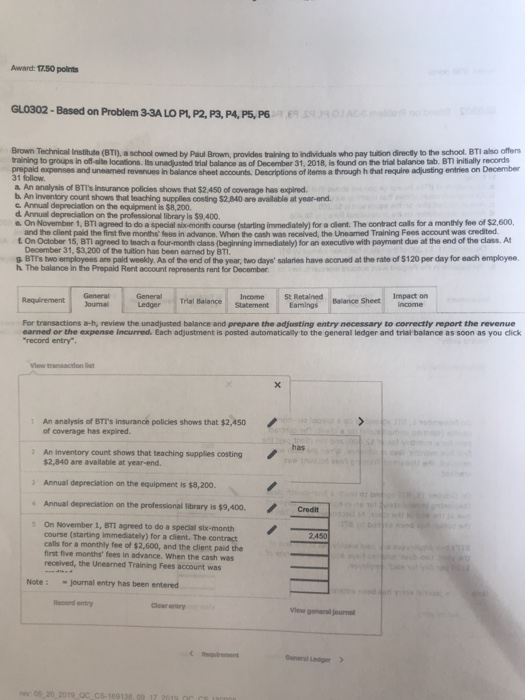

Question: Award: 17:50 points GL0302-Based on Problem 3-3A LO PL, P2, P3, P4, P5, P6 Brown Technical Institute (BT), a school owned by Paul Brown provides

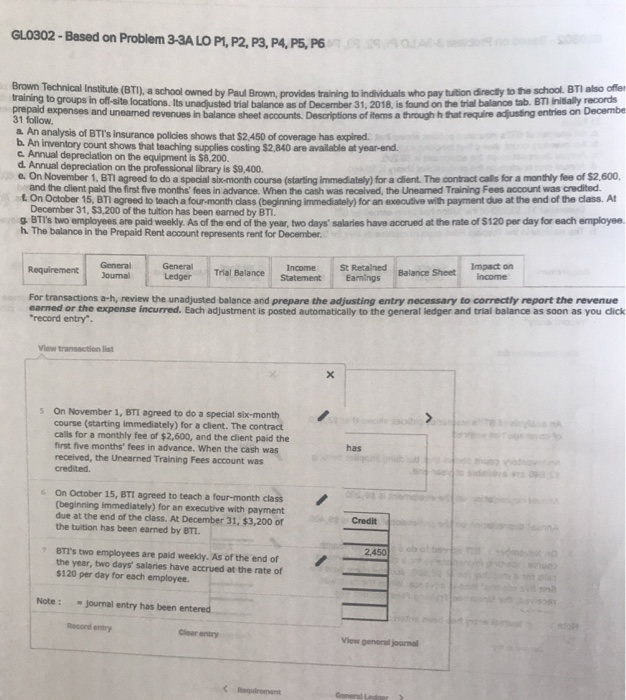

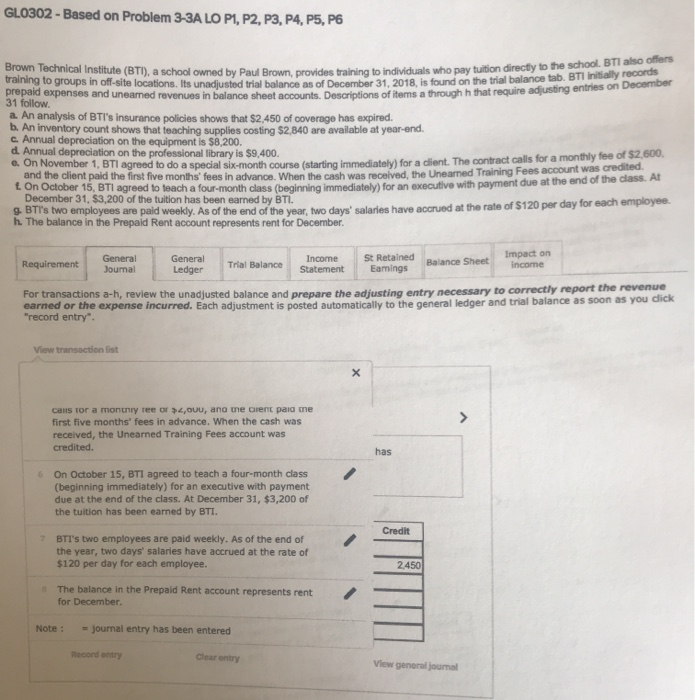

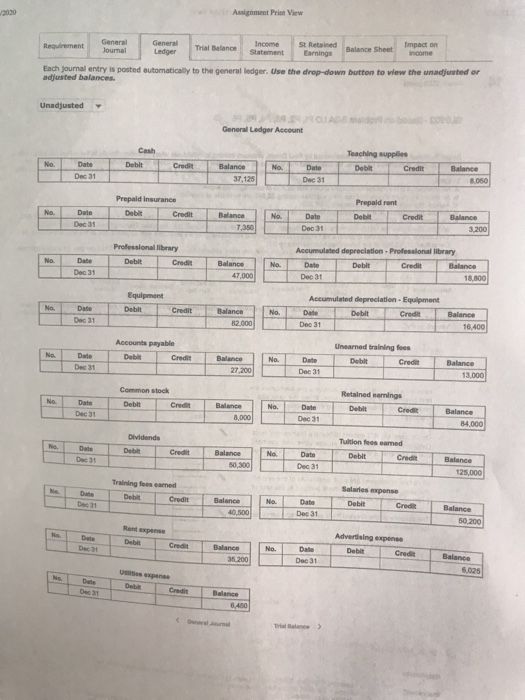

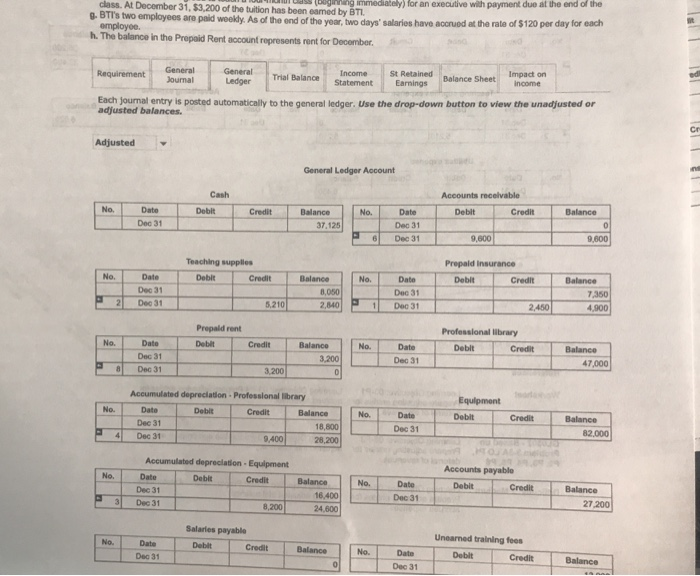

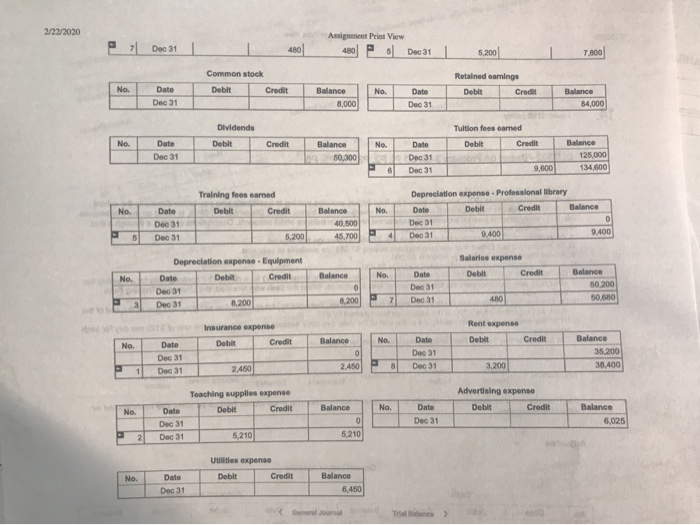

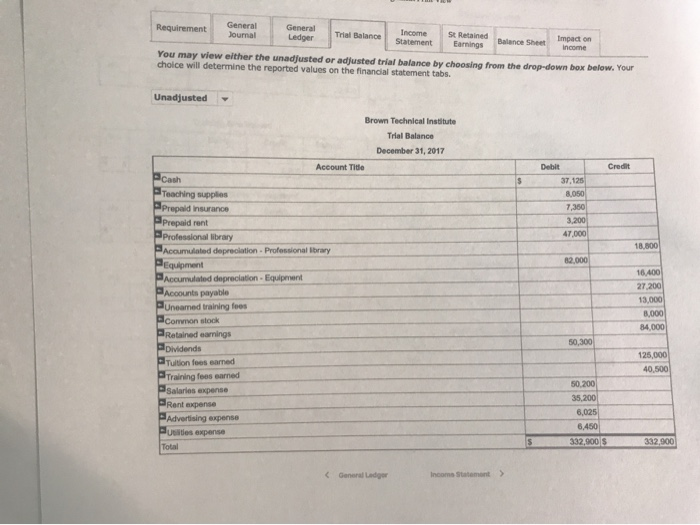

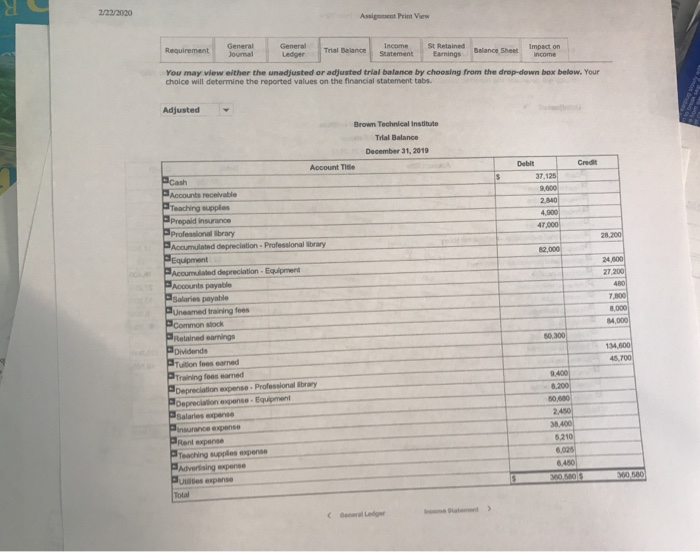

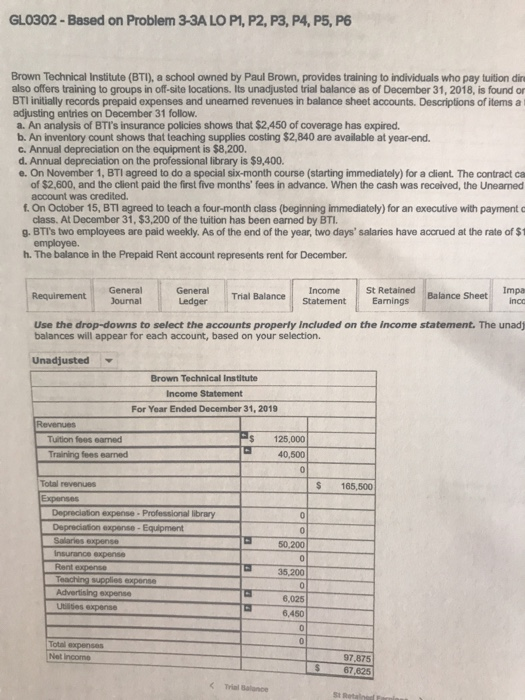

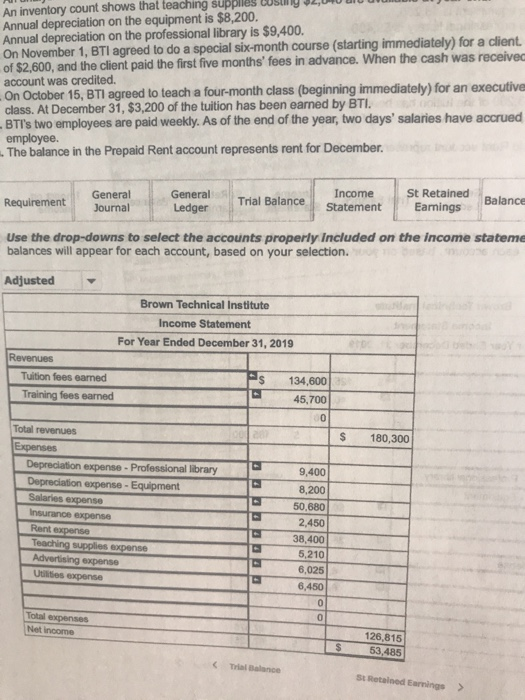

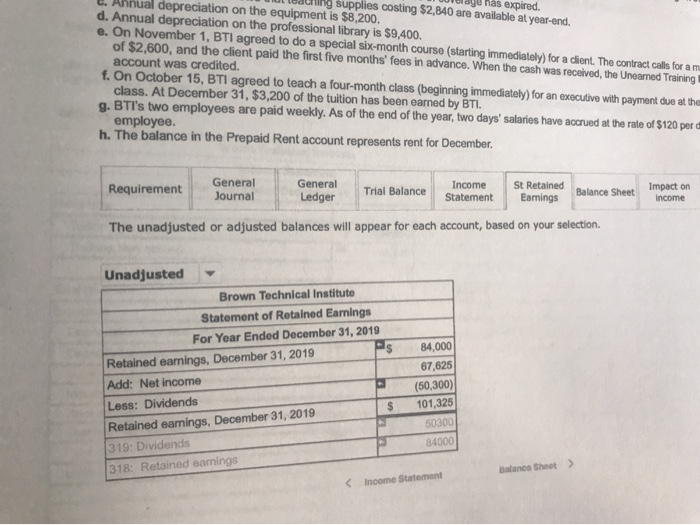

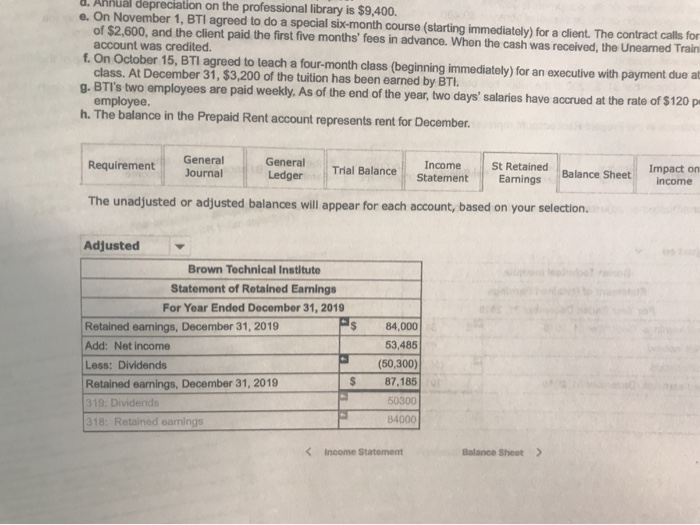

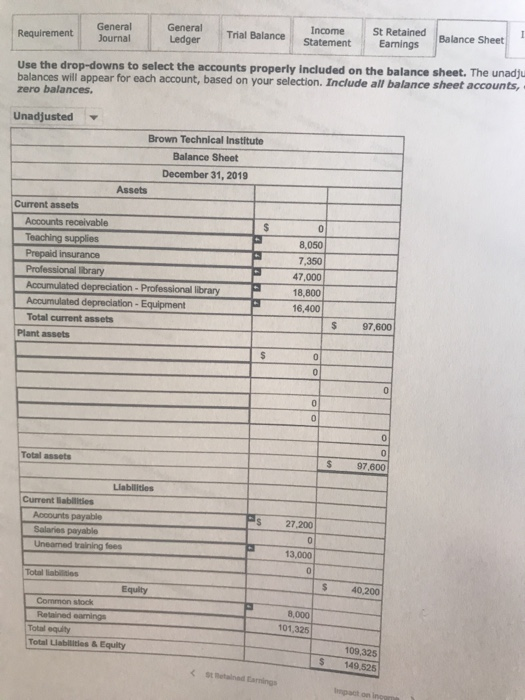

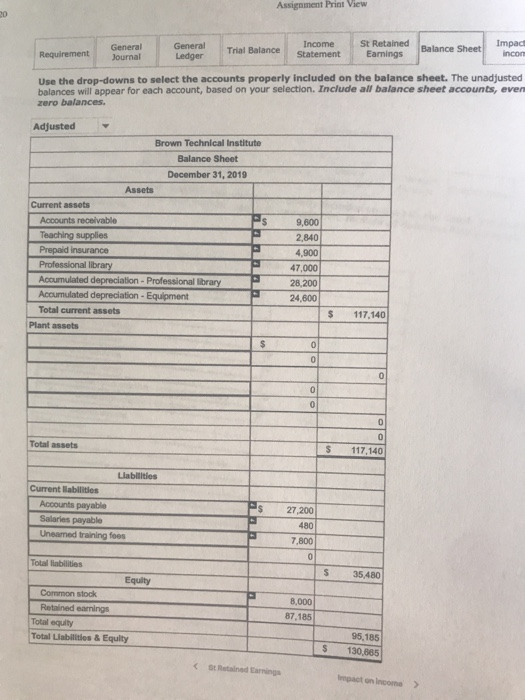

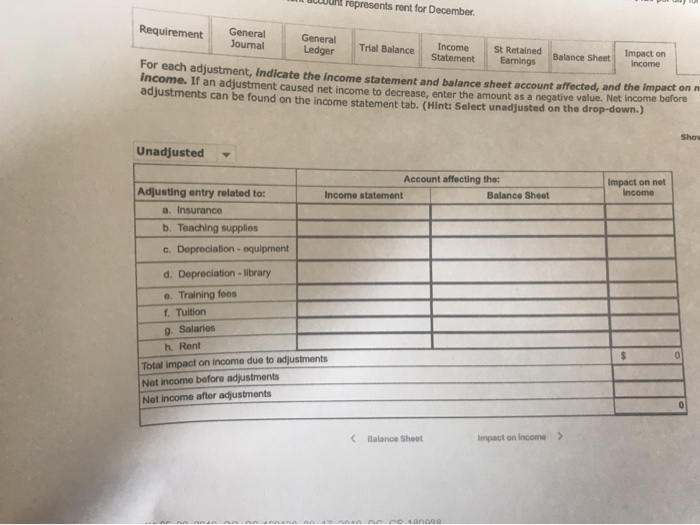

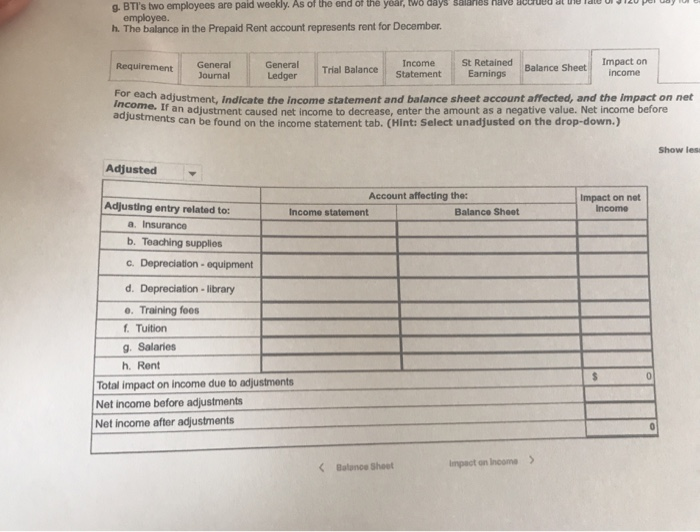

Award: 17:50 points GL0302-Based on Problem 3-3A LO PL, P2, P3, P4, P5, P6 Brown Technical Institute (BT), a school owned by Paul Brown provides aing to individuals who pay tuition directly to the school. BTI offers training to groups in oc casions 31 2018 stund on the balance tab Tiny records prepard expenses and named ones in balance sheet account Descriptions of them a through that require adjusting en on December 31 low An analysis of insurance policies shows that $2 450 of coverage has expired b. An inventory count shows that eaching supplies conting 32.800 are available at year and Annual depreciation on the equipments S200 A depreciation on the professional library is $9.400 On November 1, BTI agreed to do a specialix-month course starting immediate for a dent. The contract calls for a monthly fee of $2.600 and the client paid the first five months in advance. When the cash was received the Uneamed Training Fees account was credited On October 15, BT agreed to teach a four month class beginning immediate for an executive with payment due at the end of the class. At December 31, $3,200 of the tuition has been warned by BTI BTrstwo employees are paid weekly. As of the end of the year two days salaries have accrued at the rate of $120 per day for each employee h The balance in the Prepaid Rent account represents rent for December Requirement General Jounal General Trial Balance Ledger Income Statement Statement St Retained Earings Barance Sheet Impact on income For transactions , review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. Each adjustment is posted automatically to the general ledger and trial balance as soon as you click "record entry". Veron 1 An analysis of BTT's Insurance policies shows that $2,450 of coverage has expired. An inventory count shows that teaching supplies costing $2.340 are available at year-end. Annual depreciation on the equipment is $8,200. Annual depreciation on the professional library is $9.400. c On November BTT agreed to do a special month e (starting med for a dent. The contract for a monthly fee of $2.500, and the dient paid the tivement fees in advance. When the cash received, the reared Tr e escount was Nott u al entry has been entered GLO302 - Based on Problem 3-3A LO P1, P2, P3, P4, P5, P6 un Technical Institute (BTI), a school owned by Paul Brown Pros of December 31, 201 ainsmut (BT), a school owned by Paul Brown provides a n d who avuton directly to the school. BTI to one wang to groups in on-site locations. Its unedusted in balance December 2015 is found on the balance tab. BTI initially record prepaid expenses and unenmed revenues in bala Poses and uncomod revenues in balance sheet accounts. Descriptions of tens a though that require adjusting entries on Decembe 31 follow a. An analysis of BTI's Insurance policies shows that $2.450 of coverage has expired. b. An inventory count shows that teaching supplies costing $2.840 are available at year-end. Annual depreciation on the equipment is $8,200. d. Annual depreciation on the professional library is $0,400 On November 1, BTI agreed to do a special six- month course starting immediately for a dient. The contract calls for a monthly fee of $2.600 and the client paid the first five months' fas in advance When the cash was received the Uneamed Training Fees account was credited On October 15, BTI agreed to inach a four month class heining immediate for an a ctive with payment due at the end of the dass. Al December 31, $3.200 of the tuition has been earned by BTI. T's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $120 per day for each employee The balance in the Prepaid Rent account represents rent for December Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on income For transactions a-, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue carned or the expense incurred. Each adjustment is posted automatically to the general ledger and trial balance as soon as you click "record entry". View transaction list 5 On November 1, BTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $2,600, and the dient paid the first five months' fees in advance. When the cash was received, the Unearned Training Fees account was credited On October 15, BTT agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $3,200 of the tuition has been earned by BTL Credit 2450 BTI's two employees are paid weekdy. As of the end of the year, two days salaries have accrued at the rate of $120 per day for each employee Note: - Journal entry has been entered GL0302 - Based on Problem 3-3A LO P1, P2, P3, P4, P5, P6 dividuals who pay tuition directly to the school. BTI also offers ociation on the profession pedal six-monne. When Brown Technical Institute (BT) a school owned by Paul Brown provides training to individuals who pay tuition direcey BTI initially records training to groups in off-site locations. Its unadjusted trial balance as ps on-site locations. Its unndiusted trial balances of December 31 2018 is found on the trial balance tab. BTI initially room December prepaid expenses and uneared revenues in balance sheet account that require ad usting entries on December 31 follow. 08 and unearned revenues in balance shent accounts Description offers through a. An analysis of BTI's insurance policies shows that $2.450 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,840 are available at year-end. c. Annual depreciation on the equipment is $8,200. d. Annual depreciation on the professional library is $9,400. on November 1, BTI agreed to do a special six-month course starting immediately for a client. The contract calls for a monthly fee of 2.000 and the client paid the first five months' fees in advance when the cash was calved the Unearned Training Fees account was created On October 15, BTI agreed to teach a four-month class (heanning Immediately for an executive with payment due at the end of the class. A December 31, $3,200 of the tuition has been earned by BTI. 9. Bir two employees are paid weekly. As of the end of the year two days' salaries have acound at the rate of $120 per day for each empoyo h. The balance in the Prepaid Rent account represents rent for December. General Journal Requirement General Ledger Income Statement Trial Balance St Retained Eamings Impact on income Balance Sheet For transactions a-h, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. Each adjustment is posted automatically to the general ledger and trial balance as soon as you click "record entry". View transaction fist Cans Tor a monthly ree or 4,00U, ana me cient paid the first five months' fees in advance. When the cash was received, the Unearned Training Fees account was credited. On October 15, BTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $3,200 of the tuition has been earned by BTI. Credit 7BTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $120 per day for each employee. The balance in the Prepaid Rent account represents rent for December Note : = journal entry has been entered Record entry Clear entry View general journal Assignment Print View Requirement General Journal General Ledger Trial Balance Income m ent St Retained Camings ed h Sheet e impact on Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted or adjusted balances Unadjusted General Ledger Account Cash Debit No Credit Date Dec 31 Teaching supplies Debit Balance 37, 125 Credit Balance Dec 31 Prepaid insurance Debt Credit Prepaid rent Date Dec 31 Date Debat Credit Dec 31 1 3200 Professional library Accumulated depreciation - Professional library Date Debit Credit Balance Dec 31 18,800 Equipment Accumulated depreciation Equipment Date Debit Credit Dec 31 Balance 16.400 Accounts payable Debat Credit Date Dec 31 Unearned training fees Debit Crede Date 1 Balance 27,200 Dec 31 Balance 13.000 Common stock Retained earnings Debit Cred Date Dec 31 Balance 34.000 Dividends No Tuition fees samed Debit Credit Date Balance 125.000 Dute Dec 31 Training Debat seamed Credit Balance 40,500 Salaries expense Debit Cred Dato Dec 31 50 200 Rent expense Advertising expense Dec 31 No. Date Dec 31 Debit 6.450 class. At December 31, $3,200 of the tuition has been camed by BTL s s (begin immediately for an executive with payment due at the end of the g. Ti's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $120 per day for each employee h. The balance in the Prepaid Rent account represents rent for December Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted or adjusted balances Adjusted General Ledger Account Cash Debit Accounts receivable Debit Credit Credit Balance Dec 31 Balance 37,125 Date Dec 31 Dec 31 9,000 9,600 Teaching supplies Debit Credit Prepaid Insurance Balance Debit Credit Date Dec 31 Dec 31 Date Dec 31 Balance 7,350 4,900 5.210 2,840 Dec 31 2,450 Prepaid rent Professional library Debit Credit Debit Credit Balance Dato Dec 31 Dec 31 Date Dec 31 Balance 47,000 3 200 Equipment Accumulated depreciation. Professional library Date Debit Credit Balance Dec 31 Dec 31 9,400 28,200 Date Debit Balance 82.000 Dec 31 4 Accumulated depreciation Equipment Date | Debit Credit Dec 31 Dec 31 8,200 Accounts payable Debit Credit Date Balance Balance 16.400 24.600 27.200 Salaries payable Unearned training fees Dec 31 2/22/2020 - 7 Dec 31 1 480 Assignment Print View 480 5 Dec 31 5,200 7.800 Common stock Debit Credit Retained earnings Debit Credit No. Date Dec 31 Balance 8,000 Date Dec 31 Balance 84,000 Dividends Debit Tuition fees eamed Debit Credit Date Credit No. Dec 31 Balance 12 50,300 Dato Dec 31 Dec 31 Balance 125.000 134,600 6 9,600 Training fees earned Credit Debit wate Dec 31 Dec 31 Balance 40.500 45.700 Depreciation expense. Professional library Date Debit Credit Balance Dec 31 Dec 31 1 9.400 9.400 5,200 Depreciation expense. Equipment Salaries expense Date Credit Balance Debit Credit Date Dec 31 Dec 31 Balance 50.200 Dec 31 Dec 31 - 7 50 60 8,200 1 insurance expense Debit Credit Rent expense Debit No. Balance Date Credit Date Dec 31 Dec 31 Balance 35,200 38.400 Dec 31 Dec 31 2.450 - 3,200 Teaching supplies expense Advertising expense Debit Credit Date Debit Credit Date Balance 6.025 Dec 31 Dec 31 Dec 31 5,210 Utilities expense Debit Credit Balance Date Dec 31 8.450 General Requirement General Income Trial Balance St Retained Journal Impact on Ledger Statement Earnings Balance Sheet You may view either the unadjusted or adjusted trial balance by choosing from the drop-down box below. Your choice will determine the reported values on the financial statement tabs. Unadjusted - Brown Technical Institute Trial Balance December 31, 2017 Account Title Credit Pcash Debit 37,125 8.050 7.350 3.200 47.000 Teaching supplies Prepaid insurance Prepaid rent Professional library Accumulated depreciation - Professional ibrary PEquipment Accumulated depreciation - Equipment Accounts payablo Uneamed training fees Coron stock Retained earnings Dividends Tuition fees earned Training fees earned Salaries expense Rent expense Advertising expense usties expense Total 16.400 27200 13,000 8,000 84 000 125,000 40.500 50.200 35 200 6,025 6,450 332,900 $ 2/23/2020 Asset Print View General Journal General Requirement Trial Balance Income St Retained Earnings Balance Sheet Impact on Income You may vieweither the unadjusted or adjusted trial balance by choosing from the drop-down box below. Your choice will determine the reported values on the financial statement tabs. Adjusted Brown Technical Institute Trial Balance December 31, 2019 37,125 9,000 2. 80 4,900 Account Tide -Cash Accounts receivable Teaching supplies Prepaid insurance Professional library Accumulated depreciation - Professional library Pequipment Accumulated depreciation - Equipment Accounts payable salaries payable Uneamed training fees Common stock Ratained earnings Dividends Tuition fees earned Training fons earned Depreciation expense. Professionalsbrary Depreciation expense. Equipment salaries expense insurance expense Rent expense Teaching supplies expense Advertising expense Pues expense Total 14.60 50,60 2.450 38.400 5.210 6,025 8.450 0505 Ledger GL0302 - Based on Problem 3-3A LO P1, P2, P3, P4, P5, P6 uneamed re h An analysis of Tecember 31 follow Brown Technical Institute (BTI), a school owned by Paul Brown, provides training to individuals who pay tuition dir also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2018, is found or BTI initially records prepaid expenses and uneamed revenues in balance sheet accounts. Descriptions of items a adjusting entries on December 31 follow. a. An analysis of BTI's insurance policies shows that $2.450 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,840 are available at year-end. c. Annual depreciation on the equipment is $8,200. d. Annual depreciation on the professional library is $9,400. e. On November 1, BTI agreed to do a special six-month course (starting immediately) for a client. The contract of $2,600, and the client paid the first five months' fees in advance. When the cash was received, the Unearned account was credited. 1. On October 15, BTI agreed to teach a four-month class (beginning immediately) for an executive with payment class. At December 31, $3,200 of the tuition has been earned by BTI. 9. BTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $1 employee. h. The balance in the Prepaid Rent account represents rent for December General Journal Requirement General Ledger Income Statement Trial Balance St Retained Earnings Impa Balance Sheet Inca Use the drop-downs to select the accounts properly included on the income statement. The unady balances will appear for each account, based on your selection. Unadjusted - Brown Technical Institute Income Statement For Year Ended December 31, 2019 Revenues Tuition fees eamed Ps 125,000 Training fees earned 40.500 0 Total revenues Expenses Depreciation expense - Professional library Depreciation expense - Equipment Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utos expense 50.200 35,200 6.025 6,450 Total expenses Not Income 97.875 67.825 TH Site An inventory count shows that teaching supplies Custy 2,UNU UU UUUUU Annual depreciation on the equipment is $8,200. Annual depreciation on the professional library is $9,400. On November 1, BTI agreed to do a special six-month course (starting immediately) for a client. of $2,600, and the client paid the first five months' fees in advance. When the cash was received account was credited On October 15, BTI agreed to teach a four-month class (beginning immediately) for an executive class. At December 31, $3,200 of the tuition has been earned by BTI. -BTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued employee. ..The balance in the Prepaid Rent account represents rent for December. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Use the drop-downs to select the accounts properly included on the income stateme balances will appear for each account, based on your selection. Adjusted Brown Technical Institute Income Statement For Year Ended December 31, 2019 Revenues Tuition fees earned Training fees earned 134,600 45,700 180,300 Total revenues Expenses Depreciation expense - Professional library Depreciation expense - Equipment Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utes expense 9,400 8,200 50,680 2,450 38,400 5,210 6,025 6,450 Total expenses Net Income 126,815 53,485 Trial Bence St Retained Earnings > Il louring Supplies costing $2,840 are available at year-end. clage has expired. L. Annual depreciation on the equipment is $8,200. d. Annual depreciation on the professional library is $9,400. e. On November 1, BTI agreed to do a special six-month course (starting immediately) for a client. The contract calls foram of $2,600, and the client paid the first five months' fees in advance. When the cash was received, the Uneamed Training account was credited. f. On October 15, BTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the class. At December 31, $3,200 of the tuition has been earned by BTI. g. BTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $120 per employee. h. The balance in the Prepaid Rent account represents rent for December Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earings Balance Sheet Impact on Income The unadjusted or adjusted balances will appear for each account, based on your selection. Unadjusted Brown Technical Institute Statement of Retained Earnings For Year Ended December 31, 2019 $ 84,000 Retained earnings, December 31, 2019 67,625 Add: Net income (50,300) Less: Dividends 101,325 Retained eamings, December 31, 2019 50300 319: Dividends 84000 318: Retained earings Income Statement Balance Sheet > 3. Annual depreciation on the professional library is $9.400. e. On November 1, BTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for of $2,600, and the client paid the first five months' fees in advance. When the cash was received, the Unearned Train account was credited. f. On October 15, BTI agreed to teach a four-month class (beginning immediately) for an executive with payment due al class. At December 31, $3,200 of the tuition has been earned by BTI. g. BTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $120 p employee. h. The balance in the Prepaid Rent account represents rent for December. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earings Balance Sheet Impact on Income The unadjusted or adjusted balances will appear for each account, based on your selection. Adjusted Brown Technical Institute Statement of Retained Earnings For Year Ended December 31, 2019 Retained earings, December 31, 2019 Add: Net income Less: Dividends Retained earnings, December 31, 2019 319: Dividends 318: Retained earnings 84,000 53,485 (50,300) 87,185 50300 84000 Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Use the drop-downs to select the accounts properly included on the balance sheet. The unadjs balances will appear for each account, based on your selection. Include all balance sheet accounts, zero balances. Unadjusted Brown Technical Institute Balance Sheet December 31, 2019 Assets Current assets Accounts receivable Teaching supplies Prepaid insurance Professional library Accumulated depreciation - Professional library Accumulated depreciation - Equipment Total current assets 8.050 7.350 47.000 18.800 16,400 Plant assets Total assets Llabute Current liabilities Accounts payable Solares payable Uneamed training fees Total abis 40.200 Common stock Retained wings 3.000 101.325 Total equity Total Liables & Equity 109325 Assignment Print View General Journal General Ledger Income Statement Requirement Trial Balance St Retained Earnings Impact incon Balance Sheet Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted balances will appear for each account, based on your selection. Include all balance sheet accounts, even zero balances. Adjusted Brown Technical Institute Balance Sheet December 31, 2019 Assets Current assets Accounts receivable s Teaching supplies Prepaid insurance Professional library - Accumulated depreciation - Professional library Accumulated depreciation - Equipment Total current assets Plant assets 9.600 2,840 4,900 47,000 28,200 24,600 $ 117.140 10 Total assets Llabilitie Current abilities Accounts payable Salorios payable Uneamed training foes 27 200 7.800 Total liabilities $ Equity 35,480 Common stock Retained earnings Total equity Total Liabilities & Equity 87.185 95,185 130,685 Standa mpact on income> I wont represents rent for December Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income For each adjustment, indicate the Income statement and balance sheet account affected, and the impact on Income. If an adjustment caused net income to decrease enter the amount as a negative value. Net Income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Shou Unadjusted Account affecting the: Income statement Balance Sheet Impact on net incomo Adjusting entry related to: a. Insurance b. Teaching supplies c. Depreciation - equipment d. Depreciation - library 0. Training foos f. Tuition g. Salaries h. Rent Total impact on income due to adjustments Not income before adjustments Not income after adjustments Balance Sheet Impact on Income > OS have JUUUU LUO TAU UI ILU PUI g. BTI's two employees are paid weekly. As of the end of the year, two days S employee. h. The balance in the Propaid Rent account represents rent for December Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on income ich adjustment, indicate the income statement and balance sheet account affected, and the impact on net ar an adjustment caused net income to decrease, enter the amount as a negative value. Net Income before ents can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Show les Adjusted Account affecting the Income statement Balance Sheet Impact on net Income Adjusting entry related to: a. Insurance b. Teaching supplies c. Depreciation equipment d. Depreciation - library o. Training foos Tuition g. Salaries h. Rent Total impact on income due to adjustments Net Income before adjustments Net income after adjustments Impact on Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts