Question: Average Rate of Return Method, Net Present Value Method, and Analysis for a Service Company The capital investment committee of Arches Landscaping Company is considering

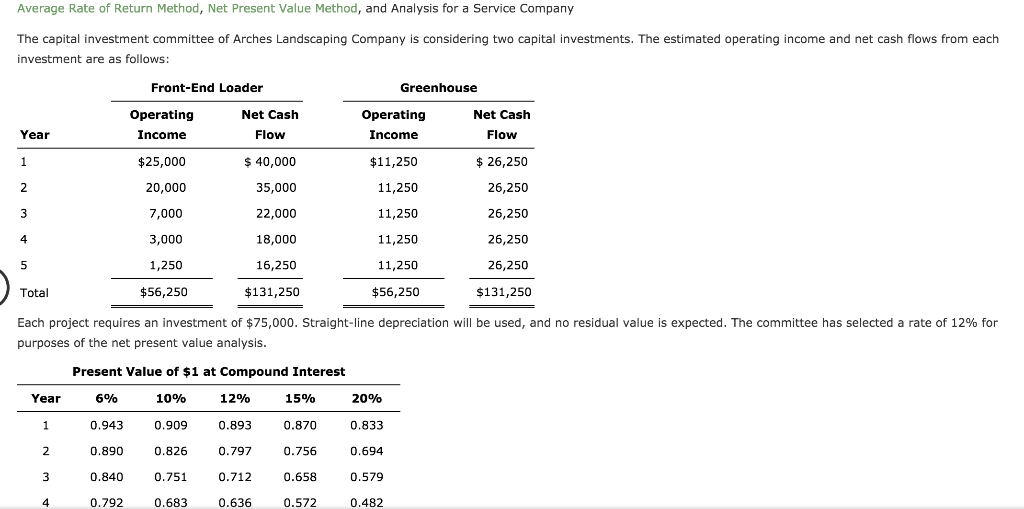

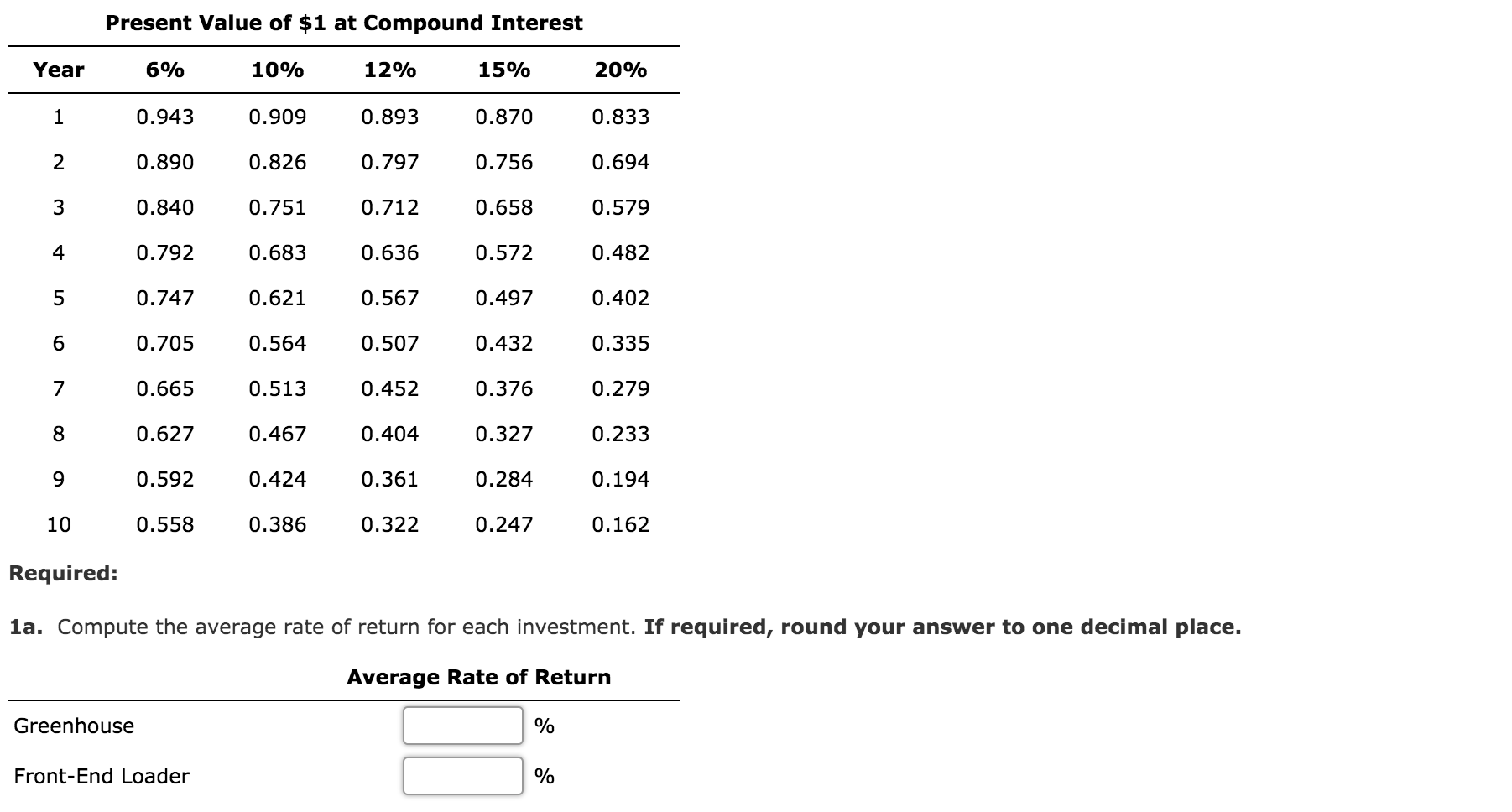

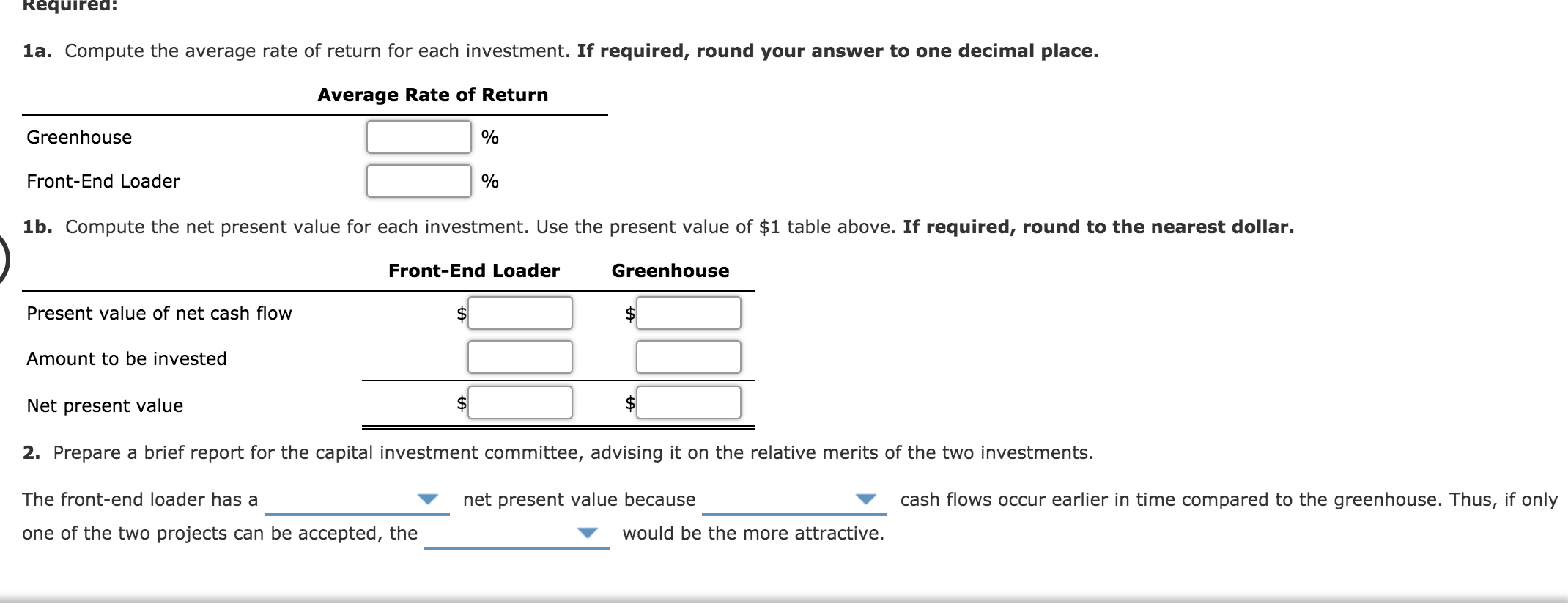

Average Rate of Return Method, Net Present Value Method, and Analysis for a Service Company The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Greenhouse Front-End Loader Operating Net Cash Income Flow Operating Income Net Cash Flow Year $25,000 $11,250 $ 26,250 $ 40,000 35,000 20,000 7,000 22,000 11,250 11,250 11,250 26,250 26,250 26,250 3,000 18,000 1,250 16,250 11,250 26,250 $131,250 Total $56,250 $131,250 $56,250 Each project requires an investment of $75,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis. Year 1 2 3 4 Present Value of $1 at Compound Interest 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0 .840 0.751 0.712 0.658 0.579 0.792 0.683 0.6360.572 0.482 Present Value of $1 at Compound Interest 6% 10% 12% 15% 20% Year 0.943 0.909 0.893 0.833 0.870 0.756 0.890 0.826 0.797 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1a. Compute the average rate of return for each investment. If required, round your answer to one decimal place. Average Rate of Return Greenhouse Front-End Loader Required: 1a. Compute the average rate of return for each investment. If required, round your answer to one decimal place. Average Rate of Return Greenhouse Front-End Loader 1b. Compute the net present value for each investment. Use the present value of $1 table above. If required, round to the nearest dollar. Front-End Loader Greenhouse Present value of net cash flow $ Amount to be invested Net present value 2. Prepare a brief report for the capital investment committee, advising it on the relative merits of the two investments. The front-end loader has a net present value because cash flows occur earlier in time compared to the greenhouse. Thus, if only one of the two projects can be accepted, the would be the more attractive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts