Question: B 00 D E F K 1 A G H 10 OER Homework Problems 2 1) Howard company paid salaries of $116,000. All of it

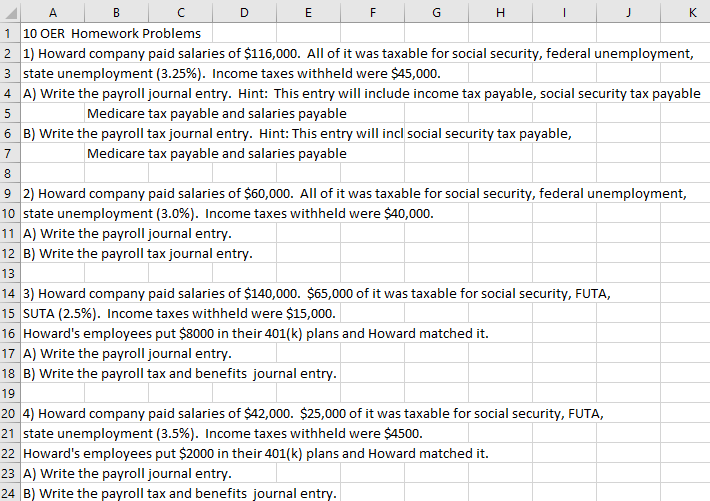

B 00 D E F K 1 A G H 10 OER Homework Problems 2 1) Howard company paid salaries of $116,000. All of it was taxable for social security, federal unemployment, 3 state unemployment (3.25%). Income taxes withheld were $45,000. 4 A) Write the payroll journal entry. Hint: This entry will include income tax payable, social security tax payable 5 Medicare tax payable and salaries payable 6 B) Write the payroll tax journal entry. Hint: This entry will incl social security tax payable, Medicare tax payable and salaries payable 7 8 92) Howard company paid salaries of $60,000. All of it was taxable for social security, federal unemployment, 10 state unemployment (3.0%). Income taxes withheld were $40,000. 11 A) Write the payroll journal entry. 12 B) Write the payroll tax journal entry. 13 14 3) Howard company paid salaries of $140,000. $65,000 of it was taxable for social security, FUTA, 15 SUTA (2.5%). Income taxes withheld were $15,000. 16 Howard's employees put $8000 in their 401(k) plans and Howard matched it. 17 A) Write the payroll journal entry. 18 B) Write the payroll tax and benefits journal entry. 19 20 4) Howard company paid salaries of $42,000. $25,000 of it was taxable for social security, FUTA, 21 state unemployment (3.5%). Income taxes withheld were $4500. 22 Howard's employees put $2000 in their 401(k) plans and Howard matched it. 23 A) Write the payroll journal entry. 24 B) Write the payroll tax and benefits journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts