Question: B 1 Format - Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 4 x fx =SUMIE 18:20) B c

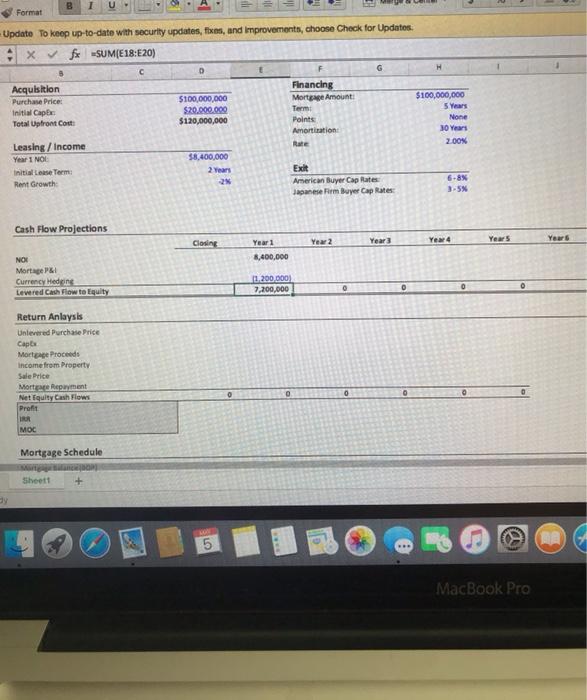

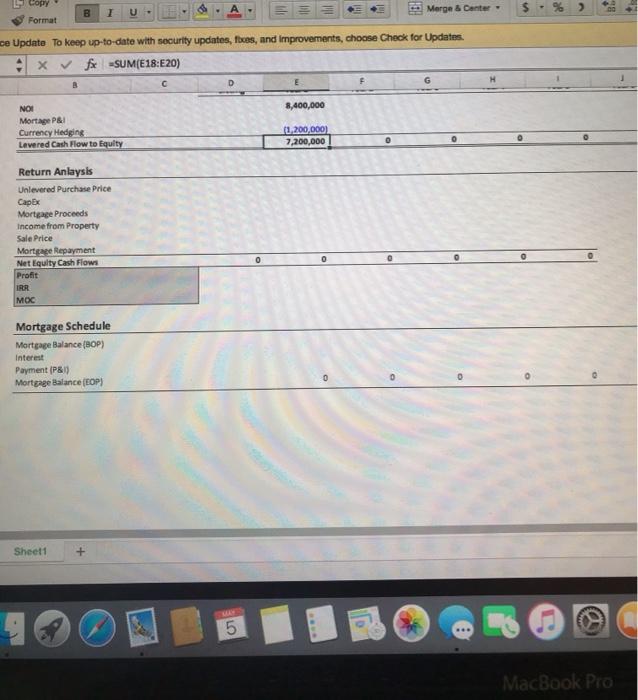

B 1 Format - Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 4 x fx =SUMIE 18:20) B c G H Acquisition Financing Purchase Price: $100,000,000 Mortgage Amount $100,000,000 Initi Cape $20.000.000 Term 5 Years Total Upfront Cost $120,000,000 Points None Amortization 30 Years Leasing/Income Rate 200N Year 1 NOE 38,400,000 Initial Lease Teem: 2 years Exit Rent Growth American Buyer Cap Rates 6.8% Japanese Buyer Cap Rates Cash Flow Projections Closin Year 2 Year Year 4 Years Year 1 8,400,000 NOR Mortage & Currency Hedeng Levered Cash Flow to Equity 1.200.000 7.200,000 Return Anlaysis Unlevered Purchase Price Cape Mortgage Proceeds income from Property Sale Price More Repayment Net faulty Cash Flows Profit IRR MOC O O 0 0 Mortgage Schedule Sheet + ay i 5 09 MacBook Pro B 1 U Merge & Center Format ce Update To keep up-to-date with security updates, foes, and improvements, choose Check for Updates -SUM(E18:E20) D NOI 8,400,000 Morte P&I Currency Hedging Levered Cash Flow to Equity 11,200,000) 7,200,000 0 Return Anlaysis Unlevered Purchase Price Capex Mortgage Proceeds Income from Property Sale Price Mortgage Repayment Net Equity Cash Flows Profit IRR MOC 0 0 Mortgage Schedule Mortgage Balance (BOP) Interest Payment (P&1) Mortgage Balance (EOP) Sheet1 5 MacBook Pro B 1 Format - Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 4 x fx =SUMIE 18:20) B c G H Acquisition Financing Purchase Price: $100,000,000 Mortgage Amount $100,000,000 Initi Cape $20.000.000 Term 5 Years Total Upfront Cost $120,000,000 Points None Amortization 30 Years Leasing/Income Rate 200N Year 1 NOE 38,400,000 Initial Lease Teem: 2 years Exit Rent Growth American Buyer Cap Rates 6.8% Japanese Buyer Cap Rates Cash Flow Projections Closin Year 2 Year Year 4 Years Year 1 8,400,000 NOR Mortage & Currency Hedeng Levered Cash Flow to Equity 1.200.000 7.200,000 Return Anlaysis Unlevered Purchase Price Cape Mortgage Proceeds income from Property Sale Price More Repayment Net faulty Cash Flows Profit IRR MOC O O 0 0 Mortgage Schedule Sheet + ay i 5 09 MacBook Pro B 1 U Merge & Center Format ce Update To keep up-to-date with security updates, foes, and improvements, choose Check for Updates -SUM(E18:E20) D NOI 8,400,000 Morte P&I Currency Hedging Levered Cash Flow to Equity 11,200,000) 7,200,000 0 Return Anlaysis Unlevered Purchase Price Capex Mortgage Proceeds Income from Property Sale Price Mortgage Repayment Net Equity Cash Flows Profit IRR MOC 0 0 Mortgage Schedule Mortgage Balance (BOP) Interest Payment (P&1) Mortgage Balance (EOP) Sheet1 5 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts