Question: AutoSave Om H CH 20- Problern Set 7 - Read-Only. Saved to this PC- Search (Alt+Q) Tammy White 2 File Insert Draw References Mailings Review

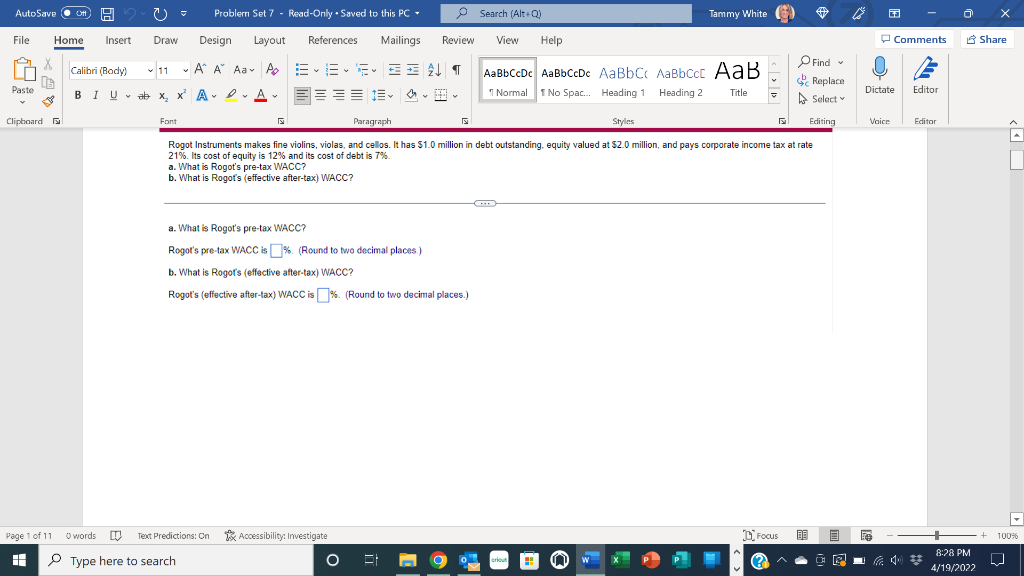

AutoSave Om H CH 20- Problern Set 7 - Read-Only. Saved to this PC- Search (Alt+Q) Tammy White 2 File Insert Draw References Mailings Review View Help Comments Share Home Design Layout X Calibri (Body) v11 11 A A A A BIUab X, X APA 21 AaBbCcDc AaBbCcDc AaBb C AaBbcc AaB 1 No Spac... Heading 1 Heading 2 Find Replace A Select Paste E E 1 Normal Title Dictate Editor Clipboard Font Paragraph Styles Editing Voice Editor Rogot Instruments makes fine violins, violas, and cellos. It has 51.0 million in debt outstanding, equity valued at $2.0 million, and pays corporate income tax at rate 21%. Its cost of equity is 12% and its cost of debt is 7% a. What is Rogot's pre-tax WACC? b. What is Rogot's (effective after-tax) WACC? a. What is Rogot's pre-tax WACC? Rogot's pre-tax WACC is % (Round to two decimal places) b. What is Rogot's (effective after-tax) WACC? Rogot's (effective after-tax) WACC is % (Round to two decimal places.) Focus BE 100% Page 1 of 11 words O Text Predictions: On Accessibility: Investigate Type here to search O lo 8:28 PM 4/19/2022 u

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts