Question: b. A risk neutral market maker clears buy and sell orders for a share in a perfectly competitive environment. She believes that there are

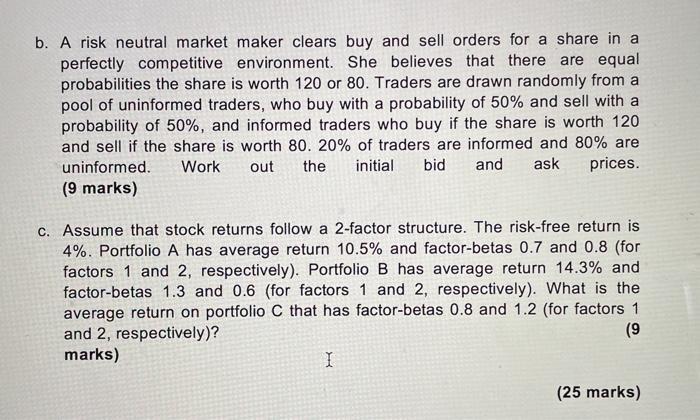

b. A risk neutral market maker clears buy and sell orders for a share in a perfectly competitive environment. She believes that there are equal probabilities the share is worth 120 or 80. Traders are drawn randomly from a pool of uninformed traders, who buy with a probability of 50% and sell with a probability of 50%, and informed traders who buy if the share is worth 120 and sell if the share is worth 80. 20% of traders are informed and 80% are uninformed. Work out the initial bid and ask prices. (9 marks) c. Assume that stock returns follow a 2-factor structure. The risk-free return is 4%. Portfolio A has average return 10.5% and factor-betas 0.7 and 0.8 (for factors 1 and 2, respectively). Portfolio B has average return 14.3% and factor-betas 1.3 and 0.6 (for factors 1 and 2, respectively). What is the average return on portfolio C that has factor-betas 0.8 and 1.2 (for factors 1 and 2, respectively)? (9 marks) I (25 marks)

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

b To work out the initial and ask prices we need to consider the expected value of the share based o... View full answer

Get step-by-step solutions from verified subject matter experts