Question: B - 5 . Tina has been proficient in preparing and filing her own tax returns for the last few tax years. She discovered that

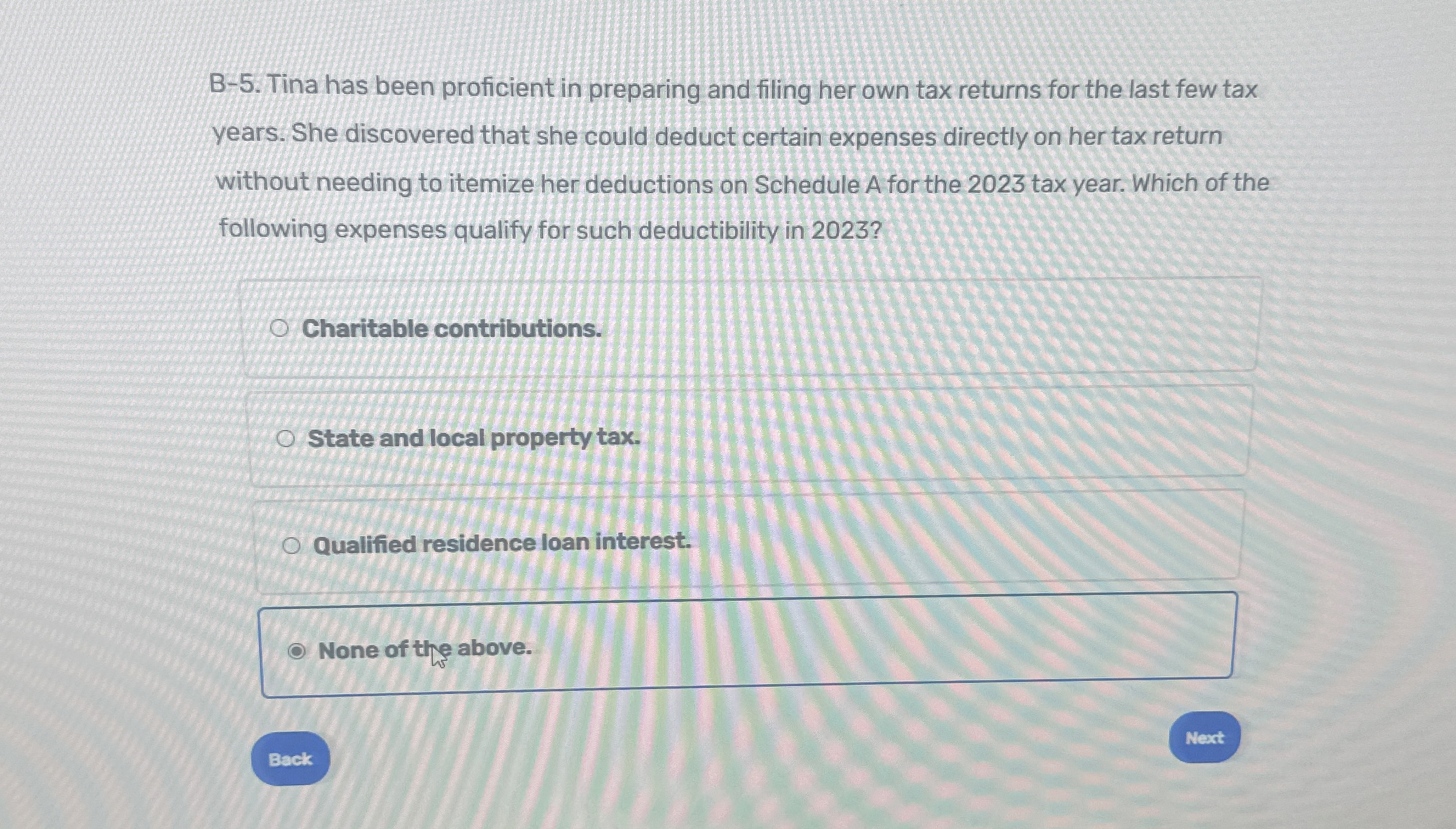

B Tina has been proficient in preparing and filing her own tax returns for the last few tax years. She discovered that she could deduct certain expenses directly on her tax return without needing to itemize her deductions on Schedule A for the tax year. Which of the following expenses qualify for such deductibility in

Charitable contributions.

State and local property tax.

Qualified residence loan interest.

None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock