ 4:41 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 11 A A A A E ALT AaBbcct AaBbcc[ AaBbc Aabbcc AaB Aabbccc Aabbccdu 1 Normal 1 No Spac... Heading 1 Heading 2 Title LG Copy * Format Painter Find Replace Select Paste BI abx x ADA Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Sensitivity Editor Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 L Question 1: Backhome Company's net income for 2020 is $650.000. and 86.000 shares of common were issued and outstanding as of January 1, 2020. On June 30, 2020, the company repurchased 20.000 of its shares for $25 each. The only potentially dilutive securities outstanding were 25.000 executive stock options issued during 2019, each exercisable for one share at $20.50; none of these have been exercised. The average market price of Backhome's stock during 2020 was $26. Instructions a) Compute basic earnings per share as it should be shown on the income statement. Show all calculations. b) Compute diluted earnings per share as it should be shown on the income statement. Show all calculations. Page 2 of 6 938 words LX C Focus 20 100% Type here to search o ,C a 99+ 4:41 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut E ALT LG Copy * Format Painter Times New Rom - 11 A A Aa to BI abx x ADA 1 Normal 1 No Spac... Heading 1 Heading 2 Title Find Replace Select Paste = Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Sensitivity Editor Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 L Question 3: On July 1, 2020, Ellsbury Inc. entered into a contract to deliver one of its specialty machines to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $3,000 in advance on July 15, 2020. Kickapoo pays Ellsbury on July 15, 2020, and Ellsbury delivers the machine (which cost Ellsbury $1,900) on July 31, 2020. Instructions a) Prepare the journal entry on July 15, 2020. for Ellsbury. Show any calculations. b) Prepare the journal entries on July 31, 2020, for Ellsbury. Show any calculations. c) Briefly explain why FASB issued ASU 2014-09, vastly changing when and how revenue is recognized d) Describe, as well as you can, how each of the five steps to the revenue recognition process are met in the above transactions. Page 4 of 6 938 words LX C Focus 20 100% Type here to search o ,C a 99+ 4:42 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut LG Copy * Format Painter Paste Find Replace Select Dictate Sensitivity Times New Rom - 11 A A Aa to E ALT BI x ADA = 1 Normal 1 No Spac... Heading 1 abx Heading 2 Title Subtitle Subtle Em... Font Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 Editor Clipboard Editing Voice Sensitivity Editor L Question 4: Metals Corporation reports pretax financial income of $260,000 for 2020. The following items cause taxable income to be different than pretax financial income. Rental income on the 2020 tax return is $65,000 greater than on the income statement. Depreciation on the tax return is greater than depreciation on the income statement by $40,000. Interest on an investment in a municipal bond of $6,500 is reported on the income statement. Metal's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2020. The company expects to realize only 25% of the benefit of any deferred tax assets. Instructions a) Compute taxable income and income taxes payable for 2020. b) Prepare the journal entry or entries to record income tax expense, income taxes payable, and deferred income taxes for 2020, including any valuation allowance needed. Page 5 of 6 938 words LX C Focus 20 100% Type here to search O ,C a 99+ 4:42 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom - 11 A A Aa to E ALT 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy * Format Painter Find c Replace Select Paste BI = 1 abx X? ADA Subtitle Dictate Subtle Em... Sensitivity Editor Clipboard Font Editing Voice Sensitivity Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 Editor L Question 5: Topper Company reported the following pretax financial income (loss) for the years 2015 through 2018 2015 2016 2017 2018 $ 70,000 $ 45,000 $(260,000) $ 90,000 1511111114113111121111111111111, LT.1 Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 30% for all years. Assume the governing laws allowed for a two-year carryback and 20-year carryforward and that the carryback provision is used. Instructions a) Prepare the journal entries for 2016, 2017, and 2018. Show all calculations. Assume that it is more likely than not that deferred tax asset benefits WILL be realized. b) Indicate the amount that will be reported as net income or net loss on the income statement for the year ended December 31, 2018. c) The company started having financial trouble late in 2018, and determined that it was more likely than not that only 25% of the benefit of any deferred tax asset would be realized. Prepare the relevant adjusting entry based on any 12/31/18 deferred tax asset. Page 6 of 6 938 words LX C Focus 20 100% Type here to search i O 99+ a 4:42 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut E ALT LG Copy * Format Painter Times New Rom - 11 A A Aa to BI abx x ADA 1 Normal 1 No Spac... Heading 1 Heading 2 Title Find Replace Select Paste Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Paragraph Styles !!!!!!!1!!!!!!!!!!!!!!!!!!!! 4.''T''.5''T''. 6.''A.7.'' Sensitivity Editor L 1..... Question 2: On July 1, 2019. Allied Material Company adopted a stock option plan that granted options to key executives to purchase 100,000 shares of the company's $1 par value common stock. The options were granted on January 1, 2020, and were exercisable 3 years after the date of grant if the grantee was still an employee of the company. The options expired 4 years from date of grant. The option price was set at $66, and the fair value option pricing model determines the total compensation expense to be $660,000. The company's fiscal year end is December 31. All of the options were exercised February 1, 2023, when the market price was $78 a share. Instructions a) Prepare the journal entry for December 31, 2020. Show all calculations. b) Indicate the account and the amount that would be on the income statement related to the options for the year ended December 31, 2021. Indicate the account and the amount that would be on the balance sheet related to the options as of December 31, 2021, and the section it would be in on the balance sheet. Show all calculations. Page 3 of 6 938 words LX C Focus 20 100% ' Type here to search O a 99+ 4:41 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom 11 A A A A E ALT AaBbcct AaBbcc[ AaBbc Aabbcc AaB Aabbccc Aabbccdu 1 Normal 1 No Spac... Heading 1 Heading 2 Title LG Copy * Format Painter Find Replace Select Paste BI abx x ADA Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Sensitivity Editor Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 L Question 1: Backhome Company's net income for 2020 is $650.000. and 86.000 shares of common were issued and outstanding as of January 1, 2020. On June 30, 2020, the company repurchased 20.000 of its shares for $25 each. The only potentially dilutive securities outstanding were 25.000 executive stock options issued during 2019, each exercisable for one share at $20.50; none of these have been exercised. The average market price of Backhome's stock during 2020 was $26. Instructions a) Compute basic earnings per share as it should be shown on the income statement. Show all calculations. b) Compute diluted earnings per share as it should be shown on the income statement. Show all calculations. Page 2 of 6 938 words LX C Focus 20 100% Type here to search o ,C a 99+ 4:41 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut E ALT LG Copy * Format Painter Times New Rom - 11 A A Aa to BI abx x ADA 1 Normal 1 No Spac... Heading 1 Heading 2 Title Find Replace Select Paste = Subtitle Subtle Em... Dictate Sensitivity Editor Clipboard Font Editing Voice Sensitivity Editor Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 L Question 3: On July 1, 2020, Ellsbury Inc. entered into a contract to deliver one of its specialty machines to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $3,000 in advance on July 15, 2020. Kickapoo pays Ellsbury on July 15, 2020, and Ellsbury delivers the machine (which cost Ellsbury $1,900) on July 31, 2020. Instructions a) Prepare the journal entry on July 15, 2020. for Ellsbury. Show any calculations. b) Prepare the journal entries on July 31, 2020, for Ellsbury. Show any calculations. c) Briefly explain why FASB issued ASU 2014-09, vastly changing when and how revenue is recognized d) Describe, as well as you can, how each of the five steps to the revenue recognition process are met in the above transactions. Page 4 of 6 938 words LX C Focus 20 100% Type here to search o ,C a 99+ 4:42 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut LG Copy * Format Painter Paste Find Replace Select Dictate Sensitivity Times New Rom - 11 A A Aa to E ALT BI x ADA = 1 Normal 1 No Spac... Heading 1 abx Heading 2 Title Subtitle Subtle Em... Font Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 Editor Clipboard Editing Voice Sensitivity Editor L Question 4: Metals Corporation reports pretax financial income of $260,000 for 2020. The following items cause taxable income to be different than pretax financial income. Rental income on the 2020 tax return is $65,000 greater than on the income statement. Depreciation on the tax return is greater than depreciation on the income statement by $40,000. Interest on an investment in a municipal bond of $6,500 is reported on the income statement. Metal's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2020. The company expects to realize only 25% of the benefit of any deferred tax assets. Instructions a) Compute taxable income and income taxes payable for 2020. b) Prepare the journal entry or entries to record income tax expense, income taxes payable, and deferred income taxes for 2020, including any valuation allowance needed. Page 5 of 6 938 words LX C Focus 20 100% Type here to search O ,C a 99+ 4:42 PM 10/25/20 AutoSave Off HI ACCT365-01 and ACCT705-01, Examination #2, Fall 2020, Chapters 16, 18, and 19.docx - Saved to this PC- Search A Raydel Guerrero (RIT Student) RG File Home Insert Design Layout References Mailings Review View Help Share Comments X Cut Times New Rom - 11 A A Aa to E ALT 1 Normal 1 No Spac... Heading 1 Heading 2 Title La Copy * Format Painter Find c Replace Select Paste BI = 1 abx X? ADA Subtitle Dictate Subtle Em... Sensitivity Editor Clipboard Font Editing Voice Sensitivity Paragraph Styles 1.IIIIIIIIIIIIIIIII.2 III.3. III.4IIIII.5 LITII.6.1.7 Editor L Question 5: Topper Company reported the following pretax financial income (loss) for the years 2015 through 2018 2015 2016 2017 2018 $ 70,000 $ 45,000 $(260,000) $ 90,000 1511111114113111121111111111111, LT.1 Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 30% for all years. Assume the governing laws allowed for a two-year carryback and 20-year carryforward and that the carryback provision is used. Instructions a) Prepare the journal entries for 2016, 2017, and 2018. Show all calculations. Assume that it is more likely than not that deferred tax asset benefits WILL be realized. b) Indicate the amount that will be reported as net income or net loss on the income statement for the year ended December 31, 2018. c) The company started having financial trouble late in 2018, and determined that it was more likely than not that only 25% of the benefit of any deferred tax asset would be realized. Prepare the relevant adjusting entry based on any 12/31/18 deferred tax asset. Page 6 of 6 938 words LX C Focus 20 100% Type here to search i O 99+ a 4:42 PM 10/25/20

Step by Step Solution

There are 3 Steps involved in it

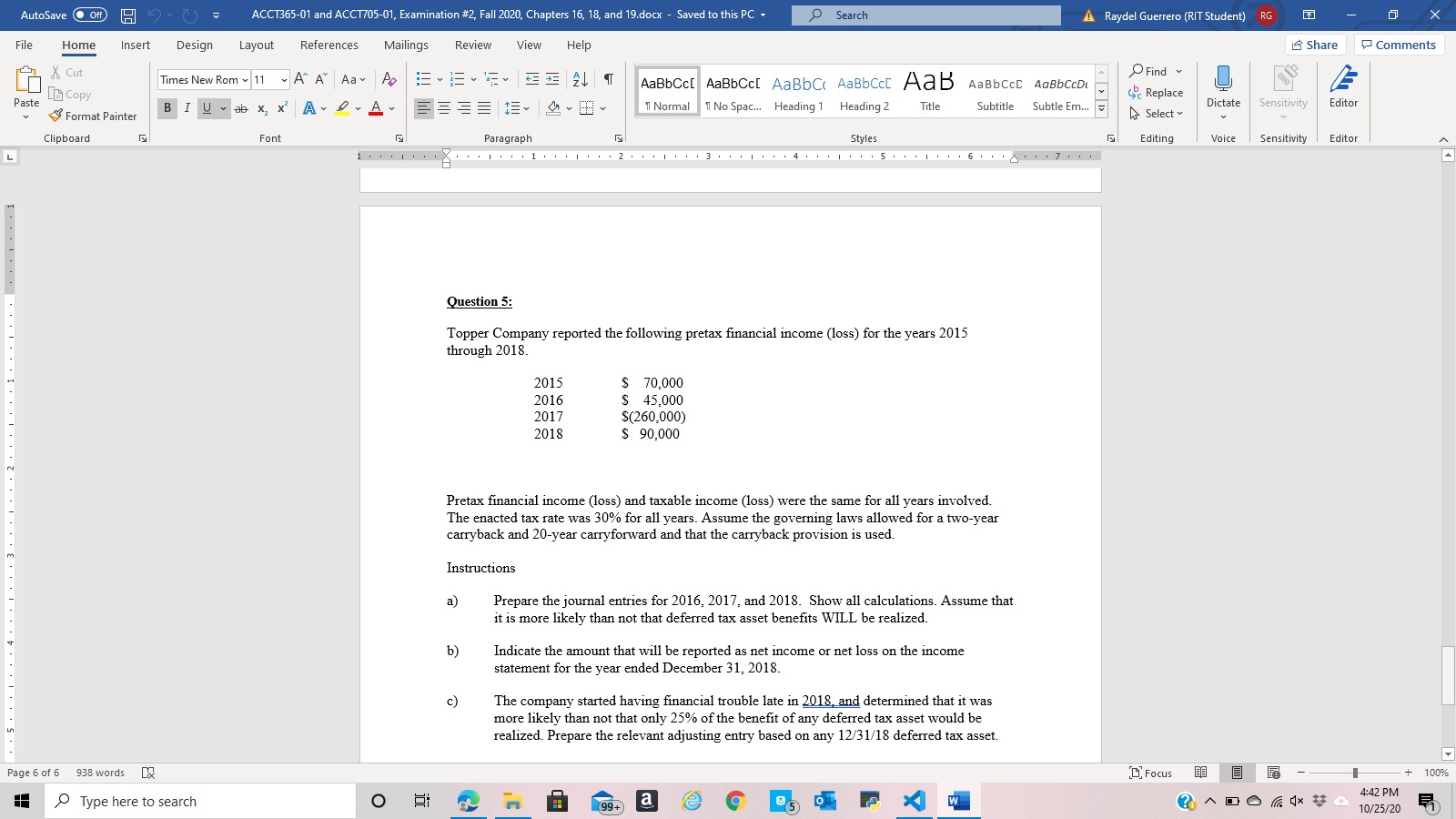

Get step-by-step solutions from verified subject matter experts