Question: average cost method (310) first-in, first-out (FIFO) method (310) gross profit method (325) inventory turnover (326) last-in, first-out (LIFO) method (310) lower-of-cost-or-market (LCM) method (320)

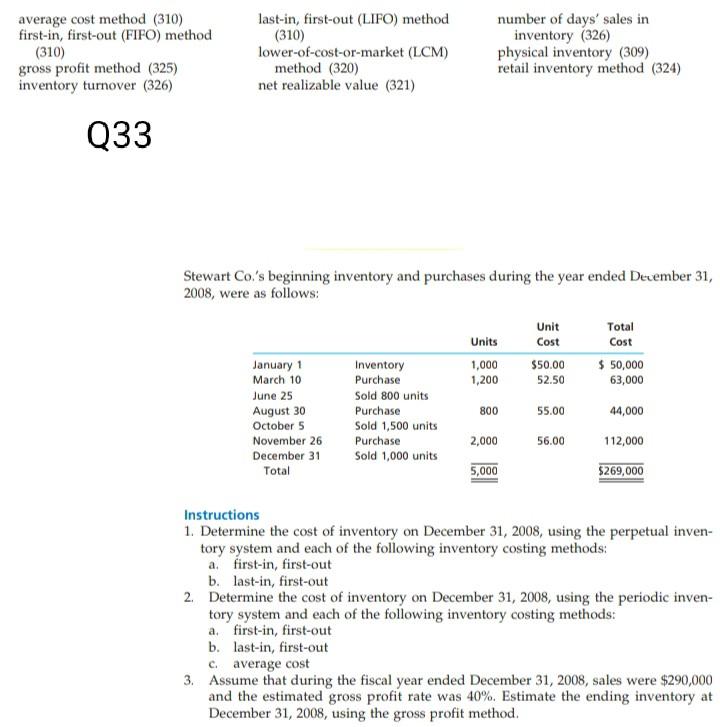

average cost method (310) first-in, first-out (FIFO) method (310) gross profit method (325) inventory turnover (326) last-in, first-out (LIFO) method (310) lower-of-cost-or-market (LCM) method (320) net realizable value (321) number of days' sales in inventory (326) physical inventory (309) retail inventory method (324) Q33 Stewart Co.'s beginning inventory and purchases during the year ended December 31, 2008, were as follows: Units Unit Cost $50.00 52.50 Total Cost $ 50,000 63,000 1,000 1,200 Inventory Purchase Sold 800 units Purchase Sold 1,500 units Purchase Sold 1,000 units 800 January 1 March 10 June 25 August 30 October 5 November 26 December 31 Total 55.00 44,000 2,000 56.00 112,000 5,000 $269,000 Instructions 1. Determine the cost of inventory on December 31, 2008, using the perpetual inven- tory system and each of the following inventory costing methods a first-in, first-out b. last-in, first-out 2. Determine the cost of inventory on December 31, 2008, using the periodic inven- tory system and each of the following inventory costing methods: a first-in, first-out b. last-in, first-out caverage cost 3. Assume that during the fiscal year ended December 31, 2008, sales were $290,000 and the estimated gross profit rate was 40%. Estimate the ending inventory at December 31, 2008, using the gross profit method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts