Question: AutoSave Ore 5. Data Review Formulas View Insert Home Draw Page Layout X E v 14 AA Times New Roman op HIH Paste BIU.aA Office

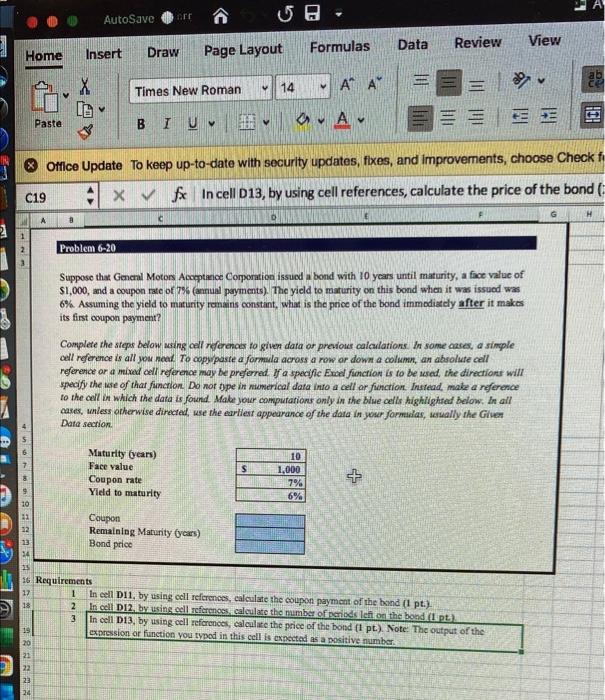

AutoSave Ore 5. Data Review Formulas View Insert Home Draw Page Layout X E v 14 AA Times New Roman op HIH Paste BIU.aA Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check fi C19 XV foc in cell D13, by using cell references, calculate the price of the bond G A 8 2 1 Problem 6-20 Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon me of 794 (annual payments). The yield to maturity on this bond when it was issued was 6%. Assuming the yield to maturity remains constant, what is the price of the bond immediately after it makes its first coupon payment? Complete the steps below msing cell references to given data or previous calculations. In some cases, a simple cell reference is all you need to copy paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred if a specific Ented function is to be used the direction will specify the nose of that function. Do nor type in merical data into a cell or function. Instead, make a reference to the call in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, wally the Given Data section Maturity (years) Face value Coupon rate Yield to maturity $ 10 1,000 7% 6% 10 Coupon Remaining Maturity years) Bond price 16 Requirements 17 1 In cell D11, by using cell references, calculate the coupon payment of the band (I pt.) 18 2 In cell D12 by using cell references calculate the number of iods left on the boundt pt 3 In cell D13, by using cell references, calculate the price of the bond (1 pt). Note: The output of the 19 expression or function you typed in this cell is expected as a positive number 21 22 NNNN 23 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts