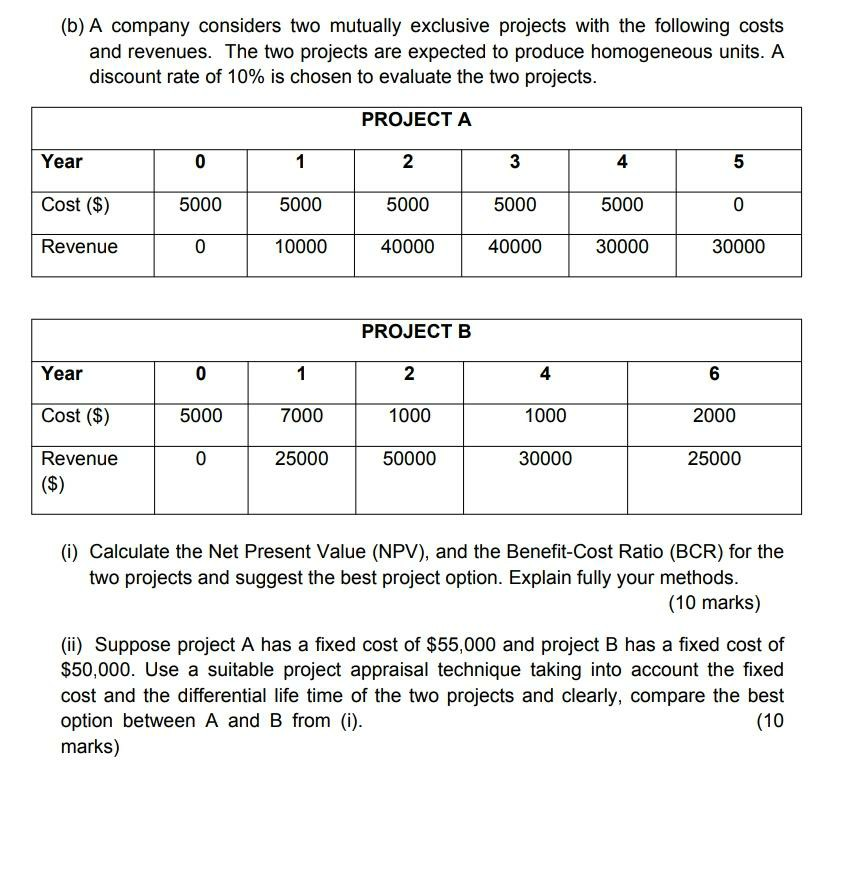

Question: (b) A company considers two mutually exclusive projects with the following costs and revenues. The two projects are expected to produce homogeneous units. A discount

(b) A company considers two mutually exclusive projects with the following costs and revenues. The two projects are expected to produce homogeneous units. A discount rate of 10% is chosen to evaluate the two projects. PROJECT A Year 0 1 2 3 4 5 Cost ($) 5000 5000 5000 5000 5000 0 Revenue 0 10000 40000 40000 30000 30000 PROJECT B Year 0 1 2 4 6 Cost ($) 5000 7000 1000 1000 2000 0 25000 50000 30000 25000 Revenue ($) (i) Calculate the Net Present Value (NPV), and the Benefit-Cost Ratio (BCR) for the two projects and suggest the best project option. Explain fully your methods. (10 marks) (ii) Suppose project A has a fixed cost of $55,000 and project B has a fixed cost of $50,000. Use a suitable project appraisal technique taking into account the fixed cost and the differential life time of the two projects and clearly, compare the best option between A and B from (i). (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts