Question: b - 2 . Calculate the external funds needed. The Optical Scam Company has forecast a sales growth rate of 2 0 percent for next

b Calculate the external funds needed. The Optical Scam Company has forecast a sales growth rate of percent for next year.

Current assets, fixed assets, and shortterm

debt are proportional to sales. The current financial statements are shown here:

a Calculate the external funds needed for next year using the equation from the chapter.

Note: Do not round intermediate calculations. Total assets

$

Total liabilities and equity

$

a Calculate the external funds needed for next year using the equation from the chapter.

Note: Do not round intermediate calculations.

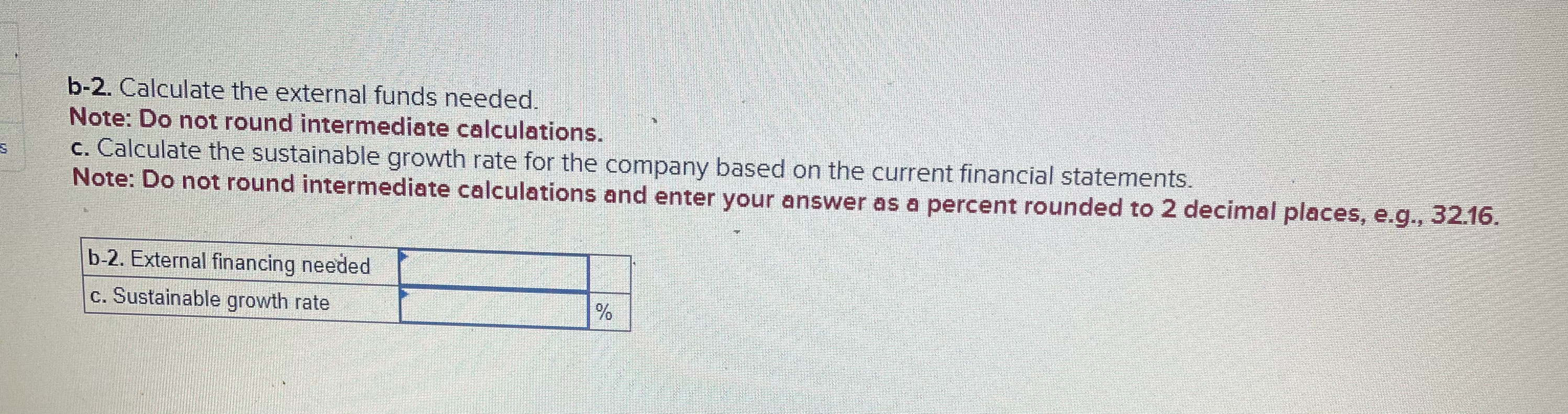

External financing needed

b Prepare the firm's pro forma balance sheet for next year.

Note: Do not round intermediate calculations.

tableBALANCE SHEET,,AssetsLiabilities and equityCurrent assets,,Shortterm debtFixed assets,Longterm debt,Common stock,Accumulated retained earnings, b Prepare the firm's pro forma balance sheet for next year.

Note: Do not round intermediate calculations.b Calculate the external funds needed.

Note: Do not round intermediate calculations.

c Calculate the sustainable growth rate for the company based on the current financial statements.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

b External financing needed

c Sustainable growth rate

Note: Do not round intermediate calculations.

c Calculate the sustainable growth rate for the company based on the current financial statements.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

b External

All of the pictures to the question are posted.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock