Question: AutoSave OH H UBE NPV and LP Assignment - Saved to this PC Table Tools Elena Sitta 0 - 0 X File Home Insert Draw

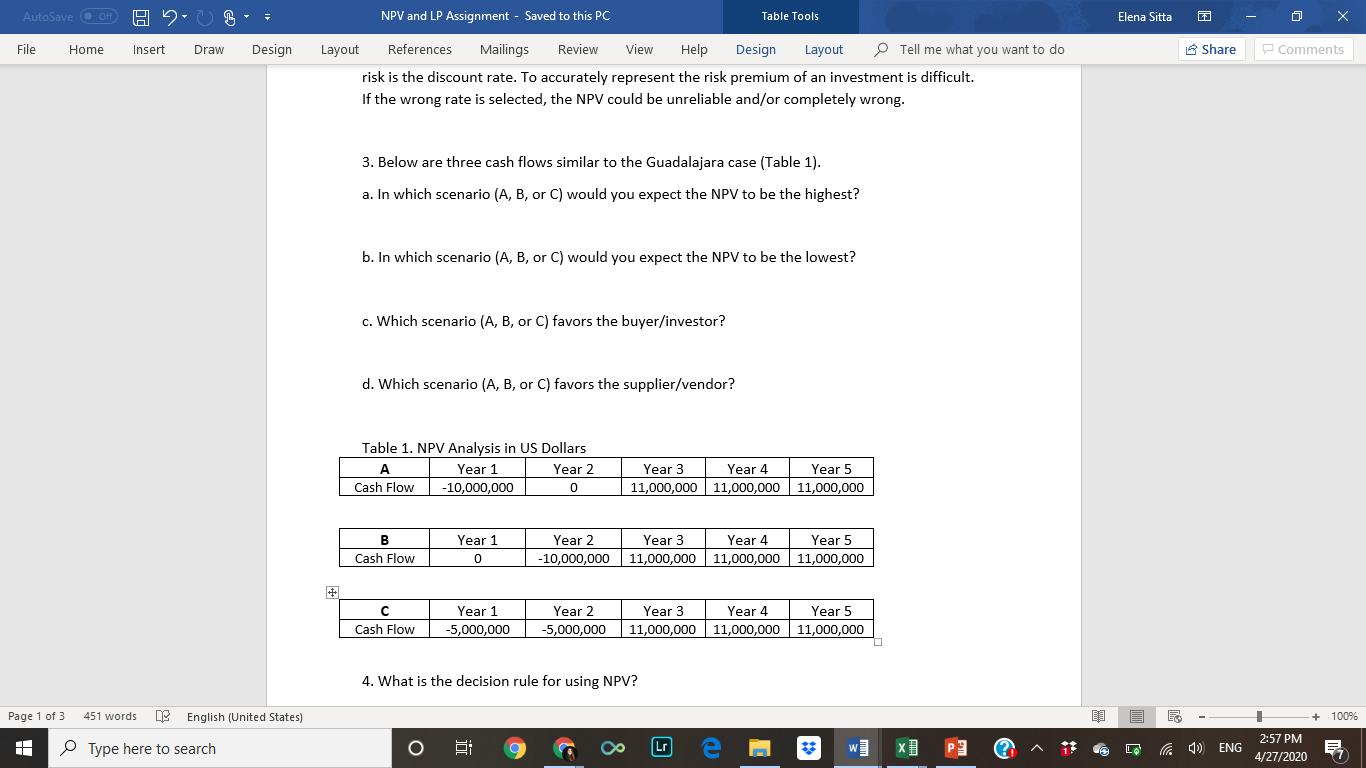

AutoSave OH H UBE NPV and LP Assignment - Saved to this PC Table Tools Elena Sitta 0 - 0 X File Home Insert Draw Design Share Comments Layout References Mailings Review View Help Design Layout Tell me what you want to do risk is the discount rate. To accurately represent the risk premium of an investment is difficult. If the wrong rate is selected, the NPV could be unreliable and/or completely wrong. 3. Below are three cash flows similar to the Guadalajara case (Table 1). a. In which scenario (A, B, or C) would you expect the NPV to be the highest? b. In which scenario (A, B, or C) would you expect the NPV to be the lowest? c. Which scenario (A, B, or C) favors the buyer/investor? d. Which scenario (A, B, or C) favors the supplier/vendor? Table 1. NPV Analysis in US Dollars Year 1 Year 2 Cash Flow -10,000,000 0 Year 3 11,000,000 Year 4 Year 5 11,000,000 | 11,000,000 | Cash Flow Year 1 0 Year 2 -10,000,000 Year 3 11,000,000 Year 4 11,000,000 Year 5 11,000,000 C Cash Flow Year 1 -5,000,000 Year 2 -5,000,000 Year 3 11,000,000 Year 4 11,000,000 Year 5 11,000,000 4. What is the decision rule for using NPV? Page 1 of 3 451 words DC English (United States) E -- - + 100% 2:57 PME Type here to search o 9 . e wi x] P1 ^ it com ENG 737/2001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts