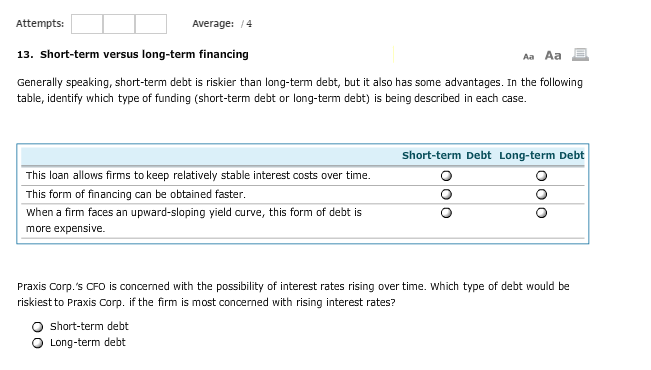

Question: Average: /4 Attempts: 13. Short-term versus long-term financing Generally speaking, short-term debt is riskier than long-term debt, but it also has some advantages. In the

Average: /4 Attempts: 13. Short-term versus long-term financing Generally speaking, short-term debt is riskier than long-term debt, but it also has some advantages. In the following table, identify which type of funding (short-term debt or long-term debt) is being described in each case. short-term Debt Long-term Debt This loan allows firms to keep relatively stable interest costs over time. This form of financing can be obtained faster When a firm faces an upward-sloping yield curve, this form of debt is more expensive Praxis Corp.'s CFO is concerned with the possibility of interest rates rising over time. Which type of debt would be riskiest to Praxis Corp. if the firm is most concerned with rising interest rates? O short-term debt O Long-term debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts