Question: b. 120 e 8.6 d 92 SES-10. Direct Write-ofr Method The direct write-off method is not generally accepted because: c. The method tails to match

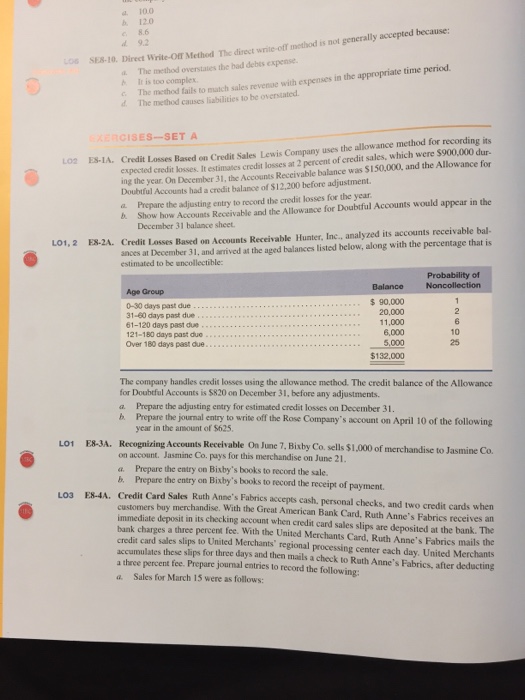

b. 120 e 8.6 d 92 SES-10. Direct Write-ofr Method The direct write-off method is not generally accepted because: c. The method tails to match sales revense with expenses in the appropriate time period d The method causes liabilities to he overstated a. The method overstates the bad debes expense. Ir is too complex Based on Credit Sales Lewis Company uses the allowance method for recording its for CISES-SET A LOZ ES-IA. Credit Losses expected credit losses. It estimates credit losses at 2 percent of credit sales, which were $900,000 dur- ing the year On Decembe Doubtful Accounts had a credit balance of $12,200 before adjustment. 31, the Accounts Receivable balance was $150.000, and the Allowance a. Prepare the adjusting entry to record the credit losses for the year & Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear in the December 31 balance sheet. ances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible LO1,2 E8-2A. Credit Losses Based on Accounts Receivable Hunter, Inc., analyzed its accounts receivable bal- Probability of Noncollection Balance Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 days past due.. Over 180 days past due $90.000 20,000 11,000 6,000 5,000 $132,000 10 25 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $820 on December 31, before any adjustments a. Prepare the adjusting entry for estimated credit losses on December 31. b Prepare the journal entry to write off the Rose Company's account on April 10 of the following year in the amount of $625 LO1 E&-3A. Recognizing Accounts Recelvable On June 7. Bixby Co. sells $1.000 of merchandise to Jasmine Co. Recei on account. Jasmine Co. pays for this merchandise on June 21. a. Prepare the entry on Bixby's books to record the sale. b. Prepare the entry on Bixby's books to record the receipt of payment LO3 ES-4A. Credit Card Sales Ruth Anne's Fabrics accepts cash. personal checks, and two credit cards when customers buy merchandise. With the Great American Bank Card, Ruth Anne's Fabrics receives an immediate deposit in its checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee. With the United Merchants Card, Ruth Anne's Fabrics mails the credit card sales slips to United Merchants' regional processing center each day. United Merchants accumulates these slips for three days and then mails a check to Ruth Anne's Fabrics, after deducting a three percent fee. Prepare journal entries to record the following: a. Sales for March 15 were as follows b. 120 e 8.6 d 92 SES-10. Direct Write-ofr Method The direct write-off method is not generally accepted because: c. The method tails to match sales revense with expenses in the appropriate time period d The method causes liabilities to he overstated a. The method overstates the bad debes expense. Ir is too complex Based on Credit Sales Lewis Company uses the allowance method for recording its for CISES-SET A LOZ ES-IA. Credit Losses expected credit losses. It estimates credit losses at 2 percent of credit sales, which were $900,000 dur- ing the year On Decembe Doubtful Accounts had a credit balance of $12,200 before adjustment. 31, the Accounts Receivable balance was $150.000, and the Allowance a. Prepare the adjusting entry to record the credit losses for the year & Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear in the December 31 balance sheet. ances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible LO1,2 E8-2A. Credit Losses Based on Accounts Receivable Hunter, Inc., analyzed its accounts receivable bal- Probability of Noncollection Balance Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 days past due.. Over 180 days past due $90.000 20,000 11,000 6,000 5,000 $132,000 10 25 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $820 on December 31, before any adjustments a. Prepare the adjusting entry for estimated credit losses on December 31. b Prepare the journal entry to write off the Rose Company's account on April 10 of the following year in the amount of $625 LO1 E&-3A. Recognizing Accounts Recelvable On June 7. Bixby Co. sells $1.000 of merchandise to Jasmine Co. Recei on account. Jasmine Co. pays for this merchandise on June 21. a. Prepare the entry on Bixby's books to record the sale. b. Prepare the entry on Bixby's books to record the receipt of payment LO3 ES-4A. Credit Card Sales Ruth Anne's Fabrics accepts cash. personal checks, and two credit cards when customers buy merchandise. With the Great American Bank Card, Ruth Anne's Fabrics receives an immediate deposit in its checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee. With the United Merchants Card, Ruth Anne's Fabrics mails the credit card sales slips to United Merchants' regional processing center each day. United Merchants accumulates these slips for three days and then mails a check to Ruth Anne's Fabrics, after deducting a three percent fee. Prepare journal entries to record the following: a. Sales for March 15 were as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts