Question: AutoSave OFF OG ... Consolidation Case-Spring 2021_deployed e Share Comments ASV I U Sort & Filter Ideas Sensitivity Find & Select Home Insert Draw Page

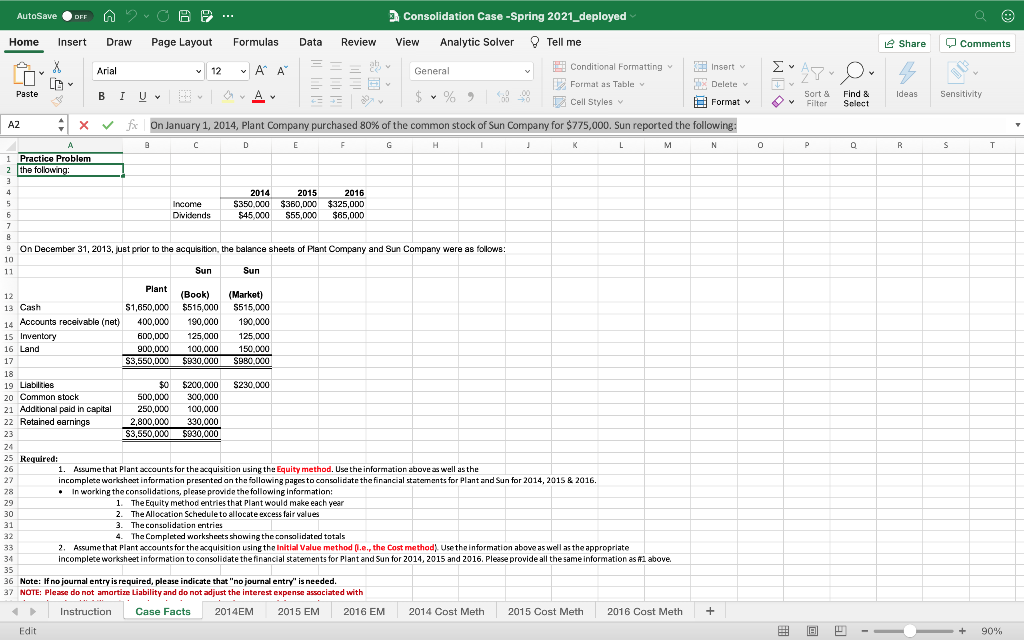

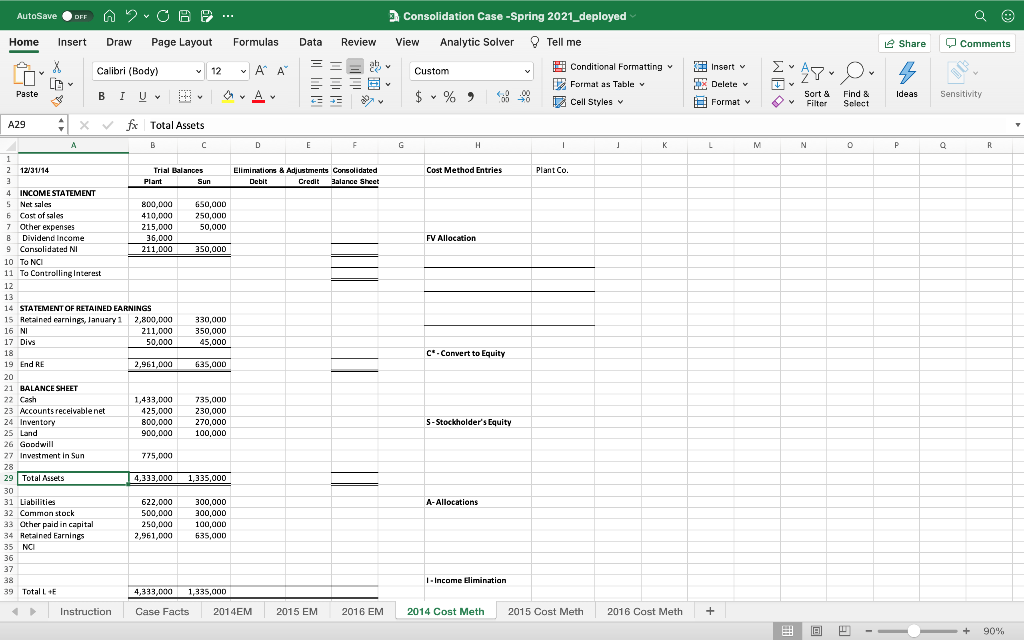

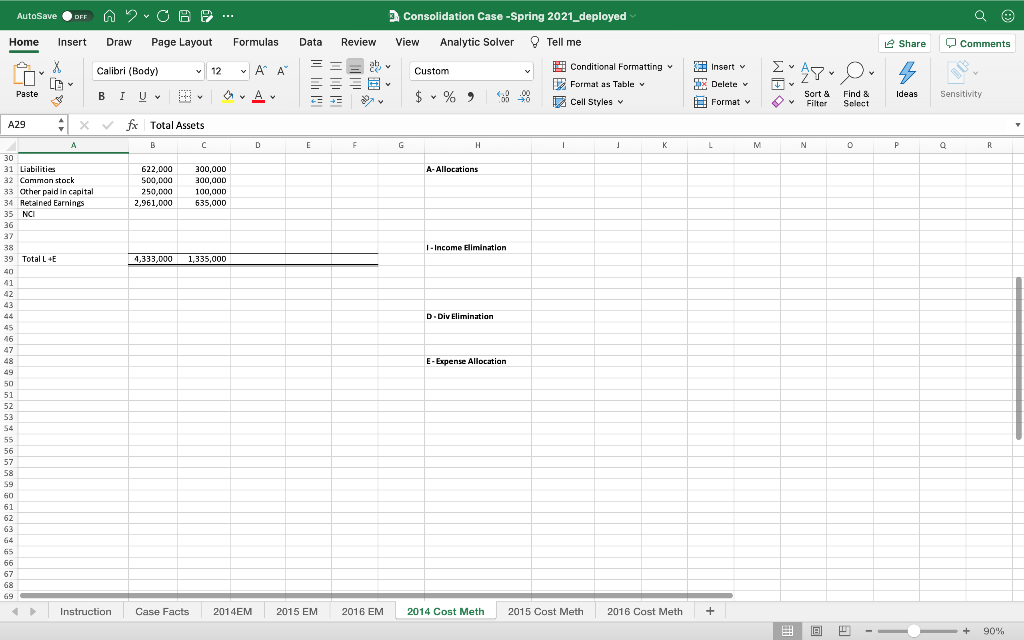

AutoSave OFF OG ... Consolidation Case-Spring 2021_deployed e Share Comments ASV I U Sort & Filter Ideas Sensitivity Find & Select Home Insert Draw Page Layout Formulas Data Review View Analytic Solver Tell me Arial 12 v General Conditional Formatting Insert La Format as Table * Delete Paste B A $ % 1 Cell Styles Format AZ x for On January 1, 2014, Plant Company purchased 80% of the common stock of Sun Company for $775,000. Sun reported the following: D F G J K M N N 1 Practice Problem 2 the following: 3 4 2014 2015 2016 5 Income $350,000 $350,000 $325,0DD 6 Dividends $45.000 S55,000 $65,000 7 A 9 C E H L 0 P 0 R S T 9 On December 31, 2013, just prior to the acquisition, the balance sheets of Plant Company and Sun Company were as follows: 10 11 Sun Sun Plant 12 (Book) (Market) 13 Cash $1,650,000 $515,000 S515.000 14 Accounts receivable (net) 400,000 190,000 190.000 15 Inventory 600,000 125.000 125.000 16 Land 900,000 100,000 150.000 17 $3,550,000 $930,000 S980.000 18 19 Liabilities $0 $200.000 S230.000 20 Common stock 500,000 300,000 21 Additional paid in capital 250.000 100,000 22 Retained earnings 2,800,000 330,000 23 $3,550,000 $930,000 24 25 Required: 26 1. Assume that Plant accounts for the acquisition using the Equity method. Use the information above as well as the 27 incomplete workshort information presented on the following pages to consolidate the financial statements for Plant and Sun for 2014, 2015 & 2016. 28 In working the consolidations, please provide the following Information: 29 1. The Equity method entries that plant would make each year 30 2. The Allocation Schedule to allocate excess fair values 31 3. The consolidation entries 32 4. The Completed worksheets showing the consolidated totals 33 2. Assume that Plant accounts for the acquisition using the initial value method ().e., the Cost method) Use the information above as well as the appropriate 34 incomplete worksheet information to consolidate the financial statements for Plant and Sun for 2014, 2015 and 2016. Please provide all the same information as #1 above 35 36 Note: If no journal entry is required, please indicate that "no journal entry" is needed. 37 NOTE: Please do not amortize Liability and do not adjust the interest expense associated with Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth . + Edit 90% AutoSave OFF A2O6... Q Home Insert Draw Page Layout Formulas e Share O Comments Consolidation Case-Spring 2021_deployed Data Review View Analytic Solver Tell me = atv Custom Conditional Formatting 12 Format as Table y $ % ) 1 Cell Styles Calibri (Body) 12 AA Insert & Delete v ' ' . 4 V Paste B I U Av Ideas Sort & Filter Format Find & Select Sensitivity V D E F G H 1 K L M N 0 F R Cost Method Entries Plant Co. Eliminations & Adjustments Consolidated Debit Credit Balance Sheet FV Allocation C. Convert to Equity A29 fx Total Assets A B C 1 2 12/31/14 Trial Balances 3 Plant Sun 4 INCOME STATEMENT 5 Net sales 800,000 650,000 6 Cast of sales 410,000 250,000 7 Other expenses 215,000 50,000 B Dividend Income 36,000 9 Consolidated NI 211,000 350,000 10 To NCI 11 To Controlling Interest 12 13 14 STATEMENT OF RETAINED EARNINGS 15 Retained earnings, January 1 2,800,000 330,000 16 NI 211,000 350,000 17 Divs 50,000 45,000 18 19 End RE 2,961,000 635,000 20 21 BALANCE SHEET 22 Cash 1,433,000 735,000 23 Accounts receivable net 425,000 230,000 24 Inventory 800,000 270,000 25 Land 900,000 100,000 26 Goodwill 27 Investment in Sun 775,000 28 29 Total Assets 4.333,000 1,335,000 30 31 Liabilities 622,000 300,000 32 Comman stock 500,000 300,000 33 Other paid in capital 250,000 100,000 34 Retained Earnings 2,961,000 535,000 35 NCI 36 37 38 39 Total 1 + 4,333,000 1,335,000 5 - Stockholder's Equity A- Allocations 1-Income Elimination Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth + IB + 90% AutoSave DEE AO6... Q Home Insert Draw Page Layout Formulas e Share O Comments Consolidation Case-Spring 2021_deployed Data Review View Analytic Solver Tell me = atv Custom Conditional Formatting Format as Table $ % ) Cell Styles Calibri (Body) 12 AA Insert & Delete v ' 4 Y Paste B I U Ideas Sensitivity Format Sort & Filter Find & Select V A29 fx Total Assets B D E F G H 1 L M N P R A- Allocations 622,000 500,000 250,000 2,961,000 300,000 200,000 100,000 535.000 A 30 31 Liabilities 32 Camman stock 33 Other paid in capital 34 Retained Eamines 35 NCI 36 37 38 39 Total L E 40 41 42 43 44 45 46 1 - Income Elimination 4,333,000 1,335,000 D. Div Elimination 47 E- Expense Allocation 49 50 51 52 53 54 55 56 57 58 S9 60 61 62 63 65 66 67 68 Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth + IB + 90% AutoSave OFF OG ... Consolidation Case-Spring 2021_deployed e Share Comments ASV I U Sort & Filter Ideas Sensitivity Find & Select Home Insert Draw Page Layout Formulas Data Review View Analytic Solver Tell me Arial 12 v General Conditional Formatting Insert La Format as Table * Delete Paste B A $ % 1 Cell Styles Format AZ x for On January 1, 2014, Plant Company purchased 80% of the common stock of Sun Company for $775,000. Sun reported the following: D F G J K M N N 1 Practice Problem 2 the following: 3 4 2014 2015 2016 5 Income $350,000 $350,000 $325,0DD 6 Dividends $45.000 S55,000 $65,000 7 A 9 C E H L 0 P 0 R S T 9 On December 31, 2013, just prior to the acquisition, the balance sheets of Plant Company and Sun Company were as follows: 10 11 Sun Sun Plant 12 (Book) (Market) 13 Cash $1,650,000 $515,000 S515.000 14 Accounts receivable (net) 400,000 190,000 190.000 15 Inventory 600,000 125.000 125.000 16 Land 900,000 100,000 150.000 17 $3,550,000 $930,000 S980.000 18 19 Liabilities $0 $200.000 S230.000 20 Common stock 500,000 300,000 21 Additional paid in capital 250.000 100,000 22 Retained earnings 2,800,000 330,000 23 $3,550,000 $930,000 24 25 Required: 26 1. Assume that Plant accounts for the acquisition using the Equity method. Use the information above as well as the 27 incomplete workshort information presented on the following pages to consolidate the financial statements for Plant and Sun for 2014, 2015 & 2016. 28 In working the consolidations, please provide the following Information: 29 1. The Equity method entries that plant would make each year 30 2. The Allocation Schedule to allocate excess fair values 31 3. The consolidation entries 32 4. The Completed worksheets showing the consolidated totals 33 2. Assume that Plant accounts for the acquisition using the initial value method ().e., the Cost method) Use the information above as well as the appropriate 34 incomplete worksheet information to consolidate the financial statements for Plant and Sun for 2014, 2015 and 2016. Please provide all the same information as #1 above 35 36 Note: If no journal entry is required, please indicate that "no journal entry" is needed. 37 NOTE: Please do not amortize Liability and do not adjust the interest expense associated with Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth . + Edit 90% AutoSave OFF A2O6... Q Home Insert Draw Page Layout Formulas e Share O Comments Consolidation Case-Spring 2021_deployed Data Review View Analytic Solver Tell me = atv Custom Conditional Formatting 12 Format as Table y $ % ) 1 Cell Styles Calibri (Body) 12 AA Insert & Delete v ' ' . 4 V Paste B I U Av Ideas Sort & Filter Format Find & Select Sensitivity V D E F G H 1 K L M N 0 F R Cost Method Entries Plant Co. Eliminations & Adjustments Consolidated Debit Credit Balance Sheet FV Allocation C. Convert to Equity A29 fx Total Assets A B C 1 2 12/31/14 Trial Balances 3 Plant Sun 4 INCOME STATEMENT 5 Net sales 800,000 650,000 6 Cast of sales 410,000 250,000 7 Other expenses 215,000 50,000 B Dividend Income 36,000 9 Consolidated NI 211,000 350,000 10 To NCI 11 To Controlling Interest 12 13 14 STATEMENT OF RETAINED EARNINGS 15 Retained earnings, January 1 2,800,000 330,000 16 NI 211,000 350,000 17 Divs 50,000 45,000 18 19 End RE 2,961,000 635,000 20 21 BALANCE SHEET 22 Cash 1,433,000 735,000 23 Accounts receivable net 425,000 230,000 24 Inventory 800,000 270,000 25 Land 900,000 100,000 26 Goodwill 27 Investment in Sun 775,000 28 29 Total Assets 4.333,000 1,335,000 30 31 Liabilities 622,000 300,000 32 Comman stock 500,000 300,000 33 Other paid in capital 250,000 100,000 34 Retained Earnings 2,961,000 535,000 35 NCI 36 37 38 39 Total 1 + 4,333,000 1,335,000 5 - Stockholder's Equity A- Allocations 1-Income Elimination Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth + IB + 90% AutoSave DEE AO6... Q Home Insert Draw Page Layout Formulas e Share O Comments Consolidation Case-Spring 2021_deployed Data Review View Analytic Solver Tell me = atv Custom Conditional Formatting Format as Table $ % ) Cell Styles Calibri (Body) 12 AA Insert & Delete v ' 4 Y Paste B I U Ideas Sensitivity Format Sort & Filter Find & Select V A29 fx Total Assets B D E F G H 1 L M N P R A- Allocations 622,000 500,000 250,000 2,961,000 300,000 200,000 100,000 535.000 A 30 31 Liabilities 32 Camman stock 33 Other paid in capital 34 Retained Eamines 35 NCI 36 37 38 39 Total L E 40 41 42 43 44 45 46 1 - Income Elimination 4,333,000 1,335,000 D. Div Elimination 47 E- Expense Allocation 49 50 51 52 53 54 55 56 57 58 S9 60 61 62 63 65 66 67 68 Instruction Case Facts 2014EM 2015 EM 2016 EM 2014 Cost Meth 2015 Cost Meth 2016 Cost Meth + IB + 90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts