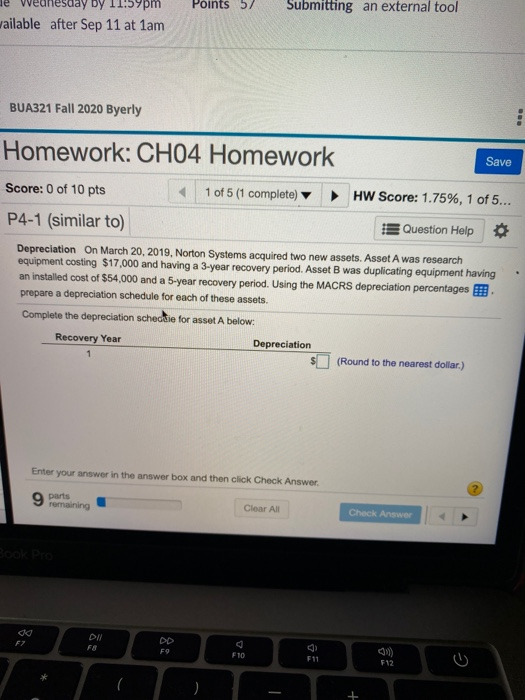

Question: ay by 11:5 Points 57 Submitting an external tool wailable after Sep 11 at 1am BUA321 Fall 2020 Byerly Homework: CH04 Homework Save Score: 0

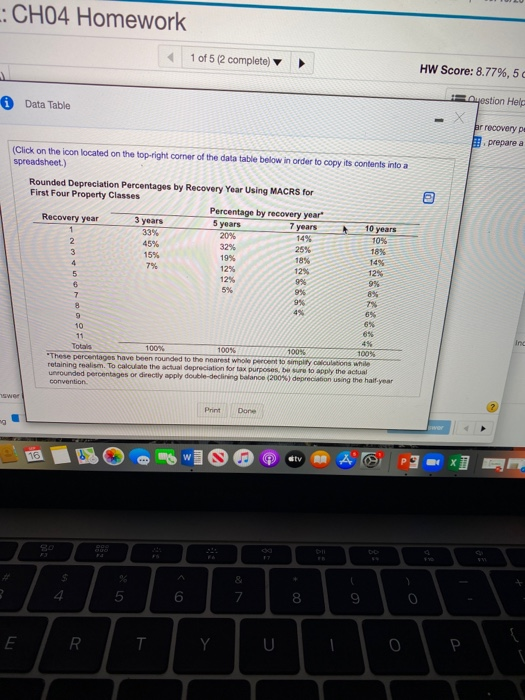

ay by 11:5 Points 57 Submitting an external tool wailable after Sep 11 at 1am BUA321 Fall 2020 Byerly Homework: CH04 Homework Save Score: 0 of 10 pts 1 of 5 (1 complete) HW Score: 1.75%, 1 of 5... P4-1 (similar to) Question Help Depreciation On March 20, 2019, Norton Systems acquired two new assets. Asset A was research equipment costing $17,000 and having a 3-year recovery period. Asset B was duplicating equipment having an installed cost of $54.000 and a 5-year recovery period. Using the MACRS depreciation percentages prepare a depreciation schedule for each of these assets. Complete the depreciation scheditie for asset A below: Recovery Year Depreciation (Round to the nearest dollar.) 1 Enter your answer in the answer box and then click Check Answer 2 9 parts remaining Clear All Check Answer DI E F9 F10 F11 F12 -: CH04 Homework 1 of 5 (2 complete) HW Score: 8.77%, 50 0 Data Table Roystion Held ar recovery pe prepare a 19% (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 10 years 33% 20% 2 14% 10% 45% 32% 25% 3 15% 18% 18% 4 7% 12% 12% 5 12% 12% 9% 9% 6 5% 9% 8% 9% 8 29 4% 9 6% 6% 10 6% 11 4% Totals 100% 100% 100% "These percentages have been rounded to the nearest whole pronto simply calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual urrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 7 Inc 100% Print Done 18 tv $ & ) 4 5 8 9 E R. T Y U 0 P ay by 11:5 Points 57 Submitting an external tool wailable after Sep 11 at 1am BUA321 Fall 2020 Byerly Homework: CH04 Homework Save Score: 0 of 10 pts 1 of 5 (1 complete) HW Score: 1.75%, 1 of 5... P4-1 (similar to) Question Help Depreciation On March 20, 2019, Norton Systems acquired two new assets. Asset A was research equipment costing $17,000 and having a 3-year recovery period. Asset B was duplicating equipment having an installed cost of $54.000 and a 5-year recovery period. Using the MACRS depreciation percentages prepare a depreciation schedule for each of these assets. Complete the depreciation scheditie for asset A below: Recovery Year Depreciation (Round to the nearest dollar.) 1 Enter your answer in the answer box and then click Check Answer 2 9 parts remaining Clear All Check Answer DI E F9 F10 F11 F12 -: CH04 Homework 1 of 5 (2 complete) HW Score: 8.77%, 50 0 Data Table Roystion Held ar recovery pe prepare a 19% (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 10 years 33% 20% 2 14% 10% 45% 32% 25% 3 15% 18% 18% 4 7% 12% 12% 5 12% 12% 9% 9% 6 5% 9% 8% 9% 8 29 4% 9 6% 6% 10 6% 11 4% Totals 100% 100% 100% "These percentages have been rounded to the nearest whole pronto simply calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual urrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 7 Inc 100% Print Done 18 tv $ & ) 4 5 8 9 E R. T Y U 0 P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts