Question: b. A decrease in one asset and an increase in another asset. c. A decrease in one liability and an increase in another liability.

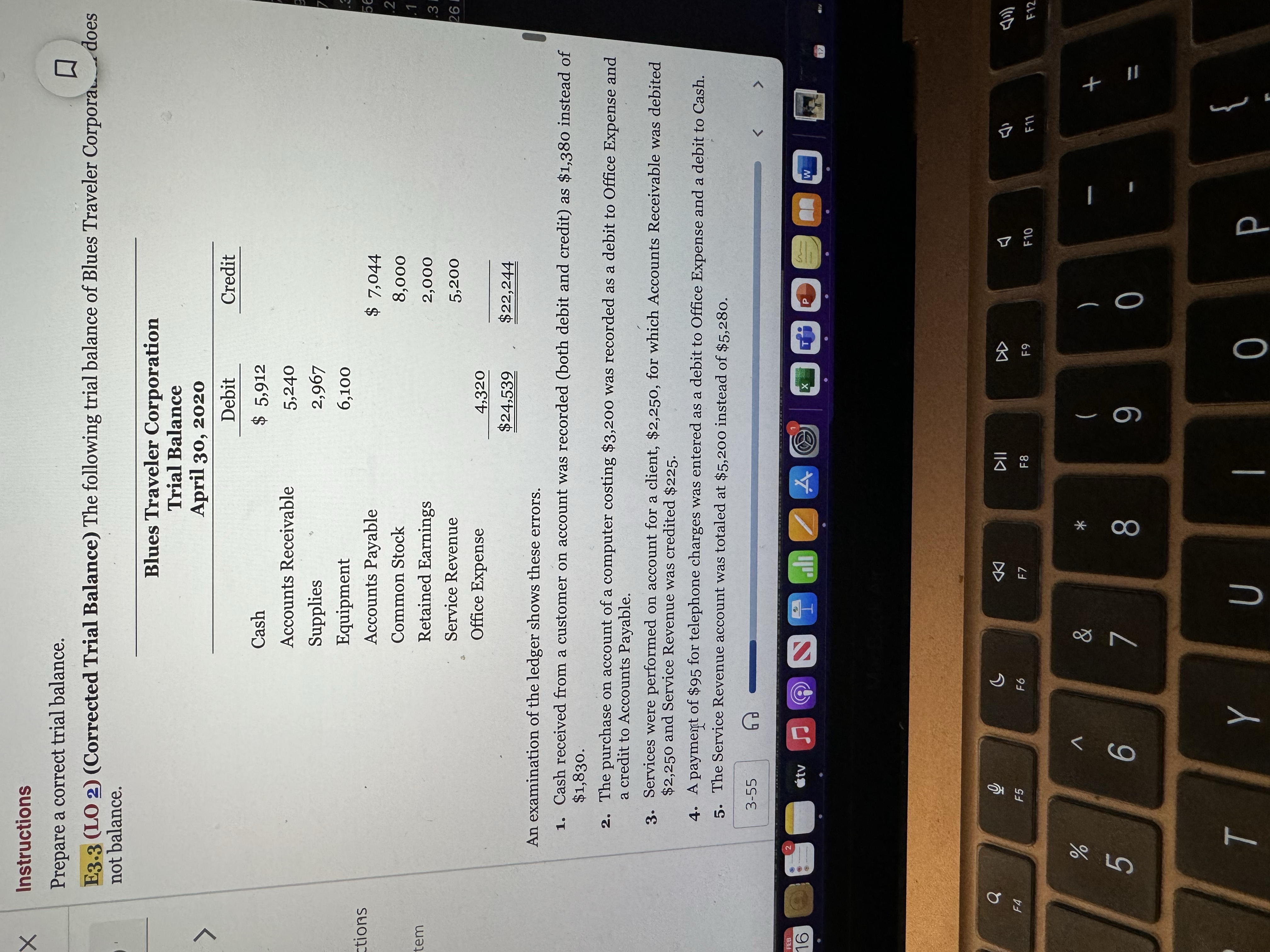

b. A decrease in one asset and an increase in another asset. c. A decrease in one liability and an increase in another liability. 2. Do the following events represent business transactions? Explain your answer in each case. a. A computer is purchased on account. b. A customer returns merchandise and is given credit on account. c. A prospective employee is interviewed. d. The owner of the business withdraws cash from the business for personal use. e. Merchandise is ordered for delivery next month. 3. Name the accounts debited and credited for each of the following transactions. a. Billing a customer for work done. b. Receipt of cash from customer on account. c. Purchase of office supplies on account. d. Purchase of 15 gallons of gasoline for the delivery truck. 4. Why are revenue and expense accounts called temporary or nominal accounts? 5. Andrea Pafko, a fellow student, contends that the double-entry system means that each transact be recorded twice. Is Andrea correct? Explain. 6. Is it necessary that a trial balance be prepared periodically? What purpose does it serve? 7. Indicate whether each of the following items is a real or nominal account and whether it appears balance sheet or the income statement. a. Prepaid Rent. J Instructions Prepare a correct trial balance. [ E3.3 (LO 2) (Corrected Trial Balance) The following trial balance of Blues Traveler Corpora does not balance. Blues Traveler Corporation Trial Balance April 30, 2020 Debit Credit Cash $ 5,912 Accounts Receivable 5,240 2,967 Equipment 6,100 56 Accounts Payable $ 7,044 .2 Common Stock 8,000 .1 Retained Earnings Service Revenue Office Expense 2,000 31 5,200 26 4,320 $24,539 $22,244 ctions Supplies tem FEB 16 U An examination of the ledger shows these errors. 1. Cash received from a customer on account was recorded (both debit and credit) as $1,380 instead of $1,830. 2. The purchase on account of a computer costing $3,200 was recorded as a debit to Office Expense and a credit to Accounts Payable. 3. Services were performed on account for a client, $2,250, for which Accounts Receivable was debited $2,250 and Service Revenue was credited $225. 4. A payment of $95 for telephone charges was entered as a debit to Office Expense and a debit to Cash. 5. The Service Revenue account was totaled at $5,200 instead of $5,280. 3-55 G > tv a FA GKO F5 % 5 @

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts