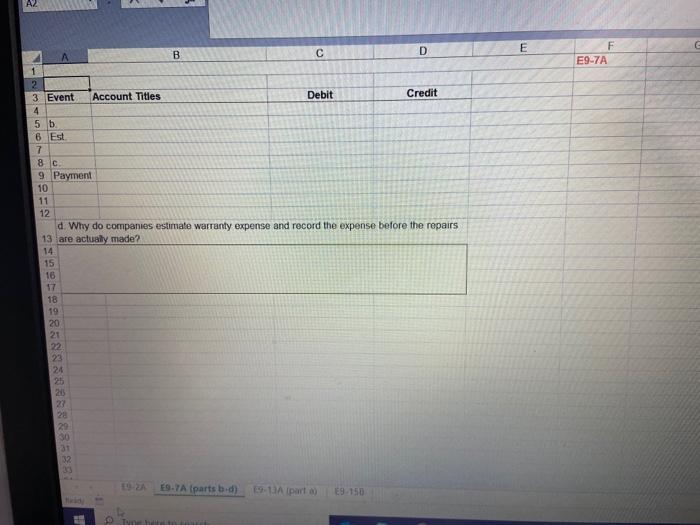

Question: AZ E B D F E9-7A 2 3 Event Account Titles Debit Credit 4 5 b 6 Est 7 8c 9 Payment 10 11 12

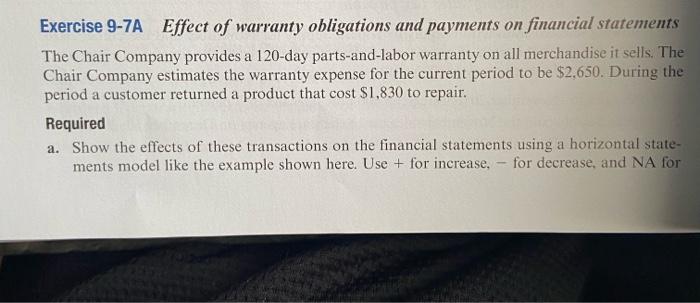

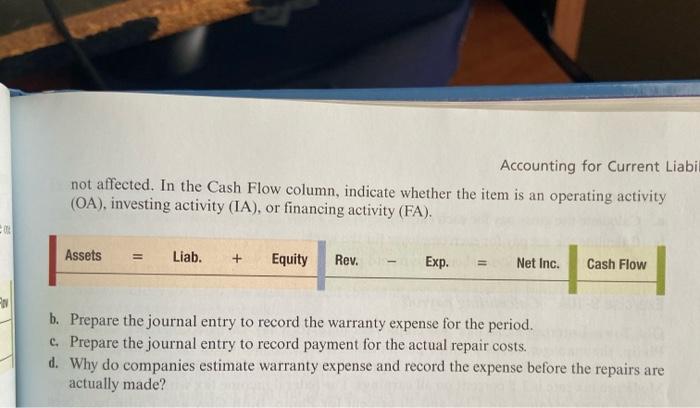

AZ E B D F E9-7A 2 3 Event Account Titles Debit Credit 4 5 b 6 Est 7 8c 9 Payment 10 11 12 d. Why do companies estimate warranty expense and record the expense before the repairs 13 are actually made? 14 15 16 18 19 20 21 22 23 24 215 27 29 32 ESTA parts bed) 19-A part That Exercise 9-7A Effect of warranty obligations and payments on financial statements The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $2.650. During the period a customer returned a product that cost $1.830 to repair. Required a. Show the effects of these transactions on the financial statements using a horizontal state- ments model like the example shown here. Use + for increase, for decrease, and NA for Accounting for Current Liabi not affected. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Assets Liab. + Equity Rev. Exp. Net Inc. Cash Flow b. Prepare the journal entry to record the warranty expense for the period. c. Prepare the journal entry to record payment for the actual repair costs. d. Why do companies estimate warranty expense and record the expense before the repairs are actually made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts