Question: (b) A company is evaluating a project for which the costs and expected cash flows are as follows: Year 0 Year 1 Year 2 Year

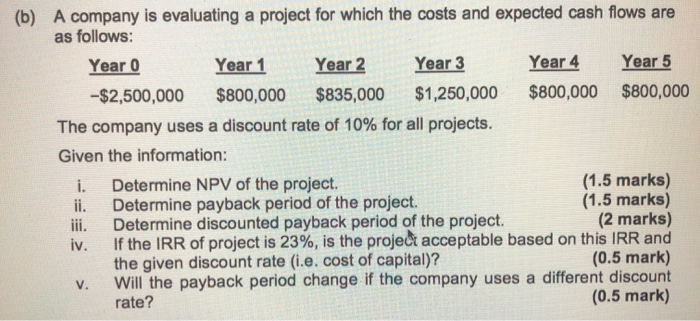

(b) A company is evaluating a project for which the costs and expected cash flows are as follows: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 -$2,500,000 $800,000 $835,000 $1,250,000 $800,000 $800,000 The company uses a discount rate of 10% for all projects. Given the information: i. Determine NPV of the project. (1.5 marks) ii. Determine payback period of the project. (1.5 marks) Determine discounted payback period of the project. (2 marks) iv. If the IRR of project is 23%, is the project acceptable based on this IRR and the given discount rate (i.e. cost of capital)? (0.5 mark) V. Will the payback period change if the company uses a different discount rate? (0.5 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts