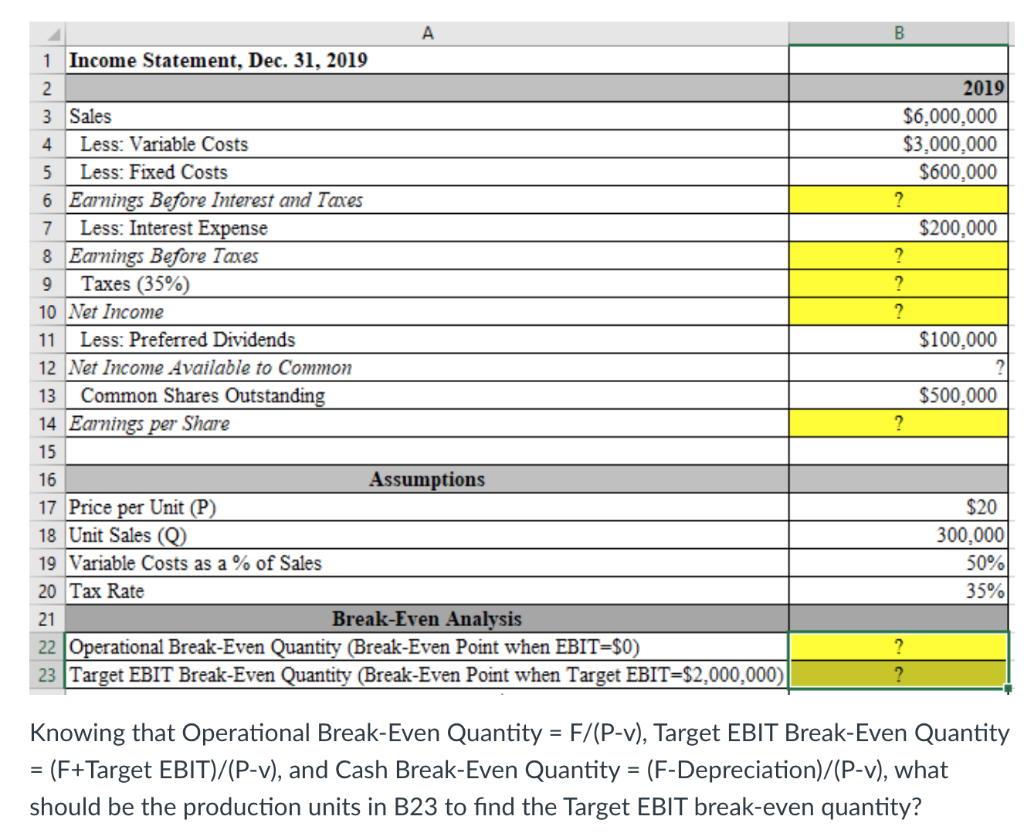

Question: B 2019 $6,000,000 $3,000,000 $600,000 ? $200,000 ? ? ? $100,000 1 Income Statement, Dec. 31, 2019 2. 3 Sales 4 Less: Variable Costs 5

B 2019 $6,000,000 $3,000,000 $600,000 ? $200,000 ? ? ? $100,000 1 Income Statement, Dec. 31, 2019 2. 3 Sales 4 Less: Variable Costs 5 Less: Fixed Costs 6 Earnings Before Interest and Taxes 7 Less: Interest Expense 8 Earnings Before Taxes 9 Taxes (35% 10 Net Income 11 Less: Preferred Dividends 12 Net Income Available to Common 13 Common Shares Outstanding 14 Earnings per Share 15 16 Assumptions 17 Price per Unit (P) 18 Unit Sales (Q) 19 Variable Costs as a % of Sales 20 Tax Rate 21 Break-Even Analysis 22 Operational Break-Even Quantity (Break-Even Point when EBIT=$0) 23 Target EBIT Break-Even Quantity (Break-Even Point when Target EBIT=$2,000,000) $500,000 ? $20 300,000 50% 35% Knowing that Operational Break-Even Quantity = F/(P-v), Target EBIT Break-Even Quantity = (F+Target EBIT)/(P-v), and Cash Break-Even Quantity = (F-Depreciation)/(P-v), what should be the production units in B23 to find the Target EBIT break-even quantity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts