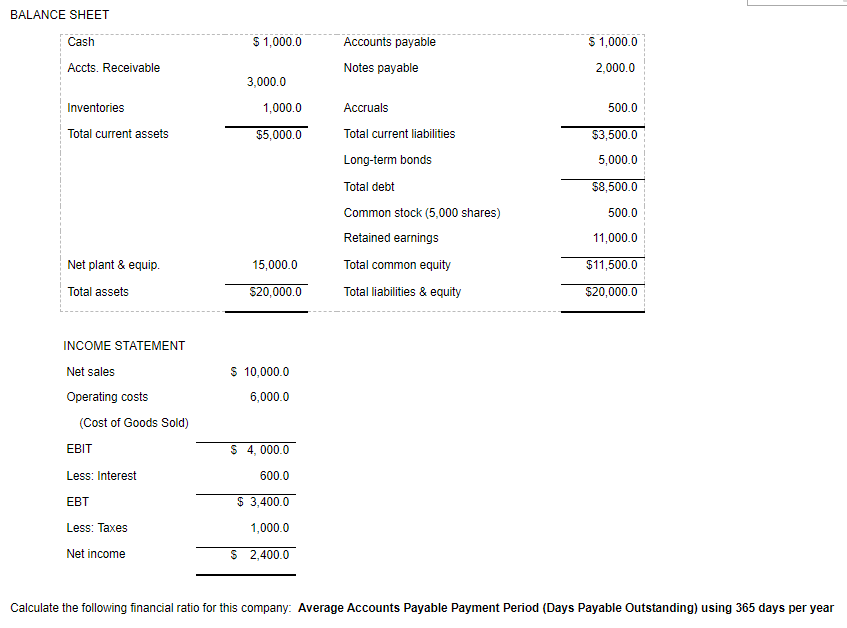

Question: Average Accounts Payable Payment Period (Days Payable Outstanding) using 365 days per year BALANCE SHEET $ 1,000.0 S 1,000.0 Cash Accts. Receivable Accounts payable Notes

Average Accounts Payable Payment Period (Days Payable Outstanding) using 365 days per year

BALANCE SHEET $ 1,000.0 S 1,000.0 Cash Accts. Receivable Accounts payable Notes payable 2,000.0 Inventories 3,000.0 1,000.0 $5,000.0 500.0 Total current assets $3,500.0 5,000.0 $8,500.0 Accruals Total current liabilities Long-term bonds Total debt Common stock (5,000 shares) Retained earnings Total common equity Total liabilities & equity 500.0 11,000.0 15,000.0 $11,500.0 Net plant & equip Total assets $20,000.0 $20,000.0 INCOME STATEMENT Net sales Operating costs (Cost of Goods Sold) EBIT S 10,000.0 6,000.0 $ 4,000.0 Less: Interest 600.0 EBT $ 3,400.0 1,000.0 Less: Taxes Net income $ 2,400.0 Calculate the following financial ratio for this company: Average Accounts Payable Payment Period (Days Payable Outstanding) using 365 days per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts