Question: ( B 9 c ) ( Cash flows and NPV for a replacement decision ) Andrew Thompson Interests ( ATI ) is using a mechanical

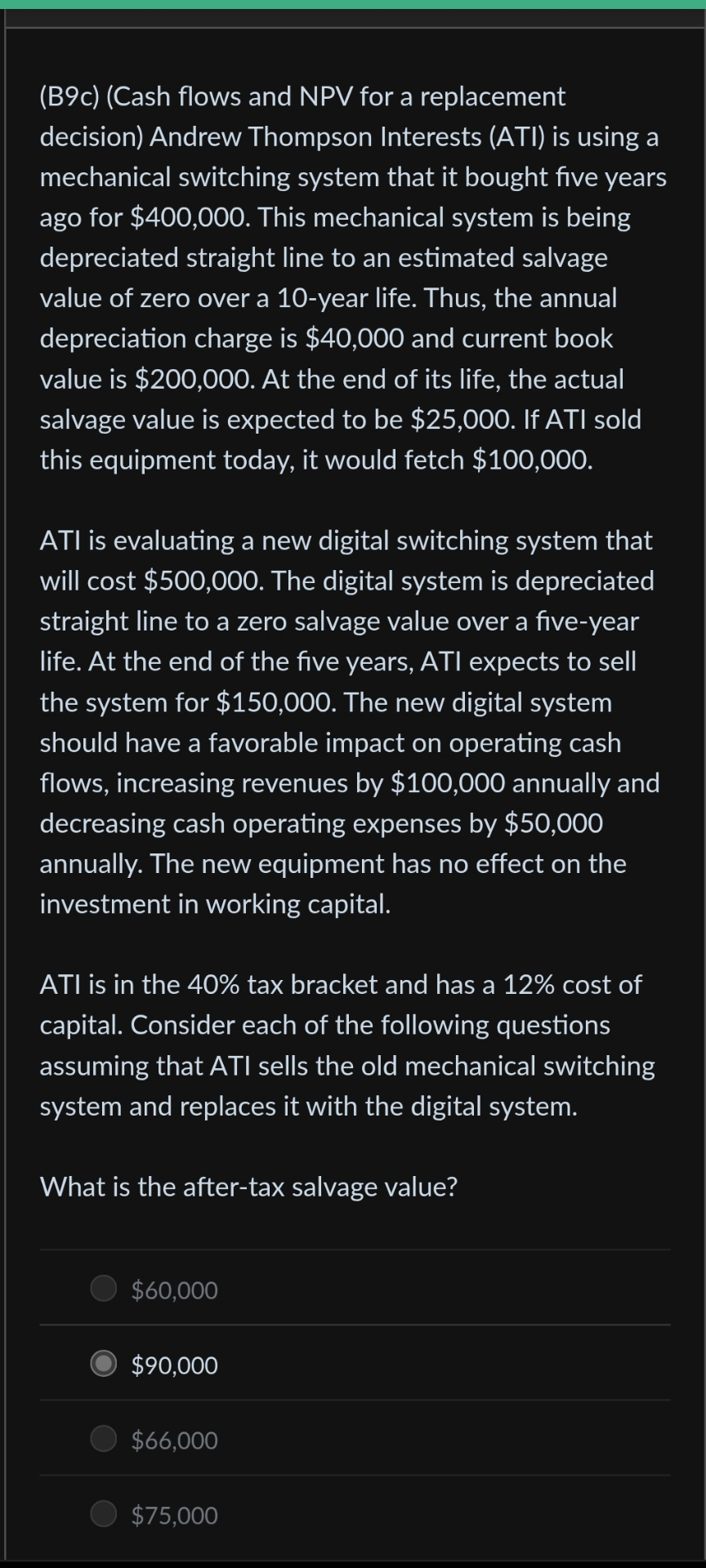

BcCash flows and NPV for a replacement decision Andrew Thompson Interests ATI is using a mechanical switching system that it bought five years ago for $ This mechanical system is being depreciated straight line to an estimated salvage value of zero over a year life. Thus, the annual depreciation charge is $ and current book value is $ At the end of its life, the actual salvage value is expected to be $ If ATI sold this equipment today, it would fetch $

ATI is evaluating a new digital switching system that will cost $ The digital system is depreciated straight line to a zero salvage value over a fiveyear life. At the end of the five years, ATI expects to sell the system for $ The new digital system should have a favorable impact on operating cash flows, increasing revenues by $ annually and decreasing cash operating expenses by $ annually. The new equipment has no effect on the investment in working capital.

ATI is in the tax bracket and has a cost of capital. Consider each of the following questions assuming that ATI sells the old mechanical switching system and replaces it with the digital system.

What is the aftertax salvage value?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock