Question: (b) A bond is a long-term promissory note issued by a business or a government unit. Briefly explain the main features of a bond. (4

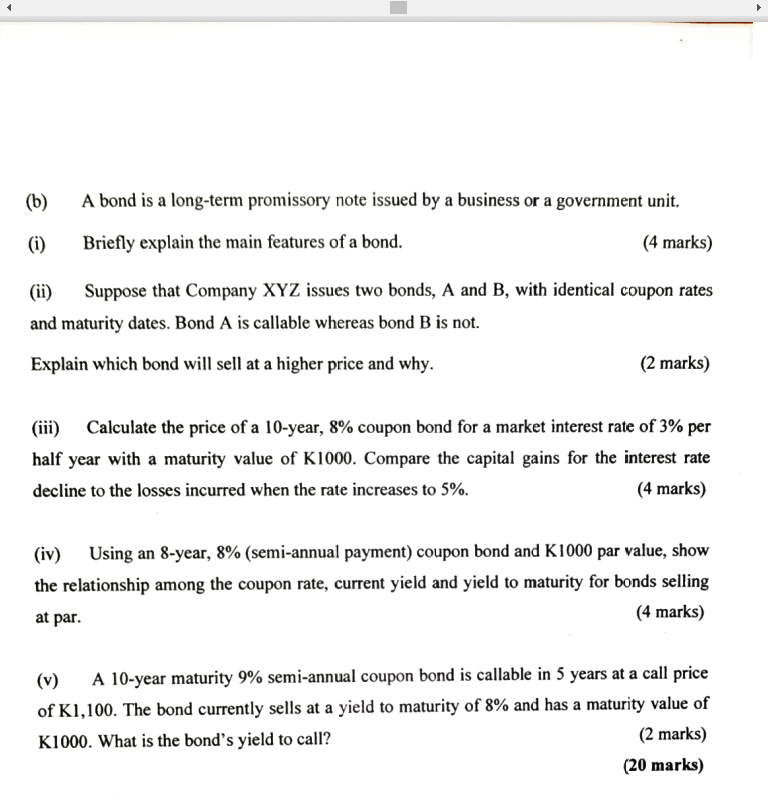

(b) A bond is a long-term promissory note issued by a business or a government unit. Briefly explain the main features of a bond. (4 marks) (i) (ii) Suppose that Company XYZ issues two bonds, A and B, with identical coupon rates and maturity dates. Bond A is callable whereas bond B is not. Explain which bond will sell at a higher price and why. (2 marks) (iii) Calculate the price of a 10-year, 8% coupon bond for a market interest rate of 3% per half year with a maturity value of K1000. Compare the capital gains for the interest rate decline to the losses incurred when the rate increases to 5%. (4 marks) (iv) Using an 8-year, 8% (semi-annual payment) coupon bond and K1000 par value, show the relationship among the coupon rate, current yield and yield to maturity for bonds selling at par. (4 marks) (v) A 10-year maturity 9% semi-annual coupon bond is callable in 5 years at a call price of K1,100. The bond currently sells at a yield to maturity of 8% and has a maturity value of K1000. What is the bond's yield to call? (2 marks) (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts