Question: Axel and Big Tiny are both involved in operating illegal businesses. Axel operates an illegal poker business and Big Tiny operates a medical marijuana facility

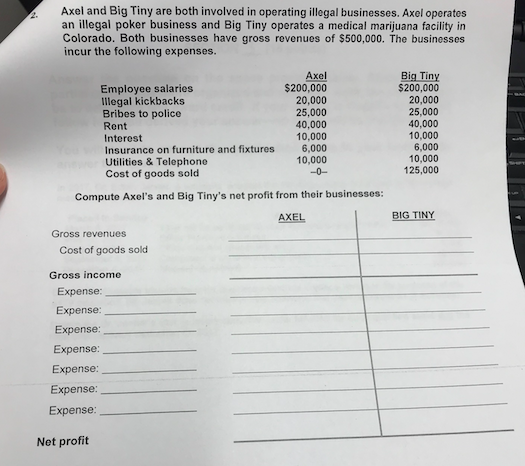

Axel and Big Tiny are both involved in operating illegal businesses. Axel operates an illegal poker business and Big Tiny operates a medical marijuana facility in Colorado. Both businesses have gross revenues of $500,000. The businesses incur the following expenses. Employee salaries Illegal kickbacks Bribes to police Rent Interest Insurance on furniture and fixtures Utilities & Telephone Cost of goods sold Axel $200,000 20,000 25,000 40,000 10,000 6,000 $200,000 20,000 25,000 40,000 10,000 6,000 10,000 125,000 Compute Axel's and Big Tiny's net profit from their businesses: AXEL BIG TINY Gross revenues Cost of goods sold Gross income Expense: Expense Expense: Expense: Expense Expense: Expense Net profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts