Question: ay in Protected View Enable Editing 2 Ejercicios de prctica 1. Correction of consolidated net income Pop Corporation paid $1,800,000 for a 90 percent interest

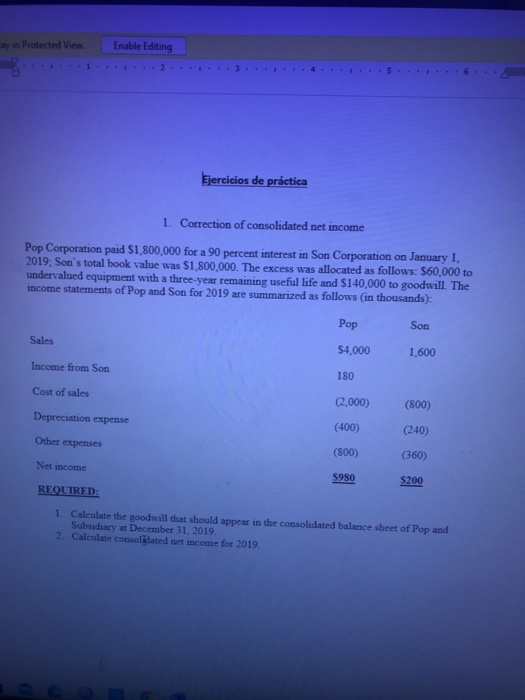

ay in Protected View Enable Editing 2 Ejercicios de prctica 1. Correction of consolidated net income Pop Corporation paid $1,800,000 for a 90 percent interest in Son Corporation on January 1, 2019; Son's total book value was $1,800,000. The excess was allocated as follows: 560,000 to undervalued equipment with a three-year remaining useful life and $140,000 to goodwill. The income statements of Pop and Son for 2019 are summarized as follows (in thousands): Pop Son Sales $4.000 1,600 Income from Son 180 Cost of sales (2.000) (800) Depreciation expense (400) (240) Other expenses (800) (360) Net income S980 $200 REQUIRED: 1. Calculate the goodwill that should appear in the consolidated balance sheet of Pop and Subsidiary at December 31, 2019 2. Calculate consolidated net income for 2019, ay in Protected View Enable Editing 2 Ejercicios de prctica 1. Correction of consolidated net income Pop Corporation paid $1,800,000 for a 90 percent interest in Son Corporation on January 1, 2019; Son's total book value was $1,800,000. The excess was allocated as follows: 560,000 to undervalued equipment with a three-year remaining useful life and $140,000 to goodwill. The income statements of Pop and Son for 2019 are summarized as follows (in thousands): Pop Son Sales $4.000 1,600 Income from Son 180 Cost of sales (2.000) (800) Depreciation expense (400) (240) Other expenses (800) (360) Net income S980 $200 REQUIRED: 1. Calculate the goodwill that should appear in the consolidated balance sheet of Pop and Subsidiary at December 31, 2019 2. Calculate consolidated net income for 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts