Question: Avery Ltd is considering investing in a project that will cost a total of $480,000 and run for 5 years. The project is expected to

Avery Ltd is considering investing in a project that will cost a total of $480,000 and run for 5 years. The project is expected to return $160,000 per annum and have annual costs of $30,000. At the end of the second year, a further $20,000 will need to be spent to keep the project up to date. The company's cost of capital is 8% and they require the project pays for itself in less than 4 years.

Should Avery Ltd proceed with the investment?

Would your answer differ if the cost of capital is 10%?

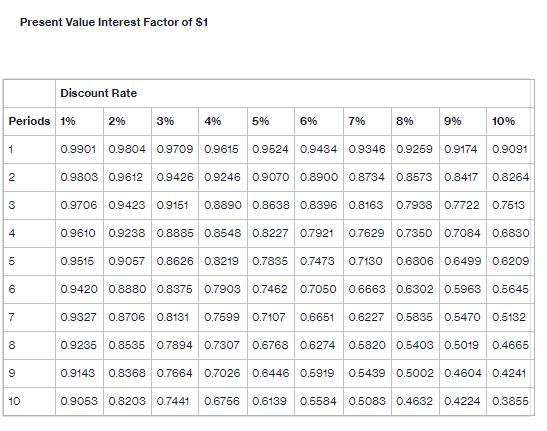

1 Periods 1% 2 3 4 01 5 6 7 00 8 Present Value Interest Factor of $1 9 Discount Rate 10 2% 3% 4% 5% 6% 7% 8% 9% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 10% 0.9091 0.8264 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855

Step by Step Solution

There are 3 Steps involved in it

To determine whether Avery Ltd should proceed with the investment we need to calculate the Net Prese... View full answer

Get step-by-step solutions from verified subject matter experts